Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Each quarter we rank the 10 sectors in our Sector Ratings for ETF & Mutual Funds and the 12 investment styles in our Style Ratings For ETFs & Mutual Funds report. For the third quarter of 2016 rankings, we noticed a long-term trend: in 11 of the past 16 quarters, the Small Cap Value style has ranked last. Within that style, we found a particularly bad fund, one that investors using traditional fund research would believe is an excellent fund.

Ivy Small Cap Value Fund (IYSAX, IYSBX, IYSCX, IYVIX), depending on share class, receives a 4 or 5 star rating from Morningstar. We’ve previously covered the inherent flaws with Morningstar’s rating system, specifically its reliance upon past performance to derive ratings. As we know, past performance is no indicator of future success, which is why the backbone of our ETF and mutual fund ratings is the quality of the holdings. After all, the performance of the holdings drive the performance of the fund.

Ivy Small Cap Value Fund receives our Dangerous or Very Dangerous rating, depending upon share class, and its poor holdings and high fees land it in the Danger Zone this week.

Poor Holdings Makes Outperformance Difficult

The only justification for mutual funds to have higher fees than ETFs is “active” management that leads to out-performance. How can a fund that has significantly worse holdings than its benchmark hope to outperform?

Ivy Small Cap Value Fund investors are paying higher fees for stock selection that is much worse than its benchmark, the iShares Russell 2000 Value ETF (IWN).

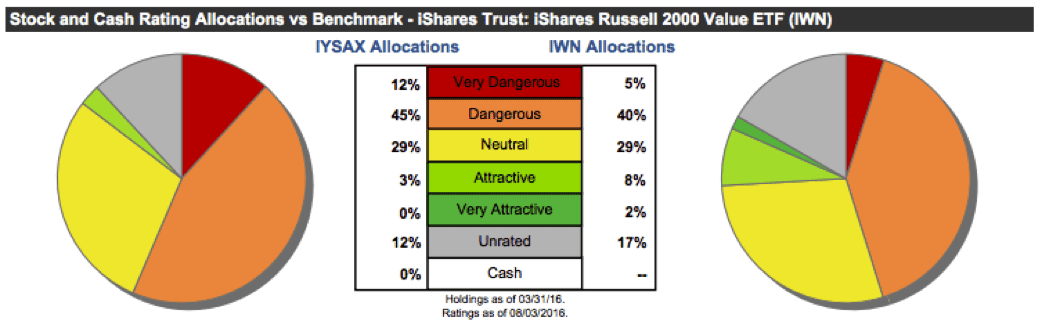

Per Figure 1, Ivy Small Cap Value Fund allocates 57% of capital to Dangerous-or-worse rated stocks, compared to IWN’s 45%. On the flip side, IWN allocates more (at 10% of its portfolio) to Attractive-or-better rated stocks than IYSAX at only 3%.

Figure 1: Ivy Small Cap Value Fund Asset Allocation

Sources: New Constructs, LLC and company filings

Furthermore, 7 of the mutual fund’s top 10 holdings receive our Dangerous-or-worse rating and make up over 25% of its portfolio.

If Ivy Small Cap Value Fund holds worse stocks than IWN, then how can one expect the outperformance required to justify higher fees?

“Value” Moniker Is Misleading

Ivy Small Cap Value Fund managers allocate to some of the most overvalued stocks in the market. By analyzing each holding, we can model the expectations already embedded within the stocks held by the mutual fund. Unfortunately, the results are not positive for investors in Ivy Small Cap Value funds.

Our findings from our discounted cash flow valuation of the fund reveal the market implied growth appreciation period (GAP) is 31 years for the iShares Russell 2000 Value and the S&P 500 – compared to 48 years for IYSAX. In other words, the market expects the stocks held by IYSAX to grow economic earnings for 17 years longer than the stocks in the Russell 2000 Value and S&P 500.

This expectation seems even more out of reach when considering the return on invested capital (ROIC) of the S&P is 17%, or nearly triple the ROIC (6%) of stocks held in IYSAX.

Lastly, the price-to-economic book value (PEBV) ratio for the S&P 500, which includes some of the world’s most successful companies, is 2.9. The PEBV ratio for IYSAX is 3.3. This ratio means that the market expects the profits for the S&P 500 to increase 290% from their current levels versus 330% for IYSAX.

At the end of the day, significantly higher profit growth expectations are already baked into the valuations of stocks held by Ivy Small Cap Value Fund, which not only makes its “value” moniker hard to justify, but also makes valuation risk higher and outperformance less likely.

Beware Misleading Expense Ratios: This Fund Is Expensive

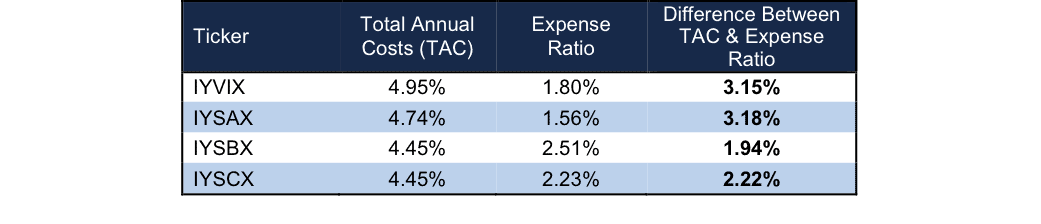

With total annual costs (TAC) of 4.95%, IYVIX charges more than 99% of Small Cap Value mutual funds. Coupled with its poor holdings, high fees make IYVIX (and the other classes of shares) even more dangerous. More details can be seen in Figure 2, which includes the three other classes of the Ivy Small Cap Value Fund that receive our Very Dangerous rating. For comparison, the average TAC of the 261 Small Cap Value mutual funds is 2.23%, the weighted average is lower at 1.89%, and the benchmark, IWN, charges total annual costs of 0.28%.

Figure 2 Ivy Small Cap Value Fund’s Understated Costs

Sources: New Constructs, LLC and company filings.

Over a 10-year holding period, the 3.15 percentage point difference between IYVIX’s TAC and its reported expense ratio results in 36% less capital in investors’ pockets.To justify its higher fees, the Ivy Small Cap Value Fund must outperform its benchmark (IWN) by the following over three years:

- IYVIX must outperform by 4.66% annually.

- IYSAX must outperform by 4.45% annually.

- IYSBX must outperform by 4.17% annually.

- IYSCX must outperform by 2.98% annually.

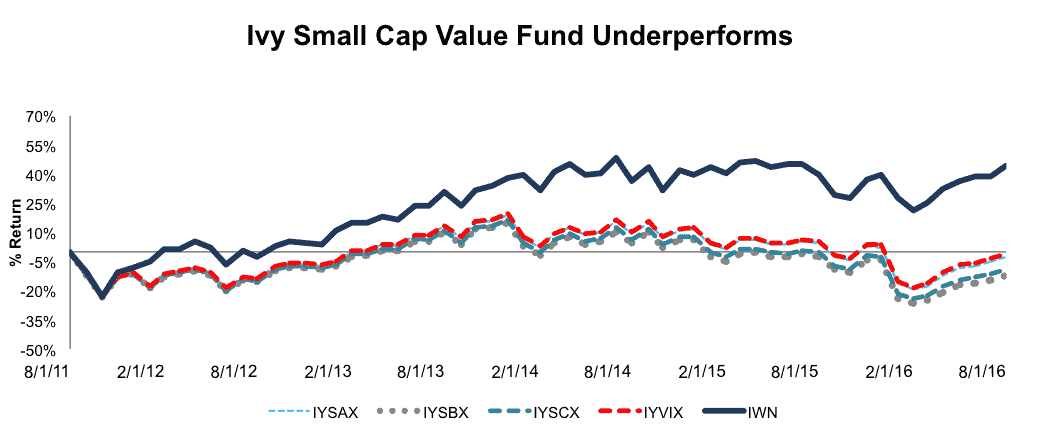

The outperformance that excessive fees require becomes even harder to justify given that the Ivy Small Cap Value Fund has underperformed over the past five years: IYVIX is down 1%, IYSAX is down 2%, IYSBX is down 12%, and IYSCX is down 9%. Meanwhile, IWN is up 44% over the same time. Figure 3 has more details. Investors should be careful not to let the fund’s year-to-date outperformance (that drives the good ratings from Morningstar) trick them into believing that performance is sustainable. Investing trends come and go (case in point, momentum stocks) but at the end of the day, the underlying fundamentals of Ivy’s holdings don’t warrant such high valuations. With such high costs and worse holdings than its benchmark, we think it overly optimistic to invest in the belief that these mutual funds will ever outperform their much cheaper ETF benchmark over more significant time frames.

Figure 3: Ivy Small Cap Value Funds’ 5-Year Return Vs. IWN

Sources: New Constructs, LLC and company filings.

The Importance of Holdings Based Fund Analysis

The analysis above shows that investors might want to withdraw most or all of the $298 million in Ivy Small Cap Value Funds and put the money into better funds within the same style. The top rated Small Cap Value mutual fund for 3Q16 is Royce Small Cap Value Fund (RVFIX, RVVHX, RYVFX, RVFKX, RVVRX). Each of these classes earn an Attractive-or-better rating and charge total annual costs nearly half that of what Ivy Small Cap Value Funds charge.

Without analysis into a fund’s holdings, investors risk putting their money in funds that are more likely to underperform, despite having much better options available.

This article originally published here on August 8, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: frankieleon (Flickr)