We recently wrote an article titled “CEO’s That Focus on ROIC Outperform,” and the corollary to that argument is that the opposite is also true: CEO’s that don’t focus on ROIC underperform. The market has many companies that have lagged behind their peers due to poor capital allocation. Any of these companies could be prime targets for activist investors to reform corporate governance and incentivize executives to focus on ROIC.

As we wrote in “Nelson Peltz on Procter & Gamble: Sign of the Future For ROIC Laggards”, “linking executive compensation to ROIC could create immediate shareholder returns and drive a long-term commitment to a lean and disciplined corporate structure. This strategy should become part of the playbook for companies looking to avoid activist takeovers.” Our Exec Comp Aligned with ROIC model portfolio focuses on stocks with attractive risk/reward and companies with executive compensation plans tied to ROIC.

Below, we highlight a company that should adopt ROIC as a performance measure before an activist comes in and does it for them. New Constructs members can access a version of this report with a second potential activist target, as well as future reports with even more tickers.

Dollar Tree (DLTR: $94/share)

Dollar Tree (DLTR) is one of the only major brick and mortar retailers that doesn’t tie exec comp to ROIC. Most other large retailers, including Walmart (WMT), Home Depot (HD), Target (TGT), and direct competitor Dollar General (DG) do tie a portion of executive compensation to ROIC.

Not coincidentally, DLTR’s total shareholder return has lagged DG over the past one, three, and five years. Its current ROIC of 7.7% lags DG’s ROIC of 9.1%, primarily due to the acquisition of Family Dollar in 2015 that we argued against at the time.

In addition to being overpriced, the capital that DLTR spent on Family Dollar appears to have burdened the balance sheet and kept it from making necessary investments in its stores, as supported by the inferior shopping experience documented by Business Insider.

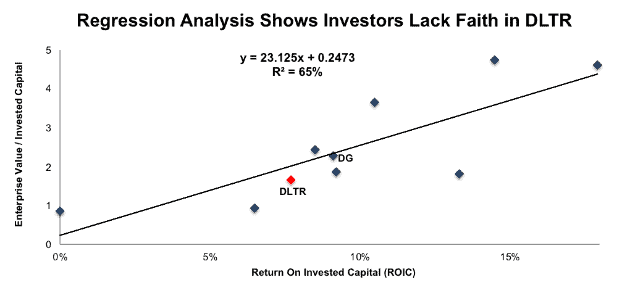

Based on its valuation, the market appears to expect a further decline in DLTR’s ROIC. Figure 1 shows that ROIC explains 65% of the difference in valuation for the 10 discount retailers we cover. DLTR’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 1. The company’s enterprise value to invested capital ratio of 1.7 implies that the market expects its ROIC to decline to 6.2%.

Figure 1: ROIC Explains 65% of Valuation for Discount Retailers

Sources: New Constructs, LLC and company filings

Meanwhile, the market’s valuation of DG implies it expects its ROIC to remain at current levels for the foreseeable future based on its location on the trend line in Figure 1.

Analysts believe Dollar Tree should sell Family Dollar to Dollar General, which shows how the management teams are perceived. The investing community has more faith in DG to manage and earn an adequate return on Family Dollar stores than they do DLTR’s management. The first step to regaining that trust is to align executives with long-term shareholders by linking compensation with ROIC.

If DLTR can merely convince the market to value the company in line with its peers, the stock is worth ~$124/share, a 31% upside. If it can improve its ROIC to the level of peer DG, it’s worth $151/share, a 61% upside.

The potential upside for DLTR shows how important corporate governance can be. Differences in executive compensation plans may seem minor, but they have a major impact on stock returns and valuations.

This article originally published on August 27, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "Danger Zone: Managers Who Get Away with Bad Corporate Governance"

Dollar Tree (DLTR) falls 15% after 2Q results missed expectations and guidance was lowered. Dollar General (DG) reported today as well and had better same-store sales growth and less margin decline.