“The heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising because most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics.”

-Warren Buffett, 1987 letter to Berkshire Hathaway shareholders

The Oracle of Omaha observed the lack of emphasis on capital allocation over 30 years ago, and since then, it seems that little changed. A 2015 Harvard Business Review article entitled “CEO’s Don’t Care Enough About Capital Allocation” found that hardly any top CEO’s talked about return on invested capital (ROIC).

Just two year earlier, in 2013, a McKinsey survey found that only 16% of board members completely understood how their companies created value. It’s no wonder that CEO’s don’t care about capital allocation when the board members that hold them accountable don’t understand the fact that ROIC is the primary driver of value creation.

However, the tide seems to be turning in recent years. The success of companies that prioritize capital allocation, along with pressure from the investment community, has led to a greater emphasis on ROIC among executives. This trend should increase the efficiency of the capital markets and create opportunities for investors to benefit from improved corporate governance.

CEOs Are Starting to Care About ROIC Because Institutional Investors Care

ROIC has become a more common word in corporate America over the past three years. In 2016, The Wall Street Journal declared ROIC “The Hottest Metric in Finance.” Proxy advisor Institutional Shareholder Services recently bought EVA Dimensions so that it could offer more than just unscrubbed accounting metrics. JPMorgan Chase (JPM) CEO Jamie Dimon called out ROIC as a key driver of value in his 2018 letter to shareholders. From 2014 to 2016, the percentage of companies that tied executive pay to capital allocation measures rose from 21% to 30%.

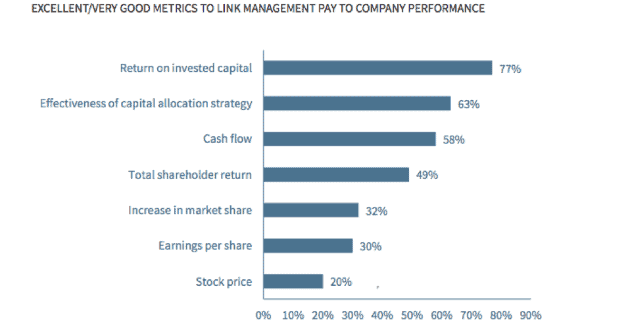

The buy-side investment community deserves the majority of the credit for this improvement. A 2016 survey of buy-side investors found that ROIC was their favorite metric to link management pay to company performance, as shown in Figure 1.

Figure 1: The Buy-Side’s Favorite Performance Metrics

Sources: Rivel Research

A number of factors, from the rise of passive investing and self-directed trading to regulations put in place after the financial crisis, have decreased the influence of sell-side research shops over the past decade. In their place, the buy-side has grown in influence and shifted the emphasis away from the unscrubbed accounting measures (which are easily manipulated) beloved by Wall Street and more towards the true drivers of value creation.

Few people on the buy-side have articulated this shift as clearly as BlackRock (BLK) CEO Larry Fink, who wrote in his annual letter to CEOs:

“We recognize that the market is far more comfortable with 10Qs and colored proxy cards than complex strategy discussions. But a central reason for the rise of activism – and wasteful proxy fights – is that companies have not been explicit enough about their long-term strategies.”

In other words, companies that focus on hitting quarterly earnings targets instead of driving long-term improvements in shareholder value should not be surprised to find themselves targeted by activist shareholders – like the ones that forced General Motors (GM) to adopt ROIC as a key performance metric in 2014.

Despite these improvements, there’s still a large disconnect between CEOs and investors regarding the importance of ROIC. 77% of buy-side investors favor ROIC as a performance metric while only 30% approve of EPS. Meanwhile, 63% of companies link long-term executive compensation to earnings while only 30% link compensation to ROIC. As the quote at the beginning of this article shows, corporate America’s ignorance in capital allocation goes back decades. Refocusing executives on the real drivers of value will take more than just a few years.

Why ROIC Matters – The Link to Value Creation

Even though the increased attention on ROIC[1] is relatively recent, the ability of a company to earn a return on capital greater than its cost of capital has long been understood to be the primary driver of value creation. Warren Buffett has consistently communicated this fact as central to his success, and in the 1990’s a variety of consulting firms rose to prominence by pitching ROIC-based models.

More recently, a 2012 McKinsey study of the capital allocation decisions of global companies found that companies that aggressively reallocate capital to the highest return segments outperform over the long-term.

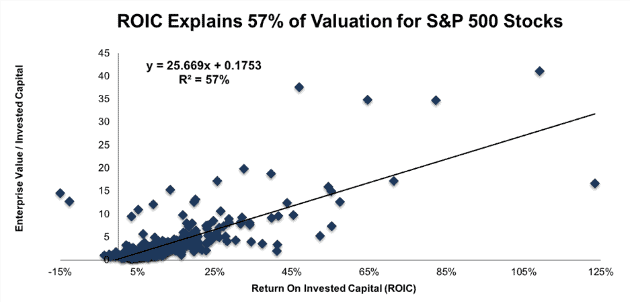

Ernst & Young leverages our research to tell a similar story. Figure 2 compares S&P 500 companies on the basis of ROIC and enterprise value/invested capital (a cleaner version of price to book). It finds that ROIC explains 57% of the difference in valuation for the S&P 500.

Figure 2: ROIC vs. Enterprise Value/Invested Capital for the S&P 500

Sources: New Constructs, LLC and company filings

Notably, other metrics such as EPS, return on equity, and EBITDA show much weaker links to valuation. Companies that incentivize executives to chase these metrics are doing a poor job of aligning management with the interests of shareholders.

Focus on ROIC Mitigates Downside Risk

Companies that focus on ROIC thrive in all markets, but they especially outperform in down markets. It’s no coincidence that the only S&P 500 stocks to go up 10% or more in 2008 were companies that earned consistently high ROICs. Momentum can boost unprofitable companies in a bull market, but when the market starts to drop cash flow becomes key.

In addition, an emphasis on ROIC prevents overinvestment in low-return projects that destroy long-term shareholder value. During bull markets, many executives overpay for acquisitions or overinvest in segments just to meet EPS growth targets. As long as markets and the economy are strong, firms often won’t face direct consequences for this misallocation of capital. When the economy turns south, though, these low-return investments become millstones around their neck dragging the stock down.

For example, during the economic recovery from 2009 to 2014, the 66 oil and gas services companies we cover increased their invested capital by 110% on aggregate. These companies were already failing to earn an adequate return on their investments – after-tax operating profit (NOPAT) only increased 42% over the same timeframe – but high oil prices kept their businesses profitable.

When commodities prices fell, these investments went from merely overpriced to being major money losers. The economic earnings of the sector turned negative – meaning ROIC was below the cost of capital (WACC) – and the iShares US Oil Equipment ETF (IEZ) is down 40% over the past 5 years.

However, not all companies in the industry participated in this overinvestment. Core Laboratories (CLB), which began tying compensation to ROIC in 2010, increased its invested capital by just 39% between 2009-2014. The company improved its ROIC from 24% to 40% over the same time.

As the industry conditions grew more challenging, CLB doubled-down on its focus on ROIC. In its 2014 proxy statement, CLB mentioned ROIC eight times. In 2018, that number increased to 39. On top of the focus on its own ROIC, CLB began highlighting the ROIC improvement for its clients. From CEO David Demshur on the companies Q2 2018 earnings call:

“Core’s clients see the largest potential increases in their ROICs, tied to boosting recovery rates from unconventional reservoirs.”

CLB’s executives understand not just how to create value for their shareholders, but also how to create value for the company’s clients. As a result, CLB has maintained a double-digit ROIC and positive economic earnings throughout the commodities rout, and its stock is down just 26% over the past five years compared to a 40% decline for the industry as a whole. A focus on ROIC can’t make a company immune to economic conditions, but it can significantly mitigate the downside risk.

Shifting Focus to ROIC Leads to Outperformance

Changes in executive compensation plans don’t often generate much hype, but they can have a major impact on returns. From 2010-2014, GM and Ford (F) had almost identical stock price returns. As mentioned above, in 2014 GM responded to activist pressure by linking executive compensation to ROIC. That same year, the company appointed as its CEO Mary Barra, who has been described by journalists as being “laser-focused” on ROIC.

Over the past five years, GM is up 5% while Ford is down 42%.

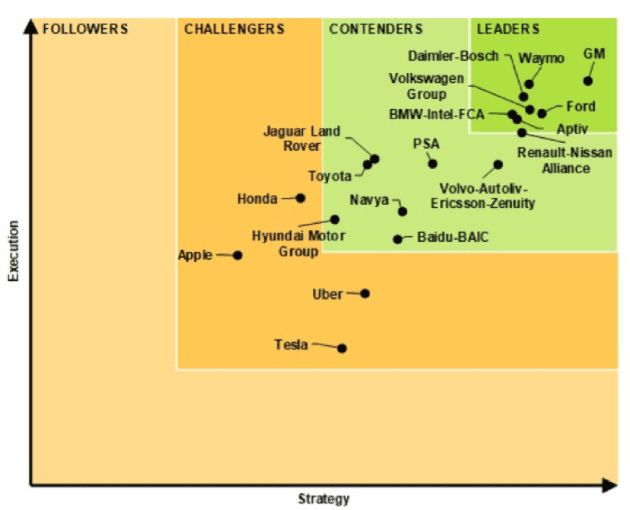

Notably, GM’s focus on ROIC has not led to underinvestment in future growth, which is a concern that critics of using ROIC often raise. Since 2013, GM has increased its invested capital by 30% and made key long-term investments, such as the production of electric vehicles and the acquisition of self-driving startup Cruise. Figure 3 shows how GM’s investment has helped it establish a leading position in the self-driving space.

Figure 3: GM Is a Leader in Self-Driving Technology

Sources: Navigant Research

Barra financed these investments by reallocating capital away from low return segments. She sold underperforming brands like Opel/Vauxhall and cut back exposure to unprofitable markets like Russia, South Africa, and Australia. Bloomberg reporter David Welch profiled Barra’s capital reallocation in 2017, writing:

“Barra has sold or closed 13 plants and walked away from five markets boasting about 26 million in total vehicle sales annually since she became CEO … in 2014.”

Barra’s strategy has paid off. GM has earned a cumulative $15.8 billion in economic earnings over the past four years, more than triple Ford’s $5.1 billion. We highlighted GM’s excellent corporate governance and cheap valuation in our Long Idea on the stock in March, and it remains in our Focus List – Long Model Portfolio.

The Consequences of Ignoring ROIC: A Tale of Two Corporate Giants

While companies that focus on ROIC can thrive, companies that ignore the key driver of long-term value create significant risk for shareholders. Two years ago, we noted that General Electric (GE) was significantly overvalued based on its ROIC, and we argued that if the company didn’t focus on improving its ROIC it could lose up to $125 billion in market cap.

As it turned out, we were wrong. GE didn’t lose $125 billion in market value – it lost over $160 billion, or more than half its market cap.

Rather than use the proceeds from the sale of GE Capital to invest in a digital overhaul of its business as we suggested, GE spent $22 billion on stock buybacks in 2016 alone. These buybacks helped boost EPS, which allowed executives to earn their bonuses that year, but failed to address the long-term issues with ROIC. As a result, GE’s ROIC dropped from 3% when we wrote our article to -1% over the last twelve months.

Now, under new CEO John Flannery, GE may finally begin the process of addressing its core problems. The Wall Street Journal reported last October that Flannery was working with the board to change the company’s compensation plans to “better align the team with investors.”

The contrast between GM and GE – two iconic American companies facing serious threats to their business – shows why ROIC is so important. One company prioritized ROIC over accounting earnings, sold off underperforming segments, and successfully invested in its future. The other company focused on buying back shares to hit EPS goals and ignored the decline in its ROIC.

As a result, GM is thriving while GE recently replaced its CEO and half its board after losing $160 billion in market value. That turnover, more than anything, explains why CEO’s are focusing more on ROIC: if they don’t, they might not be CEO for much longer.

How Investors Can Profit From ROIC

The slow shift in focus to ROIC creates opportunities for investors. Many market participants still fail to recognize the importance of aligning executives with long-term shareholder value, which means that companies like GM remain cheap.

At its current valuation of ~$37/share, GM as a price to economic book value (the zero-growth value of the business) of 0.6, which implies that the market expects NOPAT to permanently decline by 40%. Even if NOPAT declines by 2% compounded annually for the next five years, the stock is worth $75/share today, double the current stock price. See the math behind this dynamic DCF scenario here.

We believe that linking ROIC to corporate governance and executive compensation is an underrated competitive advantage. We created the Exec Comp Aligned with ROIC Model Portfolio to give investors exposure to highly profitable, undervalued companies with excellent corporate governance.[2]

We’ve also written up Long Ideas on several of the stocks in this model portfolio. One of the first stocks in the portfolio we featured was auto-parts supplier Lear Corp (LEA). Since our article in July 2016, LEA is up 55% vs. a 30% gain for the S&P 500. Other stocks from the portfolio that have been featured include:

- Colgate-Palmolive (CL)

- PepsiCo (PEP)

- Hasbro (HAS)

- NVR Inc. (NVR)

Since its inception in May of 2016, the Exec Comp Model Portfolio has performed in-line with the S&P 500 (both up 28%). This portfolio gives investors protection during downturns without sacrificing gains during a bull market.

Even outside of the model portfolio, we incorporate analysis of ROIC and corporate governance into all of our long and short ideas. Flagging misaligned executive compensation plans helps us warn investors to avoid stocks that are due for a crash, such as Valeant (VRX).

Focusing on ROIC can be a competitive advantage for investors as well as CEO’s. There’s a lot of noise in the market, from manipulated earnings announcements to baseless sell-side price targets and Jim Cramer rants. Investors that cut through the noise to understand a company’s ability to generate long-term improvements in ROIC can identify high-quality companies at undervalued prices and protect their portfolios from potential blowups.

This article originally published on August 1, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.