Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

2017 brought a rare bit of good news for chronically underfunded corporate pensions. Strong stock market performance and higher than average employer contributions drove a 20% decline – from $848 billion to $679 billion – in corporate pension underfunding.[1]

This trend appears likely to continue in 2018, but investors should remain cautious. Much of the improvement this year will come from rising discount rates reducing projected benefit obligations. One-time contributions from tax reform could also spur improvement. It’s going to take more than a couple years of positive conditions to alleviate the significant pension funding gap.

Some Firms Continue to Exploit Pensions to Manipulate Earnings

On top of overall pension funding levels, investors need to be wary of managers who exploit pensions to manage earnings. Underfunding remains dangerously high for many firms, and some companies use unusual pension plan assumptions to mislead investors. We previously highlighted how unusually high assumptions for expected return on plan assets can artificially boost earnings. This report focuses on how companies can use the discount rate to manipulate their reported benefit obligation.

The discount rate refers to the level at which future pension obligations are discounted to their present value. A higher discount rate reduces the reported benefit obligation, while a lower discount rate raises the obligation.

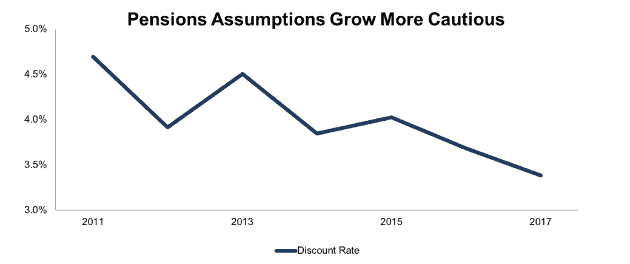

Companies have some discretion over how these assumptions are determined, but they are driven in large part by interest rates. As interest rates have fallen in recent years, discount rates – on average – have declined as well, as shown in Figure 1.

Figure 1: Benefit Obligation Discount Rates Since 2011 Are in Decline

Sources: New Constructs, LLC and company filings

The average discount rate has declined from 4.7% to 3.4% since 2011. Discount rates have been volatile due to rule changes. Congress passed a law in 2012 that allowed companies to use a 25-year average of interest rates (rather than the previous 2-year average) which provided a short-term boost to discount rates in 2013.

That boost was short-lived, and rates steeply declined over the past two years. The average discount rate fell by 30 basis points in 2017, which makes the improvement in pension funding all the more impressive. With interest rates rising again in 2018, expect to see discount rates come back up and the reported pension underfunding decrease even further.

Unusual Discount Rates Raise Red Flags

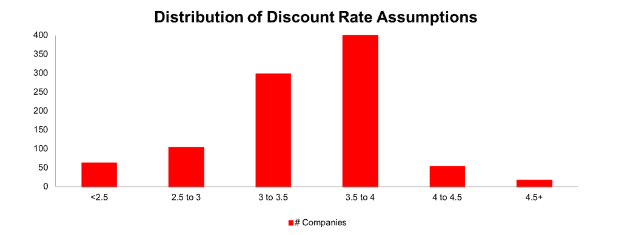

In theory, you’d expect companies to have fairly similar assumptions for discount rates. In practice, there is a wide variation, driven by geography and management discretion. Figures 2 and 3 show the distribution of discount rates in 2017 collected by the Robo-Analyst.[2]

Figure 2: Averages and Outliers for Discount Rates

Sources: New Constructs, LLC and company filings

As Figure 3 shows, the distribution of discount rates among companies is normal, with relatively few outliers on either end of the distribution.

Figure 3: Distribution of Discount Rates

Sources: New Constructs, LLC and company filings

Geography plays a big role in determining these assumptions. The company with the lowest discount rate, Bottomline Technologies (EPAY), has its pension plan in Switzerland, where the combination of low yields on government bonds and a mandated conservative asset allocation lead to a discount rate of just 0.3%.

On the other side of the coin, the company with the highest expected returns, Syntel (SYNT), has a pension plan for its Indian employees. The higher yields in this developing economy lead to a much higher discount rate of 7.7%.

One Stock to Avoid

One company whose discount rate assumptions raises a red flag is Libbey Inc. (LBY), a small glassware manufacturer. LBY’s reported pension and postretirement plan underfunding stands at $97 million, 56% of its market cap, but a closer look reveals that the issue is even worse than it appears.

LBY uses a 3.6% discount rate for its U.S. pension plans, above both the mean and median assumptions shown in Figure 2. However, the big outlier comes when we look at the pension plan for its Mexican employees, which uses a discount rate of 9.4%. By comparison, Mexican company Controladora Vuela Compañía de Aviación (VLRS) uses a 7.7% discount rate for its pension plan.

Although the Mexican plan is significantly smaller than the U.S. plan, it is completely unfunded, so it accounts for roughly 1/3 of the total pension underfunding. By using an abnormally high discount rate, LBY can obscure the true size and cost of its unfunded liability. We estimate that using 3.4% (the mean in Figure 2) as the discount rate for its U.S. plans and 7.7% as the discount rate for its Mexican plans would increase LBY’s underfunded pension liability by ~10%.

LBY also discloses that a 1% change in its discount rate would change pretax pension expense by $3.5 million (10% of pre-tax operating profit). If LBY had to use these more appropriate discount rates, it would report significantly higher liabilities and lower profits than it currently does.

The increase in the discount rate for its Mexican pension plan (up 130 basis points from 8.1% in 2015) enables LBY to reduce its reported pension underfunding from $105 million in 2015 to $95 million in 2017.

This rising discount rate has also helped mask the extent of the decline in LBY’s profitability. From 2015 to 2017, reported pre-tax operating profit[3] declined by 40%, but our adjusted net operating profit before tax (NOPBT) declined by 57%. The rising discount rate reduces pension costs and makes accounting earnings look better than they should.

Investors that rely on reported earnings might see LBY as a potential “value” stock without realizing just how much the business has declined. Performing due diligence on investments means digging into the financial footnotes to see how pension assumptions and other accounting gimmicks can distort the income statement and balance sheet.

This article originally published on June 18, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Based on our analysis of over 2,800 U.S. and international companies, ~1,200 of which report pension or other postretirement benefit assets and liabilities.

[2] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[3] Excluding an $80 million Goodwill impairment reported on the income statement in 2017

Click here to download a PDF of this report.

Photo Credit: Skitterphoto (Pexels)

1 Response to "Danger Zone: Pension Accounting – Discount Rates"

Thank you for this report. Is there a list of companies who under report their earnings or must you research each individual company to find out the difference between their earnings and pension funding?