Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

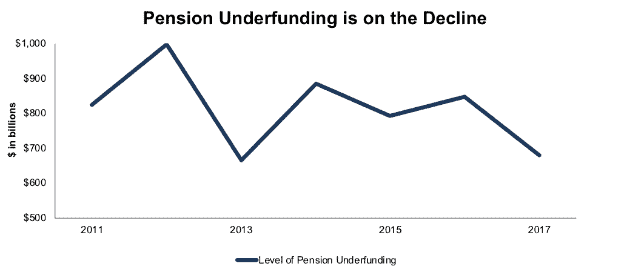

2017 brought a rare bit of good news for chronically underfunded corporate pensions. Strong stock market performance and higher than average employer contributions drove a 20% decline – from $848 billion to $679 billion – in corporate pension underfunding.[1] Figure 1 has details.

Figure 1: Level of Pension Underfunding Across our Coverage Universe

Sources: New Constructs, LLC and company filings

Even better, this trend should continue in 2018. Rising discount rates will lower projected obligations while corporate tax cuts should increase employer contributions even further.

Some Firms Continue to Exploit Pensions to Manage Earnings

Despite this positive trend, investors still need to be wary of managers who exploit pensions to manage earnings. Underfunding remains dangerously high for many firms, and some companies use unusual assumptions for discount rates and expected return on assets to mislead investors.

Companies with the Most Underfunded Pensions

The 10 companies with the worst funded pension plans[2] have a combined $215 billion funding gap, which equates to 14% of their combined market cap.

Lockheed Martin (LMT) stands out as a company with a large and growing pension funding gap. LMT significantly reduced its pension plan contributions beginning in 2015 when it began to transition its employees from a defined benefit plan to a defined contribution plan. In the process, it has been spending down plan assets to fund pension benefits, and its underfunded status has increased from $13.5 billion at the end of 2014 to $17.7 billion (20% of market cap) today.

LMT’s decision to cut back on pension contributions appears misguided when one looks at the low return on its invested capital (ROIC) over the past three years. Since 2014, LMT invested capital has increased by $12.7 billion while only generating $223 million in additional after-tax profit (NOPAT), for an incremental return on invested capital of just 2%.

It’s time to pay the piper, and LMT intends to contribute $5 billion (compared to about $50 million a year over the past few years) to its pension plan in 2018 to close the funding gap. If LMT didn’t need to play catchup on its pension plan, it would be able to use much more of its tax windfall on dividends, buybacks, or value-creating investments.

Lots of small-cap stocks have serious pension issues as well, even if the funding gap isn’t as large in absolute terms. There are 11 companies we cover whose underfunded pensions are larger than their market caps, including Focus List – Short Model Portfolio pick Sears Holdings (SHLD).

Conservative Assumptions Make Pensions More Secure

Investors can also take comfort in the fact that the decrease in pension underfunding has not been the result of accounting gimmicks. Companies can reduce their pension liabilities and costs by manipulating certain assumptions. For example, raising the long-term expected return on plan assets can reduce reported costs based on higher expected future income from the pension assets.

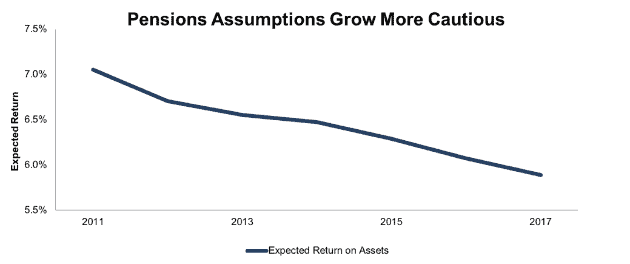

Companies have some discretion over how these assumptions are determined, but they are driven in large part by interest rates. As interest rates have fallen in recent years, expected return on plan assets – on average – have declined as well, as shown in Figure 2.

Figure 2: Expected Return Assumptions Since 2011

Sources: New Constructs, LLC and company filings

The average expected return on plan assets has declined steadily over the past five years, from 7.1% to 5.9%.

Unusual Expected Return on Assets Raises Red Flags

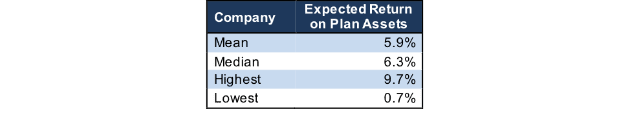

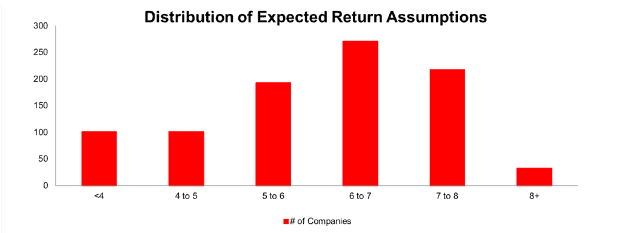

In theory, you’d expect companies to have fairly similar assumptions for long-term returns on plan assets. In practice, there is a wide variation, driven by locale, portfolio makeup, and management discretion. Figures 3 and 4 describe the distribution of expected return assumptions in 2017 collected by the Robo-Analyst.[3]

Figure 3: Averages and Outliers for Expected Return Assumptions

Sources: New Constructs, LLC and company filings

As Figure 4 shows, the large number of companies with extremely low expected returns drags the average lower, even though the largest number of companies have expected returns between 6-7%.

Figure 4: Distribution of Expected Returns Skews Lower

Sources: New Constructs, LLC and company filings

Geography plays a big role in determining these assumptions as well. The company with the lowest expected return on assets, Cohu Inc. (COHU), has its pension plan in Switzerland, where the combination of low yields on government bonds and a mandated conservative asset allocation lead to expected returns of just 0.7%.

On the other side of the coin, the company with the highest expected returns, Virtusa (VRTU) has a pension plan for its Indian and Sri Lankan employees. The higher yields in these developing economies lead to much higher expected returns of 9.7%.

A Repeat Offender for Pension Manipulation

However, not all outlier pension assumptions are driven by geography or regulations. Sometimes they are the result of management discretion. The company with the second-highest expected return on assets is Delta Airlines (DAL), whose outlier pension assumptions we have been highlighting for many years.

DAL’s assumptions grew even more unusual in 2017. While most companies decreased their expected returns, DAL actually raised its assumption slightly, from 8.94% to 8.96%.

Crucially, DAL bases its expected return on the presumption that its plan managers can generate alpha. From its 2017 10-K:

“Modest excess return expectations versus some public market indices are incorporated into the return projections based on the actively managed structure of the investment programs and their records of achieving such returns historically.”

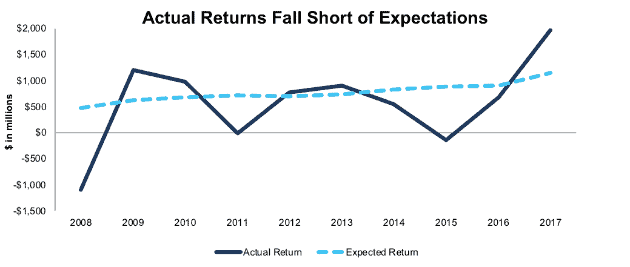

The numbers do not back up the firm’s claim of achieving high returns in the past. Figure 5 shows expected vs. actual returns for DAL’s pension plans dating back to 2008.

Figure 5: DAL Expected Vs. Actual Return on Plan Assets

Sources: New Constructs, LLC and company filings

Over the past decade, DAL expected its pension plan to produce $7.7 billion in returns, but it actually only generated $5.8 billion, a $1.9 billion shortfall. The company’s expected annual return rate has been 8.9%, but its average actual return has been just 5.7%over the past 10 years.

Even if we exclude 2008, DAL’s 8.6% average actual return comes up short of the expected returns. If the company can’t meet its targets during a 9-year bull market, how does it expect to hit those expectations in more volatile markets?

These overstated assumptions have a big impact on reported earnings. DAL estimates that a 50 basis point decrease in expected returns would increase reported pension expense by $73 million. If DAL reduced its expected returns down to the market average – a 300 basis point decrease – pension expense would increase by $438 million, or 12% of GAAP net income. After taxes, this adjustment drops EPS by roughly $0.48/share.

DAL already faces a high hurdle to meet analyst expectations. The consensus analyst forecast calls for EPS of $6.15 in 2018, a 24% increase from 2017 EPS of $4.95. It’s seems highly unlikely that the company could hit this target if it had to face the headwind of normalizing its pension assumptions.

In the long-term, it would be healthier for DAL to use more conservative assumptions that accurately reflect the economics of its pension plan. However, in a market that focuses so much on hitting quarterly earnings targets, management seems willing to use all tools at its disposal to hit the numbers.

As a result, investors need to dig into the footnotes to see where management is using unusual assumptions to boost their numbers. A 2015 survey found that CFO’s believe 20% of companies manipulate earnings on an annual basis, and pension assumptions are one of the easiest targets for this sort of manipulation. Investors need to be vigilant about accounting trickery and adjust models to capture true cash flows.[4]

This article originally published on June 4, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Based on our analysis of over 2,800 U.S. and international companies, ~1,200 of which report pension or other postretirement benefit assets and liabilities.

[2] New Constructs Pro or higher members can access a report on the New Constructs blog that shows this top 10, along with more information on individual companies with outlier pension assumptions.

[3] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[4] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the value of our adjustments.

Click here to download a PDF of this report.

Photo Credit: duzern (Flickr)