We closed this position on August 14, 2017. A copy of the associated Position Update report is here.

VeriFone (PAY: $37/share) is in the Danger Zone this week according to our investment research.

VeriFone manufactures point of service (POS) terminals for credit cards and provides services and software related to processing payments. VeriFone (PAY) is the market leader in POS solutions in the United States, with 60% of the retail terminal systems market.

Listen to David Trainer discuss VeriFone with Chuck Jaffe of Money Life and MarketWatch.com.

What’s Eating VeriFone’s Profitability?

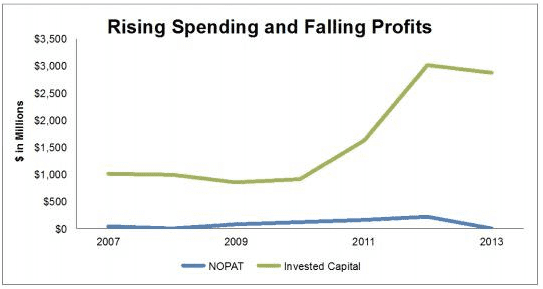

In the past, generating profit (NOPAT) growth was not a problem for VeriFone. However, new technologies in the marketplace put VeriFone’s outsized profitability to an end in 2013. VeriFone’s NOPAT declined 96% in 2013 over the prior year, and the company’s return on invested capital (ROIC) is now 0%, which ranks in the bottom quintile of all the companies we cover. VeriFone’s ROIC has been declining since 2011 to levels far below the 37% seen in 2006.

VeriFone’s after-tax margins, which declined to below 1% in 2013, reflect the commoditization of the payment business. POS technology is a relatively low-development field these days, making it difficult for one manufacturer to gain a distinct edge. Sellers using pay terminals don’t care who services their transactions, as long as it is done at the cheapest rate possible. This leaves little room for margin expansion going forward as VeriFone and its competitors will have to fight it out over lower fees per transaction.

In an attempt to win over customers, VeriFone has been spending heavily in the last few years, which can be seen by the 36% annualized growth in invested capital since 2009. SG&A and R&D spending have each more than doubled over the last three years. Figure 1 highlights how this spending has not translated into profits.

Figure 1: When Increasing Capital Does Not Lead to Profits

Sources: New Constructs, LLC and company filings

VeriFone’s Filings Reveal Hidden Dangers

VeriFone has $1.2 billion in total debt, which includes $135 million in off-balance sheet debt from operating leases. This total debt represents 30% of the company’s market cap, and 49% of its net assets.

On top of its debt, VeriFone has $479 million in total asset write-downs. Asset write-downs represent shareholder value destruction at its purest, as VeriFone is purchasing assets, causing them to decline in value, and then writing off the difference.

These write-downs represent 12% of VeriFone’s market cap and 20% of its net assets. Unfortunately, write-downs are only going to increase as the new CEO is looking to slim down the company’s product lineup.

Stronger Competition is Eroding VeriFone’s Market Position

VeriFone competes with other POS hardware providers. One of the company’s main competitors is NCR Corporation (NCR), which also manufactures POS hardware and provides payment services. Unlike VeriFone, NCR is relatively profitable with a 7% ROIC and 7% NOPAT margins in 2013. NCR’s 2014 results are also reflecting the commoditization of the POS business with increased costs and lower margins.

French company Ingenico S.A. is another large POS company, and is the global leader in POS terminals with 30% of all POS shipments in 2013. VeriFone accounted for less than 19% of global shipments in 2013, which was down from 26% the previous year. It appears Ingenico is making inroads into the U.S. market was as well, with a 47% increase in shipments in 2013 over 2012, while VeriFone saw its shipments decline 17% in the U.S.

The biggest threat to VeriFone and other POS providers comes from mobile payment service companies such as Square and Shopkeep, which specialize in POS attachments for phones and tablets, and accompanying payment and data services. VeriFone has previously tried and failed to compete with its own mobile payment system, but exited the space because of unsatisfactory margins. What VeriFone does not recognize is that these low margins are the new normal in the payment system market.

Don’t Bet on the Speculative Bull Case

Bulls claim new payment systems like EMV will benefit VeriFone uniquely — but these arguments ignore the fact that EMV technology is in widespread use around the globe already and that Ingenico already offers EMV-compatible terminals.

Another bull case for this stock is the company’s turnaround efforts to becoming less focused on POS hardware, and more focused on the systems and services provided. Apple’s (AAPL) announcement of Apple Pay using NFC terminals, which VeriFone supplies, has also caused the stock price to jump 9%. PAY was up 3% after Barron’s mentioned it in an article about Apple Pay.

We’d rather that investors bet on the reality of the payment industry than on VeriFone’s ability to take advantage of a system that has yet to be adopted by retailers.

Stupid Money Risk

VeriFone bought back less than 2% of shares in 2013 and there has been no word of a buyback this year. With VeriFone’s $4 billion market cap and over $1 billion in debt, an acquisition here seems unlikely.

Beyond Overvalued

To justify its current valuation of $34/share, PAY must grow NOPAT by 24% compounded annually for the next 26 years. This forecast also assumes a 10% pre-tax margin, which is equal to levels VeriFone achieved at its peak.

This kind of sustained growth seems unlikely given the issues that VeriFone is having growing revenue and turning a profit. Revenue in 2014 is on pace to equal that of 2012, when PAY earned a NOPAT of $215 million and 12% NOPAT margins. Yet this year, operating loss totals -$27 million so far, This kind of extreme margin compression is a result of the rapid commoditization of the payment business we described earlier, and we think it is unlikely that VeriFone will be as profitable as it once was.

Even if we assume VeriFone could grow revenues by 30% compounded annually (levels achieved prior to 2013) and achieve a margin of 5% for the next 10 years, the stock is only worth $13/share, a 62% downside from current levels. VeriFone cannot withstand such drastic margin compression long term without drastic changes in the business model.

Catalysts in the Near Future

VeriFone’s stock price this year is dependent on its efforts to monetize services, software, and install new hardware. New payment systems such as Apple Pay require retailers to be willing to purchase new terminal equipment. If Apple Pay doesn’t catch on as expected, VeriFone won’t see the increase in terminal sales required to meet expectations. Similarly, if competitors offer lower fees or transaction charges, VeriFone could be crowded out of new contracts.

Other payment systems, particularly the merchant customer exchange (MCX) backed by Walmart and other large retailers, threaten to segment the market further, forcing retailers to pick a system and stick with it, or assume the costs of switching.

Short Interest

Short interest in PAY is 2.8 million shares, or 3% of float.

If Apple Pay Will Save VeriFone, Why Are No Insiders Buying?

Over the past 6 months, insiders have bought zero shares and sold a total of 120,670 shares, a total of 2% of total insider holdings. Are insiders really that confident about a turnaround and Apple Pay if no one is buying?

Funds that Hold PAY

- Congress All Cap Opportunity Fund (IACOX, CACOX) allocates 4.7% to PAY and earns our Very Dangerous rating.

André Rouillard and Kyle Guske II contributed to this report.

Disclosure: David Trainer, Kyle Guske II and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

2 replies to "Danger Zone: What’s Eating VeriFone’s (PAY) Profitability?"

VeriFone plunges over 20% after Q2 earnings and cuts full year guidance. Now down 46% since Danger Zone publish date.

VeriFone drops over 18% after Q3 earnings disappoint and full year guidance is lowered. Now down 56% since Danger Zone publish date.