Why are non-GAAP EPS dangerous?

Because they lead investors even further astray from true profits and GAAP EPS.

While Pulitzer Prize winner and New York Times author Gretchen Morgenson, hedge fund manager Doug Kass, and activist investor Bill Ackman all have differing views about non-GAAP earnings, one thing is clear; non-GAAP earnings mislead investors from the true cash flows generated by a business.

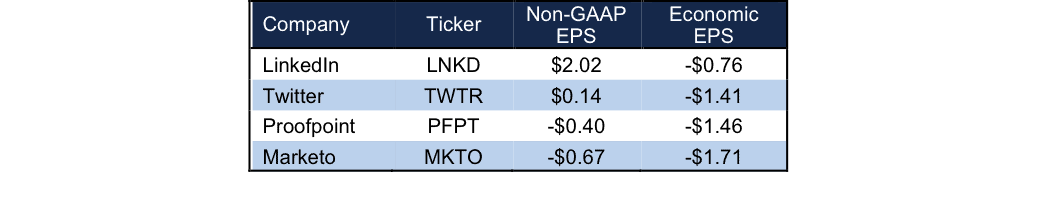

Many of our recent Danger Zone stocks use non-GAAP earnings to appear more profitable or less unprofitable in an attempt to keep their stock valuations high.

Non-GAAP Earnings Create Confusion

Sources: New Constructs, LLC

Most of the time “non GAAP earnings” means companies create the illusion of profitability when cash flows are heading the opposite direction by removing a litany of different expenses that, as management would put it, “do not truly represent the operations of the business.” In other words, expenses that would make it hard for us to earn our bonuses.

What expenses are companies removing from non-GAAP EPS?

The biggest offenders remove large amounts of stock based compensation. In fact, Twitter removed over $631 million in stock based compensation expenses, which represented 45% of revenue in 2014. In addition to stock based compensation, companies remove acquisition related costs or non-cash interest expenses, among many others.

To learn the dangers of non-GAAP earnings and how to overcome them, join CEO David Trainer, a Wall Street veteran, in this week’s free webinar “The Dangers of Non-GAAP Earnings.”

David will discuss what goes into non-GAAP earnings, why they create a problem in investing and analysis, and where you should focus when analyzing companies who report non-GAAP results.

Photo Credit: AppleDave (Flickr)