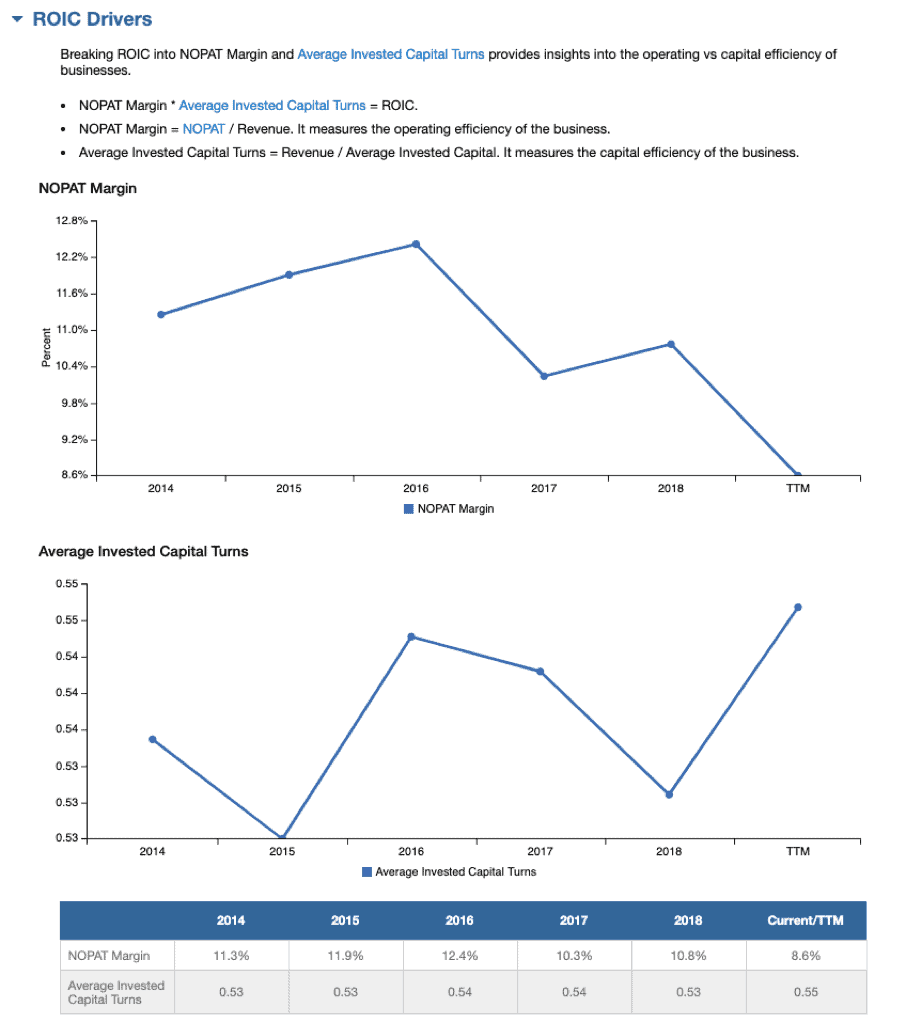

From the Rating Breakdown tab, get a five-year history of NOPAT margin and average invested capital turns right below the ROIC (return on invested capital) chart.

Breaking ROIC down into these components provides insight into how businesses can improve ROIC.

NOPAT margins show the operating efficiency of businesses while invested capital turns show the capital efficiency of businesses.

Unlimited and Institutional members can also access this information directly on the Screeners and Ratings pages.

Please contact us at support@newconstructs.com if you have any questions,

This article originally published on September 16, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.