The meme-stock and SPAC phenomenon has gone to the extreme as Digital World Acquisition Corp (DWAC), a special purpose acquisition company (SPAC) announced plans to merge with Trump Media & Technology Group (TMTG). Digital World Acquisition Corp and TMTG have no revenue, no cash flows, no profits, or even a clear business plan, and DWAC’s stock is up nearly tenfold in less than a week. Investors need to remain cautious and not get caught up in the trading fervor.

DWAC is a vehicle for TMTG to raise capital and has become a meme-stock target for speculators looking to prop up and cash in on Donald Trump’s social media power. TMTG will have close to $300 million in capital once the SPAC merger closes and no realistic plans on how it will operate a business. Given the stock price’s meteoric rise, lack of fundamentals and no clear plans for the business, putting capital into DWAC now is gambling, not investing.

The Meme-Stock to End All Meme-Stocks

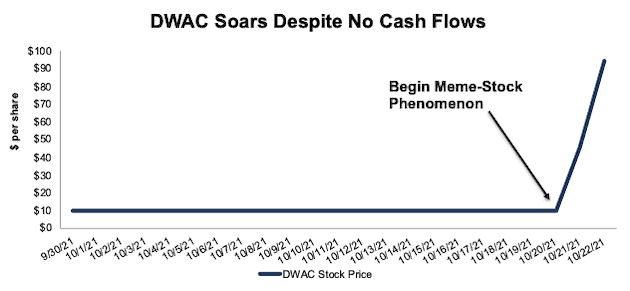

DWAC’s price and volume trends make the meme-stock trading frenzies for GameStop (GME) and AMC Entertainment (AMC) look mild. We cautioned AMC and GME investors at the time that neither business was worth anywhere near its stock price. Those businesses actually generate revenue and have concrete business plans. DWAC offers neither. Investors should be mindful that stocks can drop as fast and as far as they rise especially when they are not supported by fundamentals.

Figure 1: DWAC Stock Price Enters Meme-Stock Territory

Image Source: New Constructs, LLC

Large Competition Comes with DWAC’s Large TAM

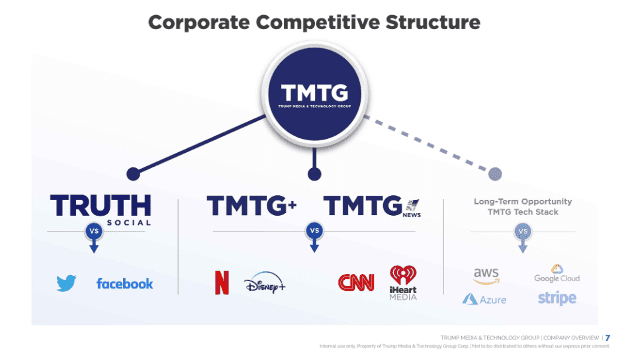

Trump Media & Technology Group, in an investor presentation unveiled with the SPAC merger announcement, plans to create a social network called Truth Social, but its ambitions don’t stop there. The presentation lays out vague “plans” of operating:

- a news network that competes with the likes of CNN and iHeartMedia;

- a streaming service, TMTG+, to go against Netflix (NFLX) and Disney+ (DIS); and

- a “TMTG Tech Stack” to go up against Amazon (AMZN) Web Services, Google (GOOGL) Cloud, and Microsoft (MSFT) Azure.

Figure 2 shows TMTG’s “Corporate Competitive Structure”, as disclosed in its presentation. Each one of these markets is highly competitive. Breaking into them requires a clear, disruptive business plan, large capital investments, excellent execution, and lots of time. Disney and Amazon built their businesses over decades with billions of dollars of capital investment.

Figure 2: TMTG Aims for a Media Conglomerate

Image Source: TMTG Corp

The presentation implies the company has a large total addressable market (TAM) as evidenced by the user bases of Netflix, Twitter (TWTR), Disney+ and the total number of podcast listeners in the United States. A large TAM normally gets investors excited, which is why most IPOs include large TAMs in their S-1s. Typically, TAM disclosures include specific plans for how the company will make money in those markets and how the capital it is raising will be deployed. The TMTG presentation offers no business plan and doesn’t even mention a single dollar figure.

Truth Social Is Not a Sure Bet

Truth Social appears to be TMTG’s key product, as evidenced by its prominence in its investor presentation. Investors should note that other social media networks founded to compete with Facebook and Twitter in the wake of Donald Trump’s ban from those platforms haven’t been clear hits. Since returning to the Apple App Store in summer 2021, Parler’s user growth slowed significantly and Gettr was plagued by security breaches and compromised/fake accounts in its early days.

It’s too early to tell if Donald Trump’s association with Truth Social will help TMTG outperform previous social media startups, but one thing is clear, launching a social media company, signing up millions of users, and securing user data is no easy feat.

How to Value Digital World Acquisition Corp? You Really Can’t

With no fundamentals to analyze, investors have no way to assess the reasonableness of DWAC’s valuation.

Our take is that the stock is extremely expensive as it trades with a market cap of ~$3.5 billion with no revenue or profits or any management guidance for revenue or profits.

It seems crazy to us that anyone would invest at DWAC at anything close to its current price. The bottom line is that owning DWAC at anything close to its current price is not investing, it is gambling.

We believe investors, and especially advisors with a fiduciary duty to clients, should avoid DWAC entirely, or risk losing significant amount of capital. While the stock could stay elevated for quite some time, the risk/reward skews heavily towards risk, to say the least.

This article originally published on October 26, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.