We published an update on GME on January 20, 2022. A copy of the associated Earnings Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

“I don’t know what the f— I’m doing, I just know I’m making money,”

Danny Tran in this TikTok video, also featured in The Wall Street Journal’s It’s All Just a Game to Me.

As more investors willfully admit they are gambling on stocks, we feel compelled to offer an easy way to make more informed decisions, and, hopefully, save people lots of money. Over the next few weeks, we’re going to give investors research that shows when meme stocks’ valuations get crazy, and they should sell. This week, we focus on GameStop (GME: $185/share) and put it in the Danger Zone.

Why Investors Need Independent Research

Wall Street isn’t in the business of warning investors of the dangers in risky stocks because they make too much money from their trading volume and underwriting of debt and equity sales.

Only independent firms are free to provide unconflicted research and navigate Wall Street conflicts and analyst biases. With new technology to cut through the deluge of data in financial filings and overcome the flaws in Wall Street research, self-directed investors are better positioned than ever to make informed decisions.

What’s the Problem Here?

The meme stock frenzy highlights the lack of reliable fundamental research, which creates a vacuum for mis-information that elevates sources like Reddit to undue levels of influence and leads investors to lose perspective.

Without reliable fundamental research, investors have no way of gauging whether a stock is expensive or cheap. Without a reliable measure of valuation, investors have little choice but to gamble if they want to own stocks. The lack of reliable fundamental research is a big problem if we want our market to have integrity and not unfairly advantage those with better information.

Figure 1: Mis-Information for Self-Directed Investors Is At an All-Time High

Image Source: Everipedia

Meme Stock #1: GameStop: Danger Zone Anywhere Above $45/share

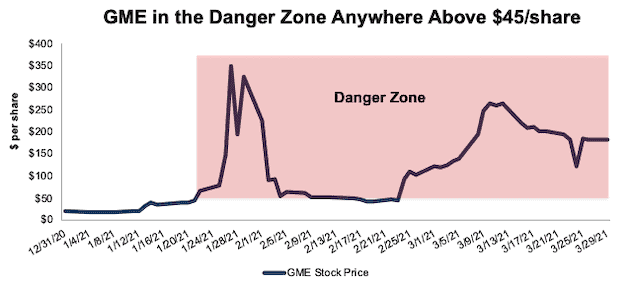

GME was not worth owning anywhere above $45/share, given the company’s fundamentals, as explained when we closed our Focus List: Long position in the stock in late January. Nevertheless, the stock went on to climb as high as $347/share before taking a roller coaster path back to ~$185/share. See Figure 2.

Figure 2: Fundamental Research to Know When to Sell GME

Sources: New Constructs, LLC and company filings

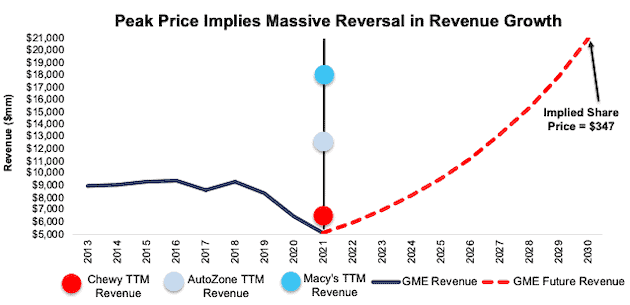

To give readers a sense of just how crazy overvalued the stock was at its peak, we do the math and show how the business would have to perform to justify $347/share.

“Crazy” at $347 Explained: Implies More Revenue Than Macy’s

Our reverse discounted cash flow (DCF) model is an excellent research tool to analyze the expectations implied by stock prices. To justify $347/share, it shows that GameStop must:

- improve its profit margin to 5.5% (10-yr avg from 2010-19 is 3.9% & all-time high was 4.8% in 2008) and

- grow revenue by 17% compounded annually through 2030 (above projected video game industry CAGR of 13% through 2027)

In this scenario, GameStop earns nearly $21 billion in revenue in 2030 or more than the trailing-twelve-months (TTM) revenue of Macy’s (M), AutoZone (AZO), and Chewy Inc. (CHWY). See Figure 3 for details.

Figure 3: GameStop’s Historical Revenue vs. DCF Implied Revenue: Scenario 1

Sources: New Constructs, LLC and company filings

For reference, GameStop’s revenue fell by 3% compounded annually from 2009 to 2019.

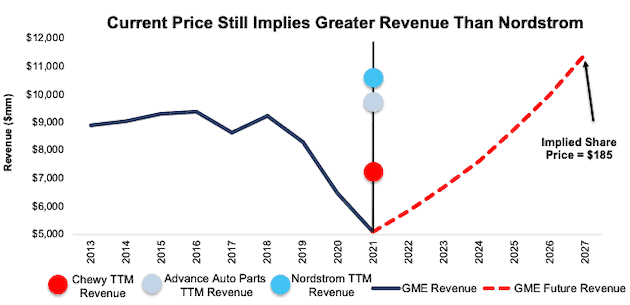

Still Crazy: At $185

For perspective on the current price, we run the same analysis to show what the company must do to justify $185/share:

- immediately improve its profit margin to 4.8% (all-time high in 2008 compared to 0.7% in 2019) and

- grow revenue by 15% compounded annually through 2027 (above projected video game industry CAGR of 13% through 2027)

In this scenario, GameStop earns over $11 billion in revenue in 2027, which is 19% higher than GameStop’s record revenue of $9.6 billion in 2012 and the TTM revenue of Nordstrom (JWN), Advance Auto Parts (AAP), and Chewy. See Figure 4 for details.

Figure 4: GameStop’s Historical Revenue vs. DCF Implied Revenue: Scenario 2

Sources: New Constructs, LLC and company filings

More Reliable Fundamental Research on other Meme Stocks

With a better grasp on fundamentals[1], investors have a better sense of when to buy and sell – and – know how much risk they take when they own a stock at certain levels.

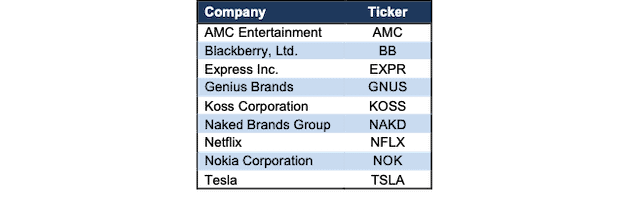

In the coming weeks, we will perform this same analysis on other meme stocks: AMC Entertainment (AMC), Blackberry (BB), Express Inc. (EXPR) Genius Brands (GNUS), Koss Corporation (KOSS), Naked Brands Group (NAKD), and Nokia (NOK). Each of these stocks were on Robinhood’s restricted stocks list and each saw a major rise and fall in late January.

We will also feature other meme stocks that trade at levels entirely disconnected from fundamental reality, such as Netflix (NFLX) and Tesla (TSLA).

Figure 5: Meme Stocks Disconnected From Fundamental Reality

Sources: New Constructs, LLC and company filings

This article originally published on April 5, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.