For the week of 1/13/20-1/17/20, we focus on the Earnings Distortion scores for 31 companies.

We measure earnings distortion using a proprietary human-assisted ML methodology featured in a recent paper from Harvard Business School (HBS) and MIT Sloan. This paper empirically shows that street earnings estimates are incomplete and less accurate since they do not consistently and accurately adjust for unusual gains/losses buried in footnotes.

As corporate managers bury key data in footnotes to manipulate earnings, and investors miss them, investment opportunities arise because stock prices tend to be driven by core earnings power.

Our Earnings Distortion Scores[1] empower investors to combat management efforts to obfuscate financial performance. The aggregate level of distortion recently reached levels not seen since right before the tech bubble and the financial crisis.

Weekly Earnings Distortion Insights

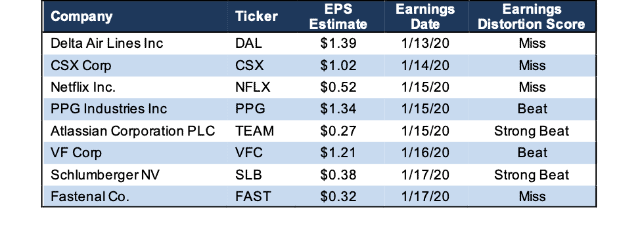

Figure 1 contains the S&P 500 companies, plus those with market caps greater than $10 billion, that we expect to beat or miss earnings expectations the week of January 13, 2020.

Figure 1: Earnings Distortion Scorecard Highlights: Week of 1/13/20-1/17/20

Sources: New Constructs, LLC and company filings

The appendix to this report shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that report earnings the week of January 13, 2020.

Details: CSX’s Earnings Distortion

Over the trailing twelve months (TTM) period, CSX had $221 million in net earnings distortion that cause earnings to be overstated. Notable unusual income buried in the fine print of the firm’s 2018 10-K include:

The gain on property dispositions comes from CSX selling off some of its real estate assets and rail lines. CSX’s other income is primarily from non-operating pension plan gains.

In total, we identified $0.27/share (6% of reported EPS) in net unusual expenses in CSX’s TTM results. After removing this earnings distortion from GAAP net income, we see that CSX’s TTM core earnings of $3.92/share are significantly below its GAAP EPS of $4.19.

The analyst consensus for CSX’s Q4 2019 earnings is $1.02/share, which comes out to $4.08/share on an annualized basis. Investors who only look at GAAP net income will think that analysts are projecting CSX’s earnings to decline. By removing earnings distortion, we show that consensus estimates imply significant growth. As a result, we expect CSX to miss earnings estimates.

Figure 1 shows that CSX is one of four companies we expect to miss earnings expectations for the week of 1/13. Two companies get our “Beat” rating, and two more are “Strong Beat”, which means we are especially confident that those stocks will beat expectations.

How to Make Money with Earnings Distortion Data

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Page 1 in Core Earnings: New Data & Evidence

In Section 4.3 of Core Earnings: New Data and Evidence, professors from HBS & MIT Sloan present a long/short strategy that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings. Positions are opened in the month each 10-K is filed and held until the next 10-K is filed, or about a year.

This simple, low turnover strategy produced abnormal returns of 7-to-10% a year. These abnormal returns show that the market misses important data in the footnotes and that investors who adjust for unusual items can make more money. Click here for more details on our data offerings.

For more on how to use core earnings and earnings distortion to pick better stocks, click here.

This article originally published on January 6, 2020.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

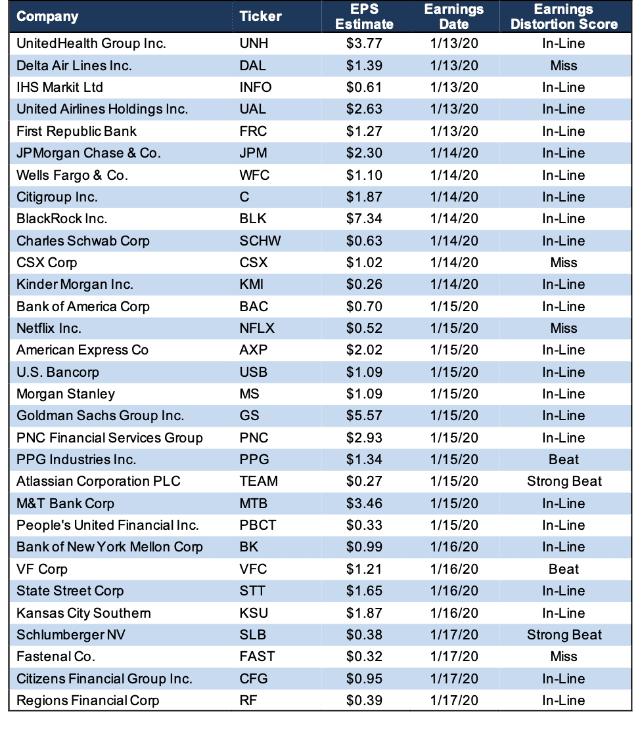

Appendix: All Major Companies That Report January 13-17

Figure 2 shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that report earnings the week of January 13, 2020.

Figure 2: Earnings Distortion Scorecard: Week of 1/13/20-1/17/20

Sources: New Constructs, LLC and company filings

[1] Note that Earnings Distortion scores will be added to our website via a new column on the Screeners and Portfolios page in January 2020.