The earnings recession is not news. What most investors do not know is that core earnings, when adjusted for unusual gains/losses hidden in footnotes, are a lot worse than investors and markets realize.

Meanwhile, the S&P 500 has been on a tear this year, up nearly 25% and currently at an all-time high.

How do stocks rise when the underlying fundamentals fall?

Answer: most investors are not aware of the more severe decline in core earnings.

Why are they not aware?

Answer: because too few people read the footnotes.

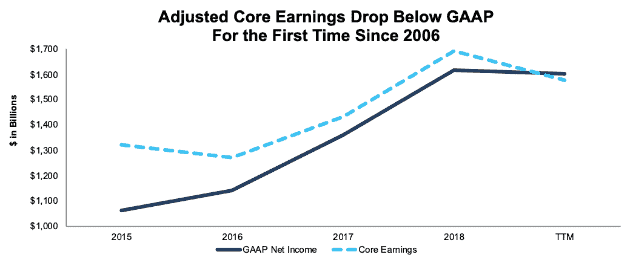

Adjusted Core Earnings Drop Below GAAP for First Time Since 2006

Over the trailing twelve months, GAAP earnings fell 1% while adjusted core earnings fell 6%[1]. Most investors know that GAAP earnings are prone to distortion because they include lots of non-recurring or unusual items. Most investors are not aware that the core earnings (from CompuStat or Wall Street analysts) are also distorted by unusual items. In fact, earnings for the S&P 500 were distorted by 22% on average in 2018 [2].

Figure 1 highlights the more severe drop in core earnings when accounting for these hidden gains or losses.

Figure 1: GAAP Net Income vs. Adjusted Core Earnings: 2015-TTM

Sources: New Constructs, LLC and company filings.

This analysis is based on the top 1,000 companies by market cap in each measurement period.

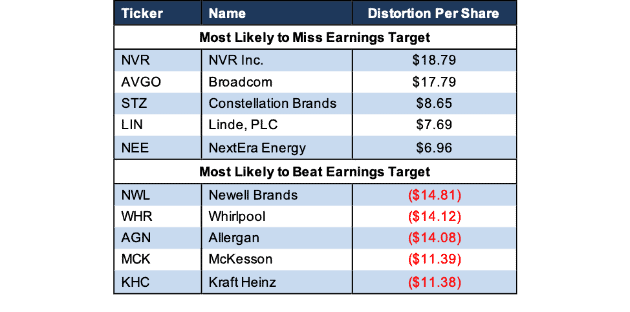

Whose Earnings Are Most Distorted?

Figure 2 shows best and worst S&P 500 companies from our Earnings Distortion Scorecard. High levels of earnings distortion means companies are overstating their earnings; so there is a greater risk of their missing their earnings targets. Negative or lower levels of earnings distortion mean the opposite.

Figure 2: Top 5 Earnings Distortion Scores the S&P 500 For the Most Recent Fiscal Year

Sources: New Constructs, LLC and company filings.

The companies most likely to miss earnings in Figure 2 overstated their core earnings by including a variety of unusual gains, including:

- A $7.3 billion one-time gain due to the impact of the corporate tax cut for Broadcom (AVGO)

- A $2 billion unrealized gain on securities for Constellation Brands (STZ)

- A $3.3 billion gain on sale of businesses for Linde, PLC (LIN)

On the other hand, large asset write-downs are the cause of the understated earnings for all the companies most likely to beat in Figure 2.

Why The Severe Drop In Core Earnings?

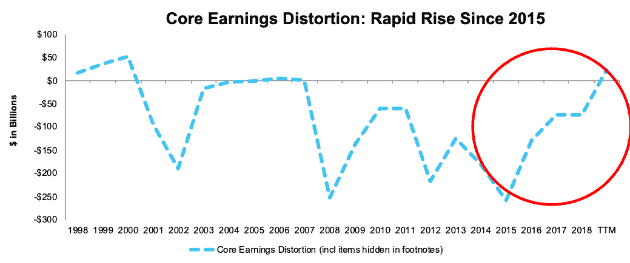

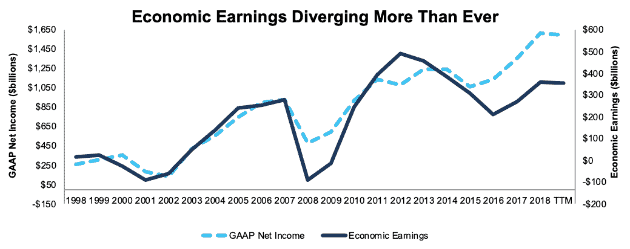

Earnings distortion from hidden gains is on a rapid rise, and core earnings from traditional sources have not been this overstated since 2000[3]. Figure 3 shows the level of core earnings distortion from the unusual gains and losses from 2000 to the present. Note the rapid rise in the distortion from gains buried in footnotes over the last few years.

Figure 3: Core Earnings Distortion: Worst Since 2000

Sources: New Constructs, LLC and company filings.

The rapid rise in earnings distortion since 2015 means that an increasing amount of corporate income is coming from unusual or one-time gains, which is not apparent to investors analyzing press releases or income statements. Corporate managers hide the one-time nature of these gains by only disclosing them in the fine print. In other words, managers are dressing up the numbers in an increasingly aggressive manner over the last few years.

Notably, earnings distortion is now positive for the first time since 2007, and the highest it’s been since 2000. Figure 3 shows that soon after earnings distortion broke into positive territory, in 2006-07 and 1998-2000, the market crashed.

Falling Interest Rates Prop Up Market

2019 has been a great year for the market, with the S&P 500 up 25% and at an all-time high.

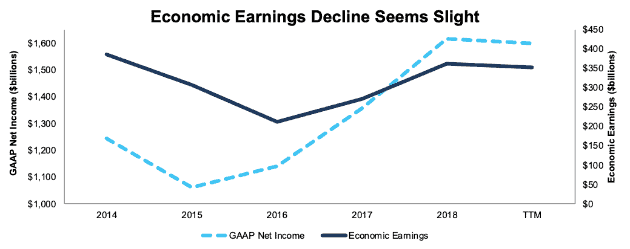

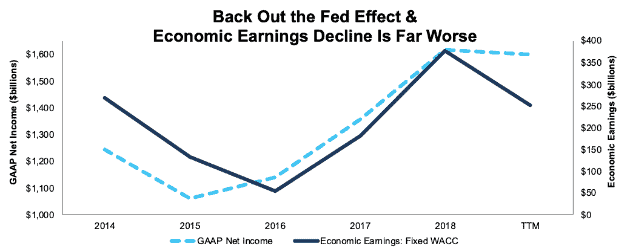

Investors should thank the Federal Reserve – who cut interest rates three times this year. These rate cuts have helped drive the 5-year treasury rate – the risk-free rate in our WACC calculation – down from 2.5% to 1.6%.

In turn, the overall market WACC fell from 6.5% in 2018 to 6.0% TTM. Since economic earnings equal (ROIC-WACC) * Invested Capital, the large decline in WACC drove economic earnings growth in 2018 and mitigates the decline in economic earnings over the TTM period. Figure 4 shows a 2% decline in economic earnings, still worse than the GAAP decline of 1%. Note that we provide a comparison of Economic Earnings and GAAP earnings from 1998 to present in the Appendix.

Figure 4: GAAP vs. Economic Earnings: 2014-TTM

Sources: New Constructs, LLC and company filings.

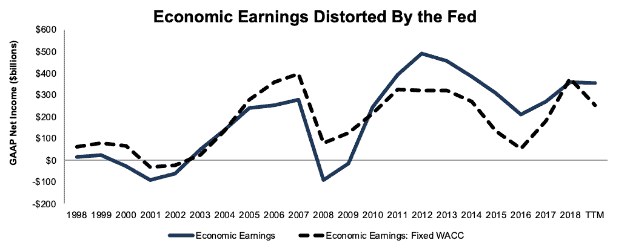

If we fix WACC at 6.4% (the 15-year average), we find that economic earnings declined by 33% from 2018 to TTM, as shown in Figure 5. In other words, the underlying economics of businesses experienced a sharp decline so far in 2019. The sharpness of this decline aligns with the decline we see in adjusted core earnings in Figure 1.

Figure 5: Economic Earnings Are Much Worse Without Fed Help

Sources: New Constructs, LLC and company filings.

As we showed in “No Real Earnings Growth in 2018 – Just Lower Taxes”, the entirety of the market’s economic earnings growth last year came from the drop in tax rates. Remove that one-time boost, and we have two years of decline in the underlying economics of businesses for the largest 1000 stocks in the market.

Given analysts’ forecasts for further declines in (unadjusted) earnings and the rising trend in earnings distortion, real economic earnings should decline even more significantly in 2020.

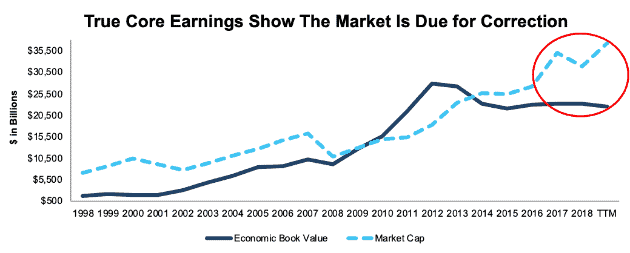

Fundamental Risk at Cyclical Peak

The combination of deteriorating fundamentals with the S&P 500 hitting all-time highs means the market is more expensive than it’s been at any time since 2006.

Figure 6: Market Cap Vs. Economic Book Value: 2005-TTM

Sources: New Constructs, LLC and company filings.

Figure 6 compares the aggregate market cap of the top 1,000 companies by market cap to their economic book value (EBV), which equals NOPAT/WACC adjusted for all senior claims to equity. NOPAT is an unlevered version of our adjusted core earnings.

The aggregate price to economic book value (PEBV) of the market now stands at 1.65, the highest that ratio has been since it hit 1.7 in 2006[4].

The fundamentals don’t support this valuation. Without falling interest rates and earnings distortion, the market would likely trade much lower. If the PEBV of the market reverts to its 10-yr average of 1.11, we are looking at a 33% decline of the market.

Catalyst for a Market Correction

We know that the Fed plans to leave interest rates unchanged for the near future so there are two likely catalysts for a market correction:

- Companies suddenly report core earnings more accurately.

- Investors figure out the true core earnings.

The odds of the first option are lower than the second. We’re not holding our breath that investors will suddenly decide to spend hours scouring footnotes and adjusting their numbers for the hidden gains/losses that managers use to manipulate earnings. It is more likely, however, that investors would start using research that does the footnotes research for them

The only remaining question is: how quickly investors adopt this research. We are not sure how to answer that question except to say that those who adopt sooner have an advantage over those that adopt later.

Earnings Distortion Reveals a Stock to Avoid

Some stocks are more risky than others.

We created the Earnings Distortion Scorecard to help investors identify stocks most at risk of an earnings miss due to accounting distortions, and Northrop Grumman (NOC) is currently near the top of the list.

We previously warned investors about NOC in our article “Earnings Distortion Makes This Stock a Sell”. NOC’s stock is up 45% so far in 2019, and the company has beat earnings expectations in all three quarters. However, our analysis shows that these earnings beats are the product of non-operating items.

Over the TTM period, NOC had $415 million in net unusual income adjustments that cause earnings to be overstated. Notable unusual gains include:

- $440 million ($2.61/share) in non-operating pension gains – Page 72 2018 10-K

- $82 million ($0.49/share) in company-defined other expenses – Page 1 3Q19 10-Q

- $84 million ($0.49/share) in non-recurring tax benefits – Page 62 2018 10-K

NOC’s GAAP EPS is up 24% TTM, but its core earnings per share are up just 3%.

Meanwhile, NOC’s valuation implies that it will continue to grow profits at the rate of GAAP EPS rather than core earnings. Our reverse discounted cash flow (DCF) model more rigorously assesses the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price.

When we look at the expectations implied by its valuation, the stock looks much more expensive. In order to justify its valuation of $356/share, NOC must improve its NOPAT margin to 10% (up from 9% in 2018) and grow NOPAT by 7% compounded annually for the next 10 years. This seems ambitious for a company that has grown NOPAT by just 3% compounded annually over the past decade. See the math behind this dynamic DCF scenario.

If NOC maintains its 2018 NOPAT margin of 9% and grows NOPAT by 3% compounded annually over the next decade, the stock is worth $224/share today, a 37% downside to the current stock price. See the math behind this dynamic DCF scenario.

Investors that want to stay safe in an increasingly dangerous market should avoid companies with overstated earnings, like NOC.

How You Can Leverage the Earnings Distortion Scorecard

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Abstract

Core Earnings: New Data and Evidence presents a long/short strategy using our data that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings. Positions are opened in the month each 10-K is filed and held until the next 10-K is filed, or about a year.

This simple, low turnover strategy produced abnormal returns of 7-to-10% a year. These abnormal returns show that the market misses important data in the footnotes and that investors who adjust for unusual items can make more money. Click here for more details on our data offerings.

We have already used the Scorecard to identify two very successful Long Ideas:

- AbbVie (ABBV), which beat street estimates on November 1 and is already up 11% (compared to 3% for S&P 500) since our article.

- Qualcomm (QCOM), which beat street estimates on November 6 and is already up 9% (compared to 4% for S&P 500) since our article.

We’ve also used the Scorecard to identify the following earnings beats:

- HCA Healthcare (HCA): beat the street on October 29

- Arista Networks (ANET): beat the street on October 31

- DuPont (DD): beat the street on October 31

- Sysco (SYY): beat the street on November 4

- CVS Health (CVS): beat the street on November 6

- AmerisourceBergen (ABC): beat the street on November 7

- Booking Holdings (BKNG): beat the street on November 7

- Skyworks Solutions (SWKS): beat the street on November 12

- Walmart Inc. (WMT): beat the street on November 14

- Macy’s Inc. (M): missed the street on November 21

This article originally published on November 20, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: More Charts and Historical Analysis

We provide ratings, models, reports & screeners on U.S. 3,000 stocks, 700 ETFs and 7,000 mutual funds.

Figure 7: Economic VS GAAP Earnings: 1998 to present

Sources: New Constructs, LLC and company filings.

Figure 8: Economic Earnings – With a Fixed WACC of 6.4%: 1998 to present

Sources: New Constructs, LLC and company filings.

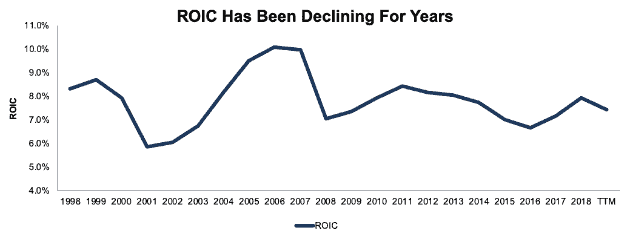

Figure 9: Return on Invested Capital (ROIC): 1998 to present

Sources: New Constructs, LLC and company filings.

[1] This analysis is based on the top 1,000 companies by market cap in each measurement period.

[2] Core Earnings: New Data and Evidence, a recent paper from Harvard Business School and MIT Sloan, shows how our footnotes adjustments create a more predictive measure of core earnings that can be used to generate alpha.

[3] See Appendix for analysis and charts from 1998 to present.

[4] For comparison, PEBV peaked at 5.27 in 2000.

1 Response to "Consensus Earnings Are Wrong & How Much Is It Costing You?"

Now I know why I have had this ominous feeling, which started several months ago. Things just didn’t seem right and obviously they aren’t. It appears to me that the Trump administration is doing every thing they can to “pump” the economy and thereby virtually insure Mr. Trump’s reelection. I have been making so much money (for me at least) in the market that I was contemplating moving some safe money that matures in early December into the market. You just helped me avoid that mistake and to check my euphoria. Thanks for the great work you do and for writing a very insightful article. I will act accordingly beginning Monday. (I anticipate a down market Monday because of this and several other similar articles I have read in the last 24 hours.) I will begin to warn my investor friends and encourage them to purchase your service.