Forget all the “earnings season” analysis you read last month. The real earnings season—annual 10-K filing season—is happening right now.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. Our analysts work tirelessly to uncover red flags hidden in the footnotes and make our models the best in the business.

There’s no way we could analyze so many filings in such a short time without our engineering team’s help. Using machine learning and natural language processing, we automate much of the rote work of data gathering and modeling. Our technology frees our analysts up to spend more time on the complicated and unusual data points that other firms miss.

Investors understand that analyzing all financial statements and footnotes is an essential part of the diligence needed to fulfill the fiduciary duty of care. How else can one make the necessary adjustments to assess a company’s true earnings and return on invested capital (ROIC)? Our innovation is to scale this diligence and make it easily accessible to our subscribers.

What We Accomplished Yesterday

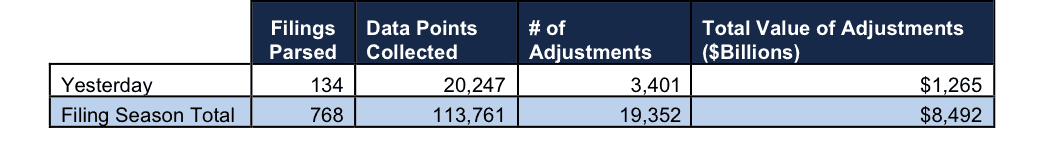

Figure 1 shows the work our analysts did yesterday and over the entirety of this filing season so far.

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

Yesterday, our analysts parsed 134 filings and collected 20,247 data points. In total, they made 3,401 adjustments with a dollar value of $1.3 trillion. That breaks down into:

- 1,448 income statement adjustments with a total value of $89 billion

- 1,382 balance sheet adjustments with a total value of $508 billion

- 571 valuation adjustments with a total value of $668 billion

In particular, analyst Hunter Gray found an unusual item yesterday in Nabors Industries’ (NBR: $15/share) 10-K.

On page 30, NBR recorded a $139 million write-down to account for its share of impairments taken by CJES, a well construction service that NBR invested in and accounted for under the equity method. This write-down was a non-cash, non-recurring charge that accounted for over 10% of NBR’s reported net loss in 2016.

NBR still generated an operating loss last year, as did a large number of companies in the oil and gas industry. However, removing the impact of this hidden write-down reveals that the company is significantly closer to profitability than its GAAP net income would suggest. It also ensures that NBR’s management will still be held accountable for the capital they invested in CJES in the years to come.

This article originally published here on March 2, 2017

Disclosure: David Trainer, Hunter Gray, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.