Our latest featured stock is an apparel retailer with overstated earnings.

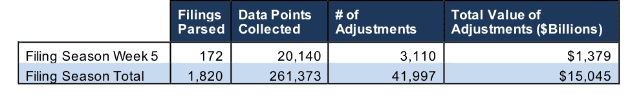

We pulled this highlight from last week’s research of 172 10-K filings, from which our Robo-Analyst technology collected 20,140 data points. Our analyst team used this data to make 3,110 forensic accounting adjustments with a dollar value of $1.4 trillion. The adjustments were applied as follows:

- 1,285 income statement adjustments with a total value of $85 billion

- 1,306 balance sheet adjustments with a total value of $558 billion

- 519 valuation adjustments with a total value of $735 billion

Figure 1: Filing Season Diligence for Week of March 19-25

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of service to their clients.

One Company to Watch in 2018

Based on our analysis of The Gap, Inc.’s (GPS) 2018 10-K, we downgraded the stock from Very Attractive to Attractive.

Gap’s net income grew by 25% in fiscal year 2018, but its economic earnings declined by 6%. Senior Analyst Lindsay Bohannon identified a few key items that explain this discrepancy.

On page 73, GPS recorded a $64 million gain (8% of GAAP net income) due to insurance proceeds from the fire at its Fishkill distribution center.

In addition, 2017 earnings were artificially depressed due to $294 million (43% of GAAP net income) in hidden write-downs. Artificially low earnings in 2017 and artificially high earnings in 2018 created the illusion of significant profit growth.

Finally, we made adjustments to account for the hidden sources of invested capital that are not included on GPS’ balance sheet. The adjustments include $381 million (7% of reported net assets) in accumulated asset write-downs (including the aforementioned write-downs in 2017) and $5.4 billion (97% of reported net assets) in off-balance sheet debt.

When we make these adjustments and account for the cost of capital, we find that GPS’s economic earnings declined from $619 million in 2017 to $579 million in 2018. The stock is still relatively cheap, but GPS’s declining profitability means it no longer earns our highest rating.

In total, we made the following adjustments to Gap’s 2018 10-K:

Income Statement: we made $530 million of adjustments, with a net effect of removing $219 million in non-operating expense. We removed $155 million in non-operating income and $375 million in non-operating expense. You can see all the adjustments made to GPS’ income statement here.

Balance Sheet: we made $7.3 billion of adjustments to calculate invested capital with a net increase of $4.5 billion. You can see all the adjustments made to GPS’ balance sheet here.

Valuation: we made $7.8 billion of adjustments with a net effect of decreasing shareholder value by $5.7 billion. Aside from debt, the largest adjustment was $990 million (8% of market cap) in excess cash.

This article originally published on March 26, 2018.

Disclosure: David Trainer, Lindsay Bohannon, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.