Finding the best mutual funds is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Don’t Trust Mutual Fund Labels

There are at least 213 different Financials mutual funds and at least 637 mutual funds across ten sectors. Do investors need 63+ choices on average per sector? How different can the mutual funds be?

Those 213 Financials mutual funds are very different. With anywhere from 26 to 401 holdings, many of these Financials mutual funds have drastically different portfolios, creating drastically different investment implications.

The same is true for the mutual funds in any other sector, as each offers a very different mix of good and bad stocks. Consumer Staples rank first for stock selection. Energy rank last. Details on the Best & Worst mutual funds in each sector are here.

Paralysis By Analysis

We think the large number of Financials (or any other) sector mutual funds hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many mutual funds. Analyzing mutual funds, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each mutual fund. As stated above, that can be as many as 401 stocks, and sometimes even more, for one mutual fund.

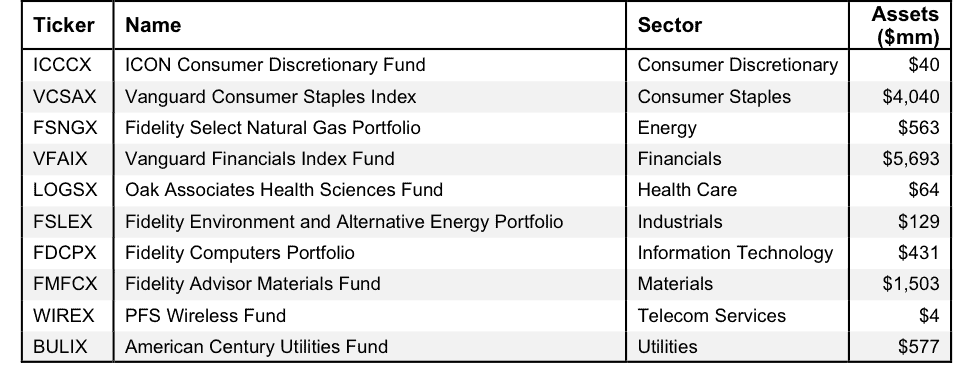

Any investor focused on fulfilling fiduciary duties recognizes that analyzing the holdings of a mutual fund is critical to finding the best mutual fund. Figure 1 shows our top rated mutual fund for each sector.

Figure 1: The Best Mutual Fund in Each Sector

Amongst the mutual funds in Figure 1, Fidelity Computers Portfolio (FDCPX) ranks first overall, Live Oak Health Sciences Fund (LOGSX) ranks second, and Vanguard Financials Index Fund (VFAIX) ranks third. Fidelity Select Natural Gas Portfolio (FSNGX) ranks last.

How to Avoid “The Danger Within”

Why do you need to know the holdings of mutual funds before you buy?

You need to be sure you do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

If Only Investors Could Find Funds Rated by Their Holdings…

Our mutual fund ratings leverage our stock coverage. We rate mutual funds based on the aggregated ratings of the stocks each mutual fund holds.

Fidelity Computers Portfolio (FDCPX) is not only the top-rated Information Technology mutual fund, but is also the overall best sector mutual fund out of the 637 sector mutual funds that we cover.

The worst mutual fund in Figure 1 is Fidelity Select Natural Gas Portfolio (FSNGX) which gets a Dangerous rating. One would think mutual fund providers could do better for this sector.

This article originally published here on February 9, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, sector, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro, or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.