Finding good stocks in today’s inflated market is even more difficult during earnings season, when noise and narratives fuel heightened speculation.

We help clients see through the noise and speculative hype. Instead of trying to guess the future, why not use research that is grounded in fundamentals and quantifying market expectations embedded in stock prices?

We do just that with our Stock Ratings, Fund Ratings, and AI Agent built with Google Cloud. The result?

Undeniable alpha – built from superior training data and an ontology that produces reliable research and stock picks.

You can get this alpha with our Most Attractive Stocks Model Portfolio, which presents the best stocks in any kind of market. The stocks in this Model Portfolio are not only undervalued (low expectations for future growth) but also possess strong fundamentals.

Below we feature one of the stocks from this Model Portfolio. This pick comes with a concise summary, which provides insight into the rigor of our research and approach to picking stocks. Whether you’re a member or not, we think it is important, especially in today’s volatile and overvalued market environment, that you’re able to see our research on stocks.

Keep an eye out for the free pick from our Most Dangerous Stocks Model Portfolio, which will be published this week as well!

We hope you enjoy this research. Feel free to share with friends and colleagues!

We update this Model Portfolio monthly. The latest Most Attractive and Most Dangerous stocks Model Portfolios were updated and published for clients on October 3, 2025.

Free Most Attractive Stocks Pick: First United Corp (FUNC)

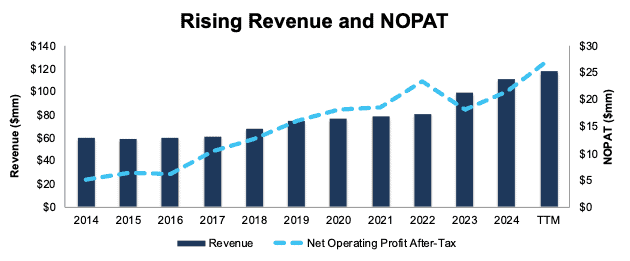

First United Corp (FUNC: $36/share) has grown revenue and net operating profit after tax (NOPAT) by 7% and 18% compounded annually since 2014, respectively. First United’s NOPAT margin increased from 8% in 2014 to 23% in the trailing-twelve months (TTM), while its invested capital turns rose from 0.4 to 0.5 over the same time. Rising NOPAT margins and invested capital turns drive First United’s return on invested capital (ROIC) from 4% in 2014 to 12% in the TTM.

Figure 1: First United’s Revenue and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

FUNC Is Undervalued

At its current price of $36/share, FUNC has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means the market expects First United’s NOPAT to permanently decline by 40% from TTM levels. This expectation seems overly pessimistic for a company that has grown NOPAT by 10% compounded annually over the last five years and 18% compounded annually over the last ten years.

Even if First United’s NOPAT margin falls to 14% (compared to 23% in the TTM) and the company grows revenue by 3% (below ten-year CAGR of 7%) compounded annually through 2034, the stock would be worth $47/share today – a 31% upside. In this scenario, First United’s NOPAT would fall <1% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario.

Should First United grow profits more in line with historical levels, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in First United’s 10-K and 10-Q:

Income Statement: we made nearly $10 million in adjustments, with a net effect of removing under $5 million in non-operating expense. Professional members can see all adjustments made to the company’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made just under $90 million in adjustments to calculate invested capital with a net increase of over $40 million. One of the most notable adjustments was for other comprehensive income. Professional members can see all adjustments made to the company’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made just under $20 million in adjustments to shareholder value, with a net increase of under $5 million. The most notable adjustment was for overfunded pensions. Professional members can see all adjustments to the company’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on October 17, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.