This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

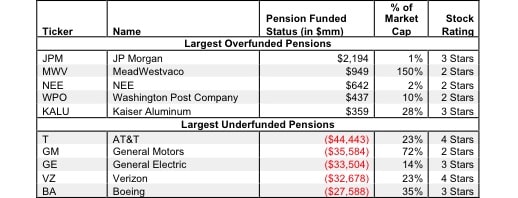

In their annual reports, companies disclose the value of the assets used to fund their pension plans and the present value of the future obligation, called the projected benefit obligation. The net funded status of a pension plan is the difference between these two values. A company with a positive net funded status has more assets than they need in their plan, which means future cash flows that would have been used to meet new obligations can instead be returned to shareholders. Companies with underfunded pensions will likely need to divert a greater amount of future cash flows away from shareholders to make up the funding gap. An accurate analysis of shareholder value should include the net funded status of pensions.

2 replies to "Pension Net Funded Status – Valuation Adjustment"

One factor you are not considering is the discount rate used to calculate pension funding. Right now interest rates are low so many companies are using a discount rate around 4%. As that rate rises, underfunded status will decrease dramatically. That’s why it is often good to be a little bit underfunded when bonds are expensive.

To quote Doug Noland (Credit Bubble Bulletin blog): “Massive federal deficits and low Fed-dictated borrowing costs sustain inflated corporate earnings and cash-flows.” http://www.prudentbear.com/2013/08/introducing-government-finance-quasi.html Mr. Trainer, how do you reconcile the results of your methodology with government-induced, massively-inflated corporate earnings and cash flows – both economic and accounting?

I remember, about seven years ago, on the website fool dot com, coming across a mention of the book “Expectations Investing” by Mauboussin and thinking how intriguing that valuation method was. The calculations required were beyond my capabilities to execute at the time, and still are. So I was impressed to see that your website incorporates his thinking in regards to what “growth expectations are embedded in the price”. Prior to re-discovering your website last week, I was leaning to “free cash flow” as being the most important metric. After reading your website, I see that ROIC is a better over-all metric.

New Constructs is a national treasure. Seriously.

Steve