Dividend-paying stocks have become a focal point for investors amid heightened market uncertainty. They offer an appealing way to generate income while navigating periods of volatility. However, the belief that one can simply invest in the highest-yielding stocks and expect reliable returns is naive.

If dividend investing were as straightforward as selecting stocks based on yield alone, then everyone would easily make lots of money on dividend stocks. In reality, the stock market does not make everyone lots of money. Only a precious few outperform. Outperformance requires discipline, scrutiny, and a strong understanding of the underlying cash flows.

Many high-yield stocks may, in fact, be masking underlying financial weaknesses. Without ample free cash flow generation, companies cannot maintain their dividend commitments. Dividend cuts tend to have devastating impacts on stock prices. We identify three types of dangerous dividend stocks in our latest training here.

The key to identifying good dividend stocks lies in robust fundamental research. A company must demonstrate the capacity to generate sufficient and consistent cash flows to support its dividend policy over time. Without this financial foundation, even the most attractive yields can prove illusory.

Luckily, our Safest Dividend Yields Model Portfolio provides you with the best of the dividend stocks. How?

It includes only Attractive or Very Attractive rated stocks whose underlying businesses generate sufficient cash flows to support dividend payments. In other words, we give you the best of both worlds: safety and upside potential.

Below you will find a free stock pick from the latest edition of our Safest Dividend Yields Model Portfolio. This summary is not a full Long Idea report, but it will give you insight into the rigor of our research and approach to picking stocks.

Feel free to share this report with friends and colleagues.

We update this Model Portfolio monthly. June’s Safest Dividend Yields Model Portfolio was updated and published for clients on June 18, 2025.

Free Stock Pick: Nexstar Media Group Inc (NXST: $171/share)

Nexstar Media Group (NXST) is the featured stock in June’s Safest Dividend Yields Model Portfolio.

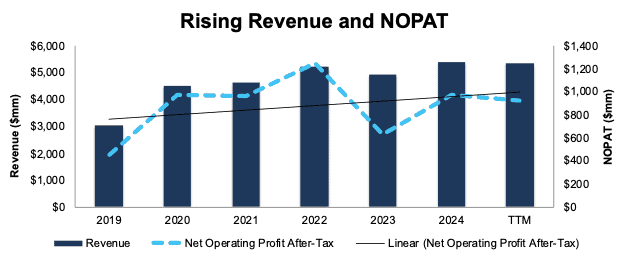

Nexstar Media Group has grown revenue and net operating profit after tax (NOPAT) by 11% and 15% compounded annually, respectively, since 2019. The company’s NOPAT margin improved from 15% in 2019 to 17% in the TTM, while invested capital turns rose from 0.4 to 0.5 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 6% in 2019 to 8% in the TTM.

Figure 1: Nexstar Media Group’s Revenue & NOPAT Since 2019

Sources: New Constructs, LLC and company filings

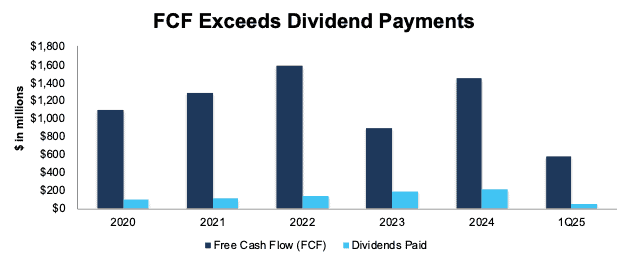

Free Cash Flow Exceeds Regular Dividend Payments

Nexstar Media Group has increased its regular dividend from $0.56/share in 1Q20 to $1.86/share in 2Q25. The current quarterly dividend, when annualized provides a 4.4% dividend yield.

The company’s free cash flow (FCF) easily exceeds its regular dividend payments. From 2020 through 1Q25, the company generated $6.9 billion (51% of current enterprise value) in FCF while paying $828 million in regular dividends. See Figure 2.

Figure 2: Nexstar Media Group’s FCF Vs. Regular Dividends Since 2020

Sources: New Constructs, LLC and company filings

As Figure 2 shows, this company’s dividends are backed by a history of reliable cash flows. Dividends from companies with low or negative FCF are less dependable since the company might not be able to sustain paying dividends.

NXST Is Undervalued

At its current price of $171/share, NXST has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects the company’s NOPAT to permanently fall 30% from TTM levels. This expectation seems overly pessimistic given that the company has grown NOPAT by 23% compounded annually over the last ten years and 15% compounded annually over the last five years.

Even if the company’s:

- NOPAT margin immediately falls to 13% (equal to the company’s lowest NOPAT margin in the last decade) through 2034, and

- revenue grows 4% (compared to 11% CAGR over the last five years) compounded annually through 2034, then

the stock would be worth $223/share today – a 30% upside. In this scenario, the company’s NOPAT would grow just 1% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario.

Should the company’s NOPAT grow more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we make based on Robo-Analyst findings in this featured stock’s 10-K and 10-Qs:

Income Statement: we made over $700 million in adjustments with a net effect of removing over $200 million in non-operating expenses. Professional members can see all adjustments made to the company’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $1 billion in adjustments to calculate invested capital with a net increase of just under $1 billion. The most notable adjustment was for asset write downs. Professional members can see all adjustments made to the company’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made over $8 billion in adjustments to shareholder value, with a net decrease of over $8 billion. Apart from total debt, the most notable adjustment to shareholder value was for deferred tax liabilities. Professional members can see all adjustments to the company’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on June 27, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.