As of today, all members get our Earnings Distortion Scores (as featured on CNBC Squawk Box) for the stocks in their portfolios.

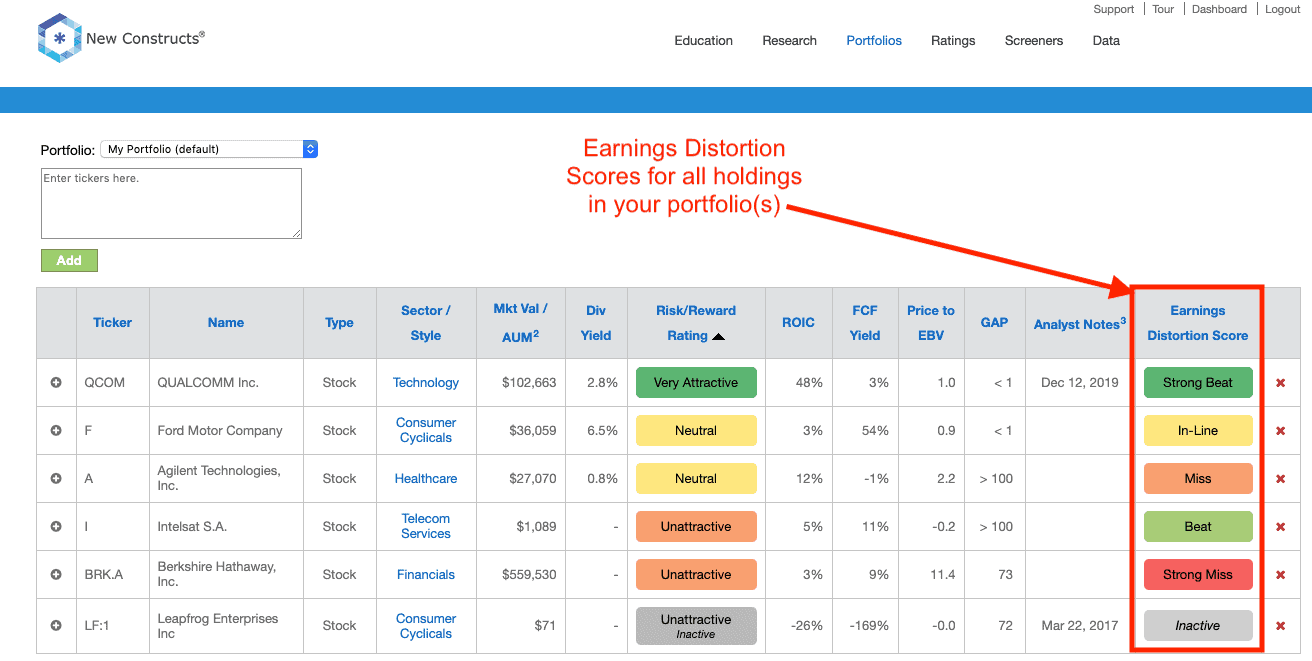

Per the picture below, you’ll see the Earnings Distortion Score at the far right of your Portfolios.

We provide Earnings Distortion Scores for all stocks under coverage. These scores indicate how likely companies are to beat or miss estimates.

We measure earnings distortion using a proprietary human-assisted ML technology featured in Core Earnings: New Data & Evidence.

Professors at Harvard Business School & MIT Sloan empirically show that our measure of “core earnings” is superior to “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI). Specifically, our earnings data is:

- More accurate (Section 3.2)

- More predictive of future earnings (Section 3.4)

- More predictive of future stock prices (Section 4.3).

Please contact us at support@newconstructs.com if you have any questions.

This article originally published on February 19, 2020.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "Get Earnings Distortion Scores in Your Portfolios"

Very nice addition to my stocks portfolio web page!