This week’s Filing Season Finds report highlights some of the most interesting footnote disclosures in the 432 10-Ks and 10-Qs our Robo-Analyst[1] analyzed last week[2].

- Fidelity National Information Services (FIS) understated profits but the stock remains expensive and

- hidden insights we found in the 10-Ks of Aon PLC (AON) and Exxon Mobile (XOM).

Since 2005, we’ve reported how traditional earnings measures are unreliable due to accounting loopholes that allow companies to manage earnings. Our Economic Earnings and Core Earnings[3] research closes those loopholes and provides more reliable analysis of profits that deliver a new source of alpha.

Profits Aren’t Enough – Valuation Matters, Too

In Fidelity National Information Services’ (FIS) 2021 10-K, our analyst Jacob McDonough highlighted how our Robo-Analyst found $845 million in acquisition, integration, and other costs on page 86. After removing this non-operating expense, and all other Earnings Distortions (net -$841 million, or 202% of GAAP earnings), we reveal that Fidelity National Information Services’ 2021 Core Earnings of $1.3 billion, or $2.03/share, are more than triple GAAP earnings of $417 million, or $0.67/share.

Despite higher profits than GAAP earnings indicate, Fidelity National Information Services earns an Unattractive Stock Rating. Profits are an indication of a good business, but a good business is not worth buying at a bad price. At its current price, FIS’ price-to-economic book value (PEBV) ratio is 10.8. This ratio means the market expects Fidelity National Services’ profits to grow nearly 11x from current levels. Buying stocks with such lofty expectations already baked into the stock price leaves little room for upside potential and greater risk for downside.

Instead, investors should look for good companies and good stocks or companies that generate strong profits with stock prices that do not reflect that strength. For examples, see our Long Idea reports.

Other Material Earnings Distortions & Insights We Found

From disclosures in the footnotes and MD&A:

Aon PLC (AON) – Costs of Terminating an Acquisition Create Understated GAAP Earnings

- Terminating an announced acquisition is sometimes as expensive as it is embarrassing. Analyst Garrett O’Grady noted that on page 36 of Aon’s 2021 10-K our Robo-Analyst found that the company bundled $1.4 billion in transaction costs and other charges related to the combination and resulting termination with Willis Towers Watson (WTW) in operating income. We remove this non-operating charge from our measure of net operating profit after-tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (-$1.1 billion, or 89% of GAAP earnings), we reveal that Aon’s 2021 Core Earnings of $2.4 billion, or $10.50/share, are much higher than GAAP earnings of $1.3 billion, or $5.55/share.

Exxon Mobil (XOM) – Hidden Impairments Obscure True Profitability

- In Exxon Mobil’s 2021 10-K, analyst Hunter Anderson noted that our Robo-Analyst found $1.2 billion in impairment charges related to suspended wells on page 85 and $200 million in impairment charges related to upstream equity investments on page 83. We remove these non-operating charges from our measure of NOPAT and Core Earnings. After removing all Earnings Distortion (-$1.6 billion, or 7% of GAAP earnings), we reveal that Exxon Mobil’s 2021 Core Earnings of $24.7 billion, or $5.77/share, are much higher than GAAP earnings of $23.0 billion, or $5.39/share. Exxon’s improved profitability, along with a cheap valuation, drives an upgrade in its Stock Rating from Unattractive to Attractive.

The Power of the Robo-Analyst

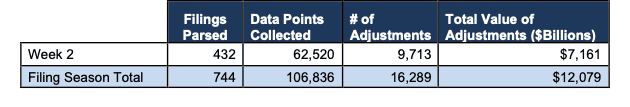

From the 432 10-K and 10-Q filings analyzed by our Robo-Analyst last week, we collected 62,520 data points. This data led to 9,713 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $7.2 trillion. The adjustments were applied as follows:

- 3,942 income statement adjustments with a total value of 369 billion

- 3,799 balance sheet adjustments with a total value of $3.7 trillion

- 1,972 valuation adjustments with a total value of $3.1 trillion

Figure 1: Filing Season Diligence for Filing Season 2022

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks and 10-Qs to update our models for companies with 12/31 and 1/31 fiscal year ends. This combination of technology and human expertise enables investors to overcome the flaws in legacy fundamental research and make more informed investment decisions.

This article originally published on February 28, 2022.

Disclosure: David Trainer, Jacob McDonough, Garrett O’Grady, Hunter Anderson, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] The Robo-Analyst analyses all the 10-Ks & 10-Qs for the companies we cover within 24-48 hours of their arrival at the SEC. Next week, we expect to analyze several hundred 10-Ks & 10-Qs.

[3] Only our Core Earnings overcomes the flaws in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan for The Journal of Financial Economics.