First, you need to determine the category or sector to which you want exposure.

Then, you determine which ETFs, within the category or sector you like, are the best …this can be the hard part.

There are a few easy screens to cull out ETFs that should be avoided and there are lots of free services for determining which ETFS have:

- Adequate liquidity

- Minimal tracking error

As long as you focus on the ETFs from issuers that are generally well-known and have a market cap of at least $100 million, then you are doing business with ETFs that have been successful enough to garner serious assets. So, you can assume their tracking error is respectable and liquidity is high enough that you will not get thrown under the bus by the bid/ask spread.

Now comes the hard part: picking the ETF with the best holdings.

Contrary to the screens above, there are very few services (free or not) that evaluate the quality of the holdings of an ETF.

Unfortunately, you cannot rely on the ETF label/name to accurately reflect the holdings of the ETF. Moreover, investors should not expect ETFs with the same label to have the same holdings.

I rolled up my sleeves and analyzed the holdings of several ETFs. Well, I did a little more than roll up my sleeves. The point is I analyzed the holdings of lots of ETFs to derive ratings on ETFs based primarily on my stock ratings of their holdings. My sample report on Technology Select Sector SPDR [s: XLK] explains my rating system for ETFs.

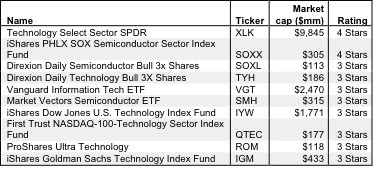

Figure 1 shows my ranking of the best ten technology ETFs with a market cap over $100 million based on the quality of their holdings. Here are my rankings on all 28 US equity technology ETFs.

Only the top two ETFs, Technology Select Sector SPDR [s: XLK] and iShares PHLX SOX Semiconductor Sector Index Fund [s: SOXX], in the technology sector get my 4-star or Attractive rating. Those are the only two ETFs I recommend investors buy. I do not recommend investors buy any ETFs with a 3-star rating or lower.

My ETF rating also takes into account the total annual costs, which represents the all-in cost of being in the ETF. This analysis is simpler for ETFs than funds because they do not charge front- or back-end loads and transaction costs are incurred directly. There is only the expense ratio, which is normally quite low. However, I penalize those ETFs with abnormally high costs.

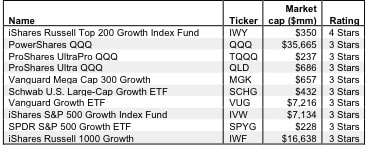

Figure 2 shows my ranking of the best ten large-cap growth ETFs with a market cap over $100 million based on the quality of their holdings. Here are my rankings on all 26 US equity large cap growth ETFs.

Figure 2: Top 10 Large Cap Growth ETFs

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The best large cap growth ETF is iShares top 200 Growth Index Fund [s: IWY]. It is the only ETF in this catgory to get my 4-star or Attractive rating and the only ETF in this category that I recommend investors buy. All the rest get my 3-star or Neutral rating and should be avoided.

If you like this approach to finding the best ETFs, you can get more rankings at my ETF screener.

The stock that shows up most consistently in both the technology and large cap growth ETFs is Apple [s: AAPL]. This stock gets my Very Attractive rating, and at 270%, it has the highest return on invested capital (ROIC) of any large cap stock in the US markets and, probably, the world.

Many people see AAPL as an expensive stock given its impressive appreciation recently. They are missing the elite level of profitability the company has achieved. With an ROIC of 270%, the company is generating $2.70 for every dollar of capital in the business. When a business is as profitable as AAPL, it requires very little top line growth to drive much larger profit growth.

For example, to justify a $600 stock price, the company needs only to grow at 15% for two years. If you believe, as I do, the company can do better than that, then the stock is cheap.

Another stock that shows up often in both the large cap growth and technology ETFs is Microsoft [s: MSFT], which, like AAPL, gets my Very Attractive rating. MSFT gets my best rating because the company’s’ ROIC, at 72%, ranks 8th in the S&P 500 while its stock price (~$32/share) implies the company’s profits will permanently decline by about 20%. High profitability and low valuation create excellent risk/reward in a stock.

Disclosure: I own AAPL and MSFT. I receive no compensation to write about any specific stock, sector or theme.