We’re excited to announce that we’ve made additions to our Company Model, Excel Company Model, and Dynamic Data Screener per client feedback. Specifically, we:

- added custom free cash flow (FCF) and FCF yield calculations to the Company Model, Excel Company Model, and Dynamic Data Screener,

- added all the components of weighted average cost of capital (WACC) to the Dynamic Data Screener, and

- clarified Cash Flow Statement values as either “reported cumulative” or “calculated single period” in our Company Model.

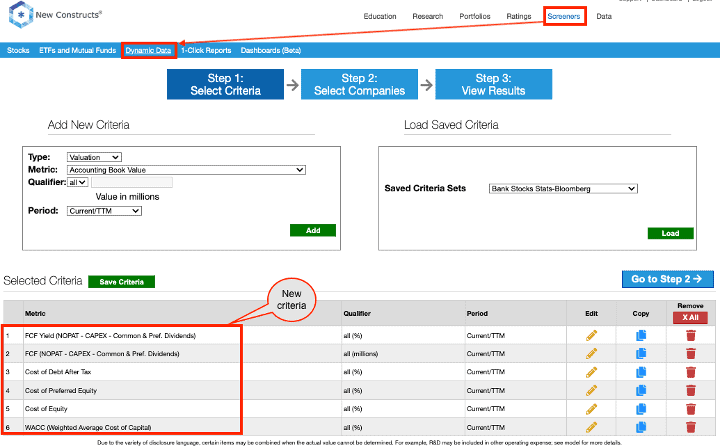

The custom FCF metrics are labeled “FCF (NOPAT – CAPEX – Common & Pref. Dividends)” and “FCF Yield (NOPAT – CAPEX – Common & Pref. Dividends)” in our model. As the label suggests, this metric calculates FCF as NOPAT minus capital expenditures and dividends. You can find this new metric in the Free Cash Flow tab of our Company Model. See Figure 1.

Figure 1: New FCF Calculation in Company Model

Source: New Constructs, LLC

In the Dynamic Data Screener, members can access the new FCF metric under the Operational section and the new FCF yield metric under the Valuation section.

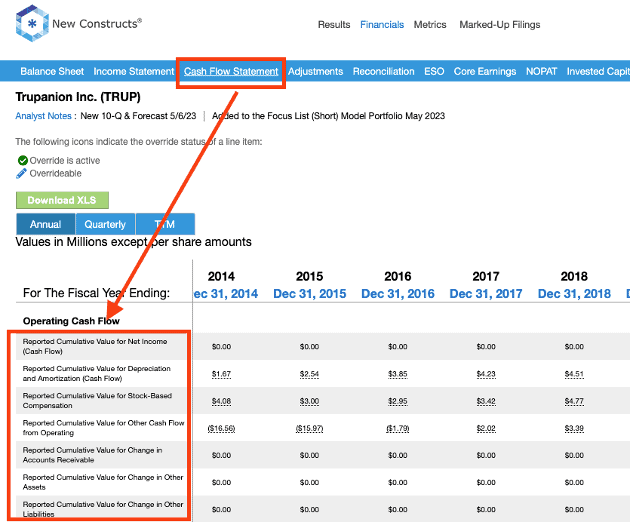

We also added all the components of WACC to the Dynamic Data Screener under the Operational section. Members can now use the Dynamic Data Screener to access and screen by:

- cost of Debt After Tax,

- cost of Equity,

- cost of Preferred Equity, and

- WACC.

Figure 2: New Criteria in the Dynamic Data Screener

Source: New Constructs, LLC

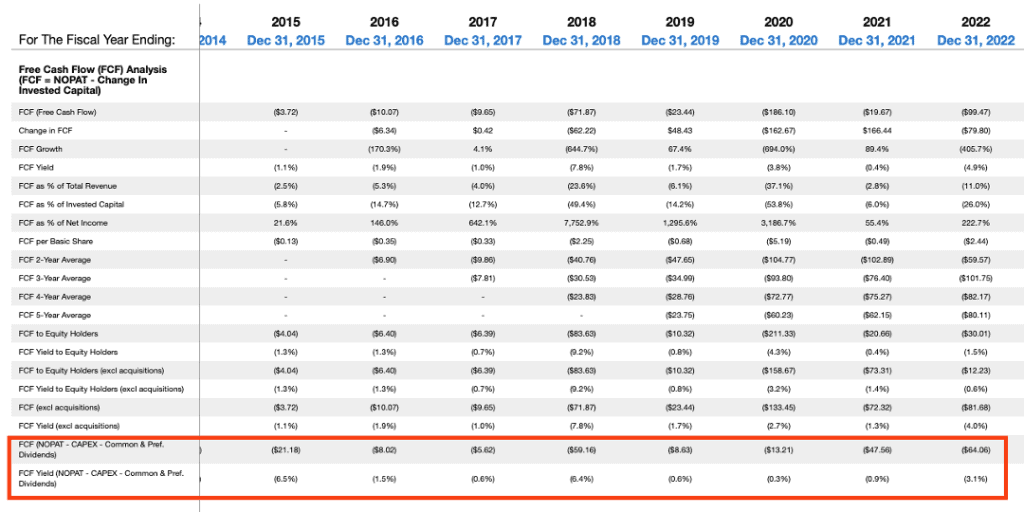

Lastly, we added clarification to Cash Flow Statement values in our Company Model and Marked-Up Filings. We added “Reported Cumulative Value” or “Calculated Single Period Value” to each line item to help users understand the type of value that is collected from the Cash Flow Statement. Figure 3 shows these descriptors on the Cash Flow Statement tab of our Company Model.

Figure 3: New Cash Flow Statement Labels in Company Model

Source: New Constructs, LLC

Want access to our models? Contact us about an Institutional membership here.

This article was originally published on May 17, 2023.

Disclosure: David Trainer, Robbie Woodward, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.