The key to successful Investing is maximizing upside potential and minimizing downside potential for every investment decision.

Since the future is inherently unpredictable, there are no “sure things” in the stock market (none that are legal…). Ergo, when battling against an uncertain future, the best strategy is to maximize one’s odds of success — which means “maximizing upside potential and minimizing downside potential for every investment decision”. In other words, we want to be long “good risk/reward” (low risk/high reward potential) and sell/short “bad risk/reward” (high risk/low reward potential). Finding the best and worst risk/reward in the US stock market is what New Constructs is built to do.

That’s the theory.

Here’s how we implement.

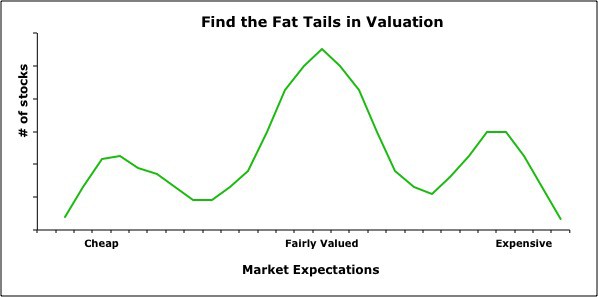

Because we cover over 3000+ of the largest and most actively-traded US stocks, our broad market perspectives are well-informed. Figure 1 highlights the pockets of inefficiency we see in the valuation of stocks across the entire U.S. equity market. The figure also shows that the market is fairly efficient on a large number of stocks as well.

Figure 1: Market Efficiency: Not Perfect By Any Means

Next, we determine the true economic profitability to identify (a) undervalued stocks with understated cash flows and (b) overvalued stocks with overstated cash flows.

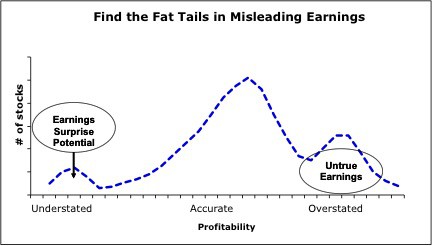

Figure 2 provides another illustration of our broad-market insights into how companies’ reported profits correlate to their true economic profits. It is not a very pretty picture. Most companies, in an effort to keep up with their peers, manipulate accounting rules to overstate their profitability.

Figure 2: Earnings Are Not What They Appear To Be Most Of the Time

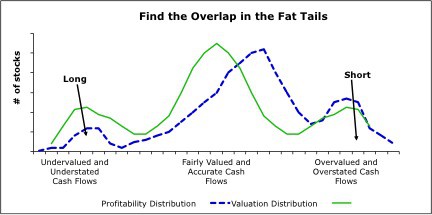

Next, we overlay valuation and economic profitability to find the best and worst stocks in the market. See Figure 3.

Figure 3: Long = Most Attractive Stocks; Short = Most Dangerous Stocks

We focus on the stocks where the fat tails overlap. We want to be long stocks with the best risk/reward as measured by a very low valuation (limited downside) and understated cash flows (earnings upside). We want to be short the stocks with the worst risk/reward as measured by a very high valuation (high downside) and overstated earnings (earnings downside).

All the other stocks where valuation seems fairly efficient and earnings somewhat accurate are of limited interest to us. I think focusing on the extreme inefficiencies in the market is best.

You will see a Risk/Reward Rating on every one of the 3000+ companies we cover. For an example, download a free report from our Free Archive.

For articles featuring some of our best long and short ideas, click here.

5 replies to "Investment Strategy 101"

[…] per Investment Strategy 101 and How to make money picking stocks, BMY fits the Risk/Reward profile of a great stock […]

[…] per Investment Strategy 101 and How to make money picking stocks, CL fits the risk/reward profile of a great stock to buy. […]

[…] « Investment Strategy 101 Greenspan and Larry Summers quashed warnings about derivatives in the 1990s » […]

[…] For details on our analysis of the economics of BRK.A and our stock rating system, see the free report available at the link above as well as Investment Strategy 101. […]

[…] For details on our analysis of the economic earnings of NUE and our stock rating system, see the free report available at the link above as well as Investment Strategy 101. […]