McDonald’s (MCD) is up 16% since we added it to our Most Attractive Stocks list in November of 2012, and I still see plenty of value for hungry investors.

Impressive Profit Growth

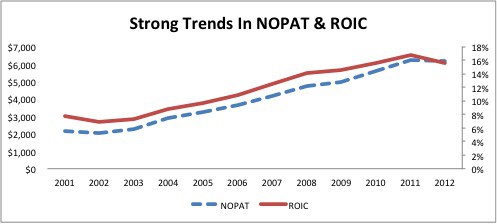

Over the past ten years, McDonald’s has written the textbook on how to successfully run and expand an already large business. Since 2002, McDonald’s has grown (NOPAT) by 12% compounded annually.

At the same time, MCD’s ROIC rose to 16%, putting it in the top quintile of the 3000 companies I cover.

As I recently discussed in my Wal-Mart article, significantly growing NOPAT while maintaining a high ROIC is difficult for companies with brick and mortar stores. The increased invested capital required to build new stores usually results in a short-term decline in ROIC. Figure 1 shows that MCD has not had this problem.

Figure 1: Net Operating Profit After Tax vs. Return on Invested Capital

Indeed, growing profits at 12% compounded annually for a decade while also nearly tripling ROIC is a formidable achievement. And it drove huge shareholder value creation. From 2002 to 2012, MCD’s economic earnings grew 35% compounded annually. For comparison, main competitor YUM! Brands (YUM) only managed 15% compounded annual economic earnings growth over that same period.

Simultaneous high growth and ROIC increases prove MCD’s management team takes care of the real bottom line as well as (or better than) any other and is a proven shareholder value creator.

Strong Growth Potential

Despite MCD’s excellent track record for profit growth, the bear argument on MCD focuses on its limited growth potential. Bears say growth will stall due to increased competition and market saturation, and I disagree on both fronts. On the competition front, I wrote on Nov 13, 2012:

“MCD has a superior business model than Wendy’s and Burger King. Wendy’s ROIC is only 3.5%. I estimate BKW’s ROIC, though I do not officially cover it, at just 7.8%. Wendy’s and Burger King can run all the promotions they want, but any share they take from MCD is only temporary because MCD has a lower cost advantage.”

Nothing has changed on that front.

Starbucks (SBUX) and YUM! Brands (Taco Bell, KFC and Pizza Hut) have top-quintile ROICs like MCD. But, neither of those firms have anywhere close to the scale of MCD. After all, a high ROIC is easier to achieve and maintain for smaller businesses. And SBUX and YUM! Brands (YUM) are much smaller than MCD. 2012 revenues for SBUX and YUM were a combined $26.9 billion, while MCD’s 2012 revenues were $27.6 billion. MCD’s fiscal year 2000 revenues were larger than SBUX and YUM’s 2012 results. SBUX and YUM have some catching up to do.

Meanwhile, MCD has no plans to slow its growth. The company is investing over $3 billion in stores this year. $2 billion is targeted for new stores as the firm adds to its global footprint of 34,000 stores, including 20,000 international locations.

Given McDonald’s proven track record of growing and creating shareholder value, it is hard to make a straight-faced argument that the $3 billion investment in new and existing stores will not produce any profit growth.

I think the only argument is how fast MCD will grow. I expect they will grow faster than their top competitors, SBUX and YUM who are spending $1.2 billion and $1 billion, respectively, on stores in 2013. If the companies’ ROICs are the same in 2013 vs 2012, MCD’s profit (NOPAT) growth will be almost triple that of SBUX or YUM.

The risk of ROIC decline is far greater with SBUX and YUM as they have not proven, as MCD has, that they can grow and maintain ROICs. SBUX and YUM have a long way to go before they can match MCD’s success.

I see no reason why MCD’s long track record of success will not continue as the company continues to expand.

Take Advantage While the Stock is Still Cheap

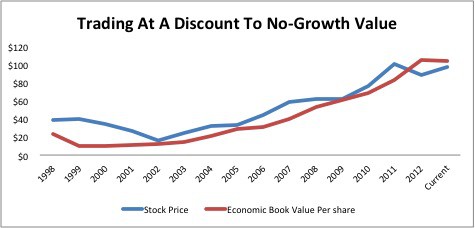

Currently, MCD is trading at a price to economic book value ratio of 0.94, meaning the market is forecasting a permanent 6% decline in profits.

The stock market is giving MCD no credit for the company’s proven track record of value creation and strong growth potential. Instead, the market predicts MCD’s profits will permanently drop. I think it is pretty clear the market’s expectations are too low for MCD. Investors should take advantage.

Figure 2: Stock Price vs. Economic Book Value (EBV) Per Share

ETFs and Mutual Funds with MCD

It appears institutional investors aren’t recognizing the value in MCD. There are no ETFs or mutual funds with sufficient liquidity and significant allocations to MCD that earn an Attractive-or-better rating. No wonder so many active managers underperform.

The best way to get this stock is to buy it directly – and you don’t have to pay any management fees.

André Rouillard and Sam McBride contributed to this article.

Disclosure: David Trainer is long MCD. David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector or theme.

1 Response to "McDonald’s Is Still on the Value Menu"

The high valuation for Yum Brands and now the company’s “constrained” up side both reinforce J.P. Morgan’s preference for McDonald’s /quotes/zigman/233369 /quotes/nls/mcd MCD and Starbucks /quotes/zigman/20720 /quotes/nls/sbux SBUX .