In the past three weeks, Netflix has cancelled two of its original series (Sense8 and The Get Down) after cancelling only five series from 2013-2017. These cancellations come on the heels of executives’ comments about needing a better return on investment. When taken together, it’s clear Netflix is beginning to acknowledge the challenging economics of producing original content, just as we warned in April 2016. Creating successful original content is very costly and very hit-or-miss. The surfacing of this ugly truth could be a catalyst for more investors to question the viability of Netflix’s business model and to send NFLX shares to a more rational level.

Content Costs Continue to Outpace Revenue Growth

Apart from the two cancellations, Netflix’s streaming content obligations continue to grow faster than revenue. We first warned about Netflix’s alarming streaming content obligation growth in 2014. Since then, the issue has only worsened as free cash flow has fallen further.

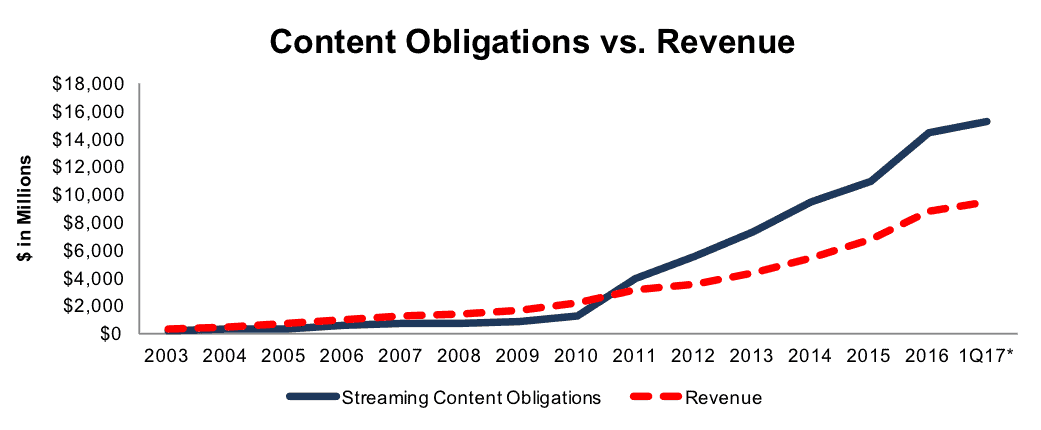

Since 2010, content obligations have grown 42% compounded annually while revenue has grown 24% compounded annually, per Figure 1. At the end of 1Q17, content obligations totaled $15.3 billion and have grown faster than revenue YoY in six of the past seven years. Netflix chief content officer Ted Sarandos recognized this issue when he stated “a big expensive show for a tiny audience is hard, even in our model, to make that work very long.” The realities of Netflix’s costly business model are finally catching up to the firm.

Figure 1: Content Obligation Growth Outpaces Revenue

*Revenue from the trailing twelve months

Sources: New Constructs, LLC and company filings

Cash Burn Compounds Obligation Growth Issues

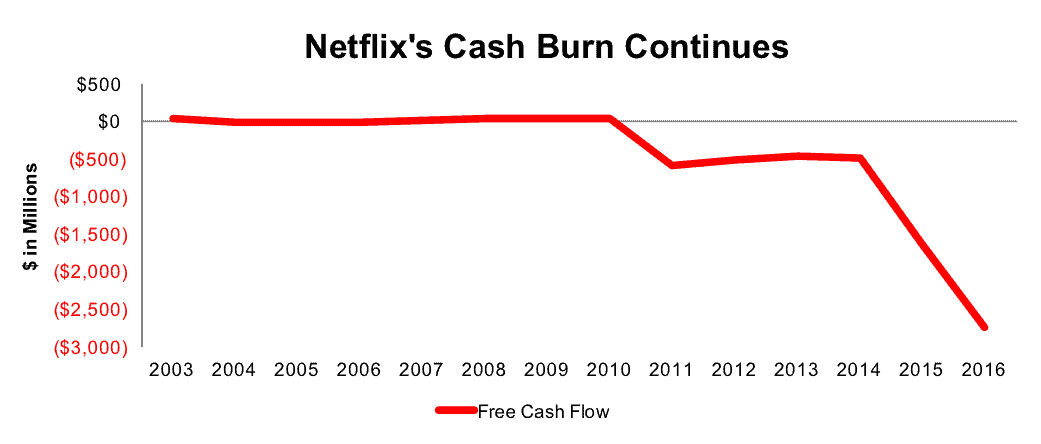

As Netflix’s content obligations increase, its free cash flow (FCF) only grows more negative. Since 2010, the last year Netflix generated positive FCF (and first year it began increasing its content library), Netflix has burned through a cumulative $6.4 billion in cash, per Figure 2.

Figure 2: Netflix’s 2016 Free Cash Flow is -$2.8 Billion

Sources: New Constructs, LLC and company filings.

Membership Growth Can’t Offset Costly Content

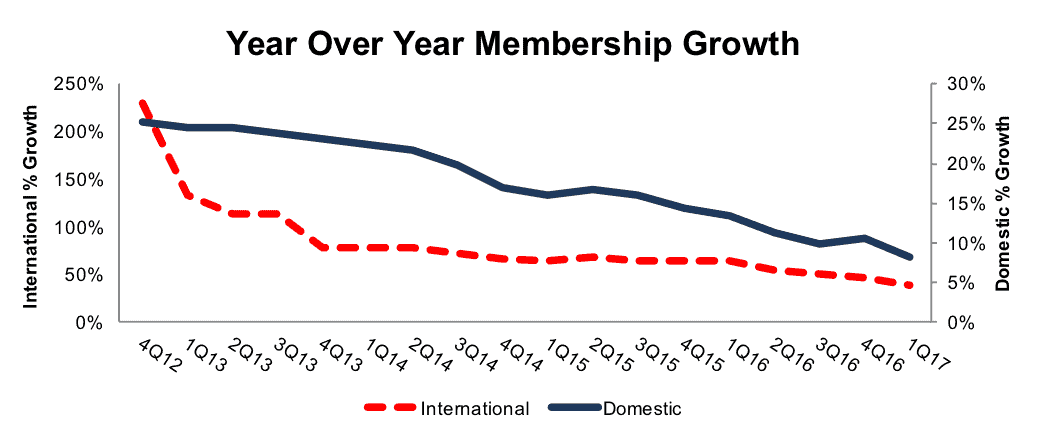

Netflix could certainly justify the massive content costs were it rapidly expanding its membership base. One could argue that membership growth (and subsequent revenue) more than offsets the costs of creating original content. However, Netflix’s membership growth rates, both domestically and abroad, have been slowing for quite some time.

Per Figure 3, international members grew 39% YoY in 1Q17, down from 65% in 1Q16 and 78% in 1Q14. Similarly, domestic members grew 8% YoY in 1Q17, down from 13% in 1Q16 and 22% in 1Q14.

Figure 3: Netflix’s Membership Growth Rates

Sources: New Constructs, LLC and company filings.

Competition Is Breaking Netflix’s Business Model

When we first placed Netflix in the Danger Zone in November 2013, we focused on two competitors in the streaming video segment, Amazon Prime and Hulu. Since then, the streaming video market has grown dramatically, and Netflix has lost much of its early-mover advantage, as we detailed in July 2016. Today, the market is highly fragmented with competitors offering live TV bundles, original content, and exclusive access to content from certain movie studios to attract customers. A non-exhaustive list of competitors can be seen below:

- Verizon Go90

- CBS All Access

- Hulu

- Amazon Prime Video

- Starz

- Showtime

- HBO Now

- Sling TV

- DIRECTV NOW

- PlayStation Vue

The increase in competition leaves limited pricing power, a lynchpin for the viability of Netflix. Without pricing power, Netflix can’t afford to continue to do all the things that have helped management hype the stock, such as invest in growing original content, attracting new members and maintaining its large content library. As we have written for some time, investors will not tolerate huge cash flow losses forever. The recent revelations about not being able to afford to continue to invest in original content indicate that key investors are, in fact, losing patience and are not as willing to continue to fund the company’s large cash losses. Accordingly, all investors, not just the bankers and insiders, should beware especially since the valuation of the stock is yet to recognize the cracks in the Netflix bull thesis.

Win More Assets, Keep More AUM, Avoid Regulators’ Scrutiny

Learn more today and sign up now!

NFLX Valuation Remains Unrealistically Optimistic

Now that investors are beginning to acknowledge the true economics of Netflix’s business, the time to value Netflix based on fundamentals has arrived. And, NFLX investors should be afraid, very afraid.

The future cash flow expectations embedded in the stock price make NFLX one of the most overvalued stocks in the market. Here’s why:

Even if Netflix can maintain TTM NOPAT margins (5%) and can grow NOPAT by 25% compounded annually for the next decade, the stock is worth only $52/share today – a 66% downside. This scenario assumes NFLX can grow revenue by consensus estimates in 2017 (27%) and 2018 (20%), and 20% each year thereafter.

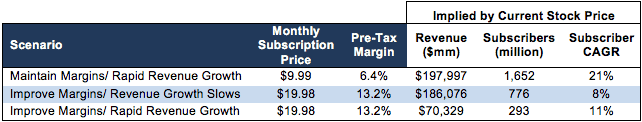

To further illustrate just how overvalued NFLX remains, we quantify three scenarios for the improvement in margins, subscribers, and/or revenue that is required to justify NFLX’s current price of $152/share. For reference, Netflix currently has just under 99 million paying subscribers, and there are 248 million potential subscribers (people 18 and above) in the United States.

Scenario 1: If we assume that Netflix maintains its current price structure, its current pre-tax margins (6.4%), and can grow revenue by consensus estimates in EY1 & EY2 and by 23% thereafter (average of last five years), the company must grow NOPAT by 26% compounded annually for the next 15 years to justify its current price of $152/share. In this scenario, Netflix would generate of $198 billion in revenue (15 years from now), which at current subscription prices implies the company would have 1.6 billion subscribers.

Scenario 2: If we assume that Netflix adopts a strategy that improves margins by doubling prices at the expense of revenue growth, the current expectations are still overly optimistic. If Netflix can increase pre-tax margins to 13.2% (highest in company history, 2010), and grow revenue by 12% (half the five year average), the company must grow NOPAT by 16% compounded annually for 28 years to justify its current price. In this scenario, Netflix would be generating over $186 billion in revenue 28 years from now, which at double current subscription prices implies the company would have 776 million subscribers.

Scenario 3: Even if we assume Netflix is able to drastically improve margins through price increases without any impact on revenue growth, shares are still overvalued. If Netflix can achieve 13.2% pre-tax margins and grow revenue by consensus estimates in EY1 & EY2 and by 23% thereafter, the company must grow NOPAT by 37% compounded annually for the next decade to justify the current price. In this scenario, Netflix would generate over $70 billion in revenue 10 years from now, which at double current subscription prices implies the company would have 239 million subscribers, nearly triple its current user base.

Each of these scenarios also assumes Netflix is able to grow revenue and NOPAT without spending on working capital or fixed assets, an assumption that is unlikely, but allows us to create unquestionably optimistic scenarios. For reference, NFLX’s invested capital has grown on average $1.4 billion (15% of 2016 revenue) per year over the last five years.

Figure 4 summarizes three potential scenarios for the profit growth needed to justify $152/share.

Figure 4: Valuation Scenarios for NFLX

Sources: New Constructs, LLC and company filings.

Clearly, the current valuation of NFLX implies a future cash flow stream that even the strongest of business models would be challenged to achieve. Given the flaws in Netflix’s business and the market’s increasing awareness of them, holders of NFLX are taking imprudent risk with the stock at anywhere close to its current valuation.

This article originally published on June 13, 2017.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

2 replies to "Netflix’s Costly Business Model Proves Unsustainable"

If you thought Netflix’s valuation was inflated back when you wrote this, I’d love to see what you have to say about it now! It’s more than doubled since then… Has anything changed that would change your opinion about it, or do you think the overvaluation is just 2x worse now?

Netflix’s subscriber growth has been more resilient than expected, but the fundamental imbalance of their cost structure remains. The company keeps burning cash to pursue growth at any cost. This means it has to keep raising debt to fund its spending, which gives Wall Street an incentive to prop up the stock so they can keep earning underwriting fees.

Netflix’s valuation remains unsustainable. At some point either growth numbers will slow down or Wall Street will stop funding the cash burn, and at that point the company will have to rein in its content spending to a more rational level.