Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

We recently wrote an article titled “CEO’s That Focus on ROIC Outperform,” and the corollary to that argument is that the opposite is also true: CEO’s that don’t focus on ROIC underperform. The market has many companies that have lagged behind their peers due to poor capital allocation. Any of these companies could be prime targets for activist investors to reform corporate governance and incentivize executives to focus on ROIC.

As we wrote in “Nelson Peltz on Procter & Gamble: Sign of the Future For ROIC Laggards”, “linking executive compensation to ROIC could create immediate shareholder returns and drive a long-term commitment to a lean and disciplined corporate structure. This strategy should become part of the playbook for companies looking to avoid activist takeovers.”

Below we highlight two companies that should adopt ROIC as a performance measure before an activist comes in and does it for them.

Dollar Tree (DLTR: $94/share)

Dollar Tree (DLTR) is one of the only major brick and mortar retailers that doesn’t tie exec comp to ROIC. Most other large retailers, including Walmart (WMT), Home Depot (HD), Target (TGT), and direct competitor Dollar General (DG) do tie a portion of executive compensation to ROIC.

Not coincidentally, DLTR’s total shareholder return has lagged DG over the past one, three, and five years. Its current ROIC of 7.7% lags DG’s ROIC of 9.1%, primarily due to the acquisition of Family Dollar in 2015 that we argued against at the time.

In addition to being overpriced, the capital that DLTR spent on Family Dollar appears to have burdened the balance sheet and kept it from making necessary investments in its stores, as shown by the inferior shopping experience documented by Business Insider.

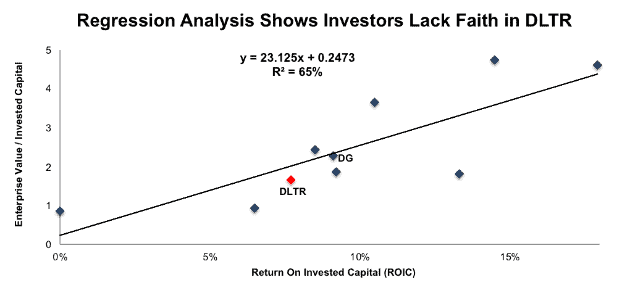

Based on its valuation, the market appears to expect a further decline in DLTR’s ROIC. Figure 1 shows that ROIC explains 65% of the difference in valuation for the 10 discount retailers we cover. DLTR’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 1. The company’s enterprise value to invested capital ratio of 1.7 implies that the market expects its ROIC to decline to 6.2%.

Figure 1: ROIC Explains 65% of Valuation for Discount Retailers

Sources: New Constructs, LLC and company filings

Meanwhile, the market’s valuation of DG implies it expects its ROIC to remain at current levels for the foreseeable future based on its location on the trend line in Figure 1.

Analysts believe Dollar Tree should sell Family Dollar to Dollar General, which shows how the management teams are perceived. The investing community has more faith in DG to manage and earn an adequate return on Family Dollar stores than they do DLTR’s management. The first step to regaining that trust is to align executives with long-term shareholders by linking compensation with ROIC.

If DLTR can merely convince the market to value the company in line with its peers, the stock is worth ~$124/share, a 31% upside. If it can improve its ROIC to the level of peer DG, it’s worth $151/share, a 61% upside.

Cardinal Health (CAH: $51/share)

Cardinal Health is one of the big 3 pharmaceutical distributors – along with McKesson (MCK) and AmerisourceBergen (ABC) – that account for ~90% of all drug distribution revenues in the United States. CAH is the only one of these three that does not tie executive compensation to ROIC, and its stock has been the worst performer over the past 1, 10, and 15-year periods.

CAH’s performance looks especially poor compared to ABC, which has tied compensation to ROIC since 2008. As middlemen, both companies earn low NOPAT margins of ~1%. However, ABC’s invested capital turns (the revenue earned per dollar of capital invested in the business) is 15.8, while CAH’s is just 4.2. In other words, ABC earns more than three times the amount of revenue per dollar of capital invested as CAH. That large a difference in capital efficiency suggests one management team cares more about capital allocation than the other.

CAH’s overpriced acquisitions, which have led to significant write downs, play a major role in this discrepancy. CAH has $2.5 billion in accumulated after-tax write downs (16% of market cap), while ABC has just $368 million (2% of market cap).

CAH took a $1.4 billion write-down in the most recent quarter due to the underperformance of its Cordis medical device unit, which it acquired from Johnson & Johnson (JNJ) in 2015. Tying executive compensation to ROIC could put a curb on this destruction of capital, or at least incentivize management to pay more attention to it.

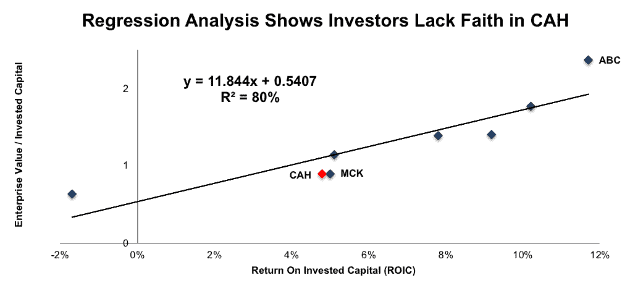

Based on its valuation, the market expects more write-downs from CAH’s management. Figure 2 shows that ROIC explains 80% of the difference in valuation for the 8 drug sellers we cover. CAH’s stock trades at a significant discount to peers as shown by its position below the trend line. The company’s enterprise value to invested capital ratio of 0.89 implies that the market expects its ROIC to decline from 5% to 3%.

Figure 2: ROIC Explains 80% of Valuation for Drug Sellers

Sources: New Constructs, LLC and company filings

Figure 2 shows that ABC, as the most profitable company in the industry, garners a premium valuation. It also shows that merely listing executive compensation as a performance metric will not create shareholder value if the link is not strong enough. MCK ranks almost even with CAH on both ROIC and valuation despite tying a portion of long-term incentive pay to ROIC.

MCK doesn’t get credit from the market for including ROIC as a performance metric due the fact that it only links a small fraction of compensation to ROIC. Under the current plan, just 5% of long-term incentives are tied to ROIC. Executives have significantly more of their pay tied to EPS, operating cash flow, and total shareholder return. So, not surprisingly, they focus on these other measures because those are the ones that affect their pocketbook.

As a result, MCK’s performance, both in terms of ROIC and stock price, has been much closer to CAH than to ABC. If CAH wants to truly create shareholder value, it should commit to linking a significant portion of executive pay to ROIC to ensure that executives place a premium on capital allocation.

If CAH can convince the market to value the company in line with its peers, the stock is worth ~$72/share, a 40% upside from the current price. If it can achieve an ROIC equal to ABC, the stock is worth ~$149/share, a 190% upside.

This article originally published on August 27, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Free-Photos (Pixabay)