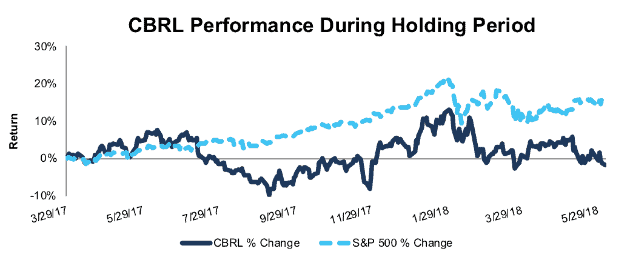

Cracker Barrel (CBRL: $156/share) – Closing Long Position – down 2% vs. S&P up 16%

Cracker Barrel Old Country Store was originally selected as a Long Idea on 3/29/17. At the time of the initial report, the stock received a Very Attractive rating. Our investment thesis highlighted strong after-tax operating profit (NOPAT) growth, a rising return on invested capital (ROIC), profitability at or near top of the industry, and an undervalued stock price.

During the 432-day holding period, CBRL underperformed as a long position, falling 2% compared to a 16% gain for the S&P 500. CBRL was downgraded to Neutral on 5/30/18 after we parsed its latest 10-Q. While the firm’s valuation remains cheap (price-to-economic book value (PEBV) ratio equals 1.0 and its market-implied growth appreciation period is less than 1), its fundamentals have deteriorated.

CBRL’s pretax operating margin in its restaurant business decreased despite a 2.5% price increase, and restaurant traffic declined 1% year-over-year in the past nine months. CBRL’s ROIC fell from 14.4% in fiscal 2017 to 13.3% over the last twelve months. In addition, TTM economic earnings fell 12% over the prior TTM period.

The decline in fundamentals, along with an increasingly competitive industry, lead us to close this position and remove it from our Focus List – Long Model Portfolio.

Figure 1: CBRL vs. S&P 500 – Price Return

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on June 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.