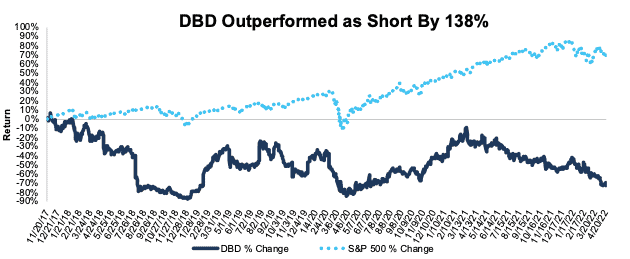

Diebold Nixdorf (DBD) – Closing Short Position – down 73% vs. S&P up 65%

We put Diebold Nixdorf (DBD: $5/share) in the Danger Zone on November 20, 2017. DBD earned an Unattractive rating at the time of the report. We felt the acquisition of Wincor Nixdorf, to create the largest maker of automated teller machines (ATMs) was not accretive, but rather destructive to shareholders. This acquisition, along with declining net operating profit after-tax (NOPAT), declining return on invested capital (ROIC), and an overvalued stock price made owning DBD a poor risk/reward proposition.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to provide a new source of alpha.

During the roughly four-and-a-half year holding period, DBD outperformed as a short position, falling 73% compared to a 65% gain for the S&P 500.

The company’s revenue has declined 4% compounded annually since 2017, but the business’s profitability has improved. NOPAT margin improved from 2% in 2019 to 4% in 2021 and ROIC improved from 2% to 6% over the same time. Additionally, the company is now looking to leverage its experience building ATMs to build electric vehicle charging stations, which could provide a new growth outlet.

Given the outperformance as a short, especially after falling 46% year-to-date, DBD no longer offers the same risk/reward. As a result, we’re closing this Danger Zone pick.

Figure 1: DBD vs. S&P 500 – Price Return – Successful Danger Zone Pick

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on April 25, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.