John B. Sanfilippo & Son, Inc. (JBSS: $63/share) – Closing Long Position – up 7% vs. S&P up 4%

John B. Sanfilippo & Son was originally selected as a Long Idea on 11/1/17. At the time of the initial report, the stock received a Very Attractive rating. Our long thesis highlighted a shift towards branded foods driving market share growth and improvement in margins.

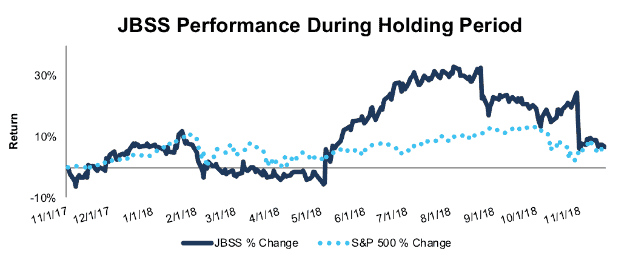

During the 383-day holding period, JBSS outperformed as a long position, gaining 7% compared to a 4% gain for the S&P 500.

JBSS was downgraded to Neutral on 11/3/18 after the company’s latest earnings report raised a number of questions about our original thesis

The company’s net operating profit after tax (NOPAT) margin has shrunk from 4.7% when we published our article to 3.9% over the trailing twelve months. Operating expenses increased 31% year-over-year in the most recent quarter compared to a 5% revenue decline.

Meanwhile, market share for the company’s key brands has declined slightly over the past year, in contrast to several prior years of market share improvement. The introduction of a store-brand competitor has reduced available shelf space and led to sales declines.

These two issues raise enough questions that we no longer have confidence in the long-term competitive advantage of the business. As a result, we are closing this position.

Figure 1: JBSS vs. S&P 500 – Price Return – Successful Long Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 20, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.