Northrop Grumman (NOC) – Closing Short Position – up 8% vs. S&P up 9%

We put Northrop Grumman (NOC: $363/share) in the Danger Zone on November 4, 2019. At the time, NOC received an Unattractive rating and had significantly overstated TTM earnings due to high levels of earnings distortion. This report, along with all of our research, utilizes our “novel dataset”[1] of footnotes disclosures to get the truth about earnings, as shown in the Harvard Business School and MIT Sloan paper, “Core Earnings: New Data and Evidence.”

Despite beating earnings expectations in its 4Q19 earnings release, NOC’s revenue came in below expectations and the stock fell 6% in the three days after its earnings report. We recently parsed NOC’s 2019 10-K and the stock now earns an Attractive Risk/Reward rating given its improved fundamentals and lower valuation.

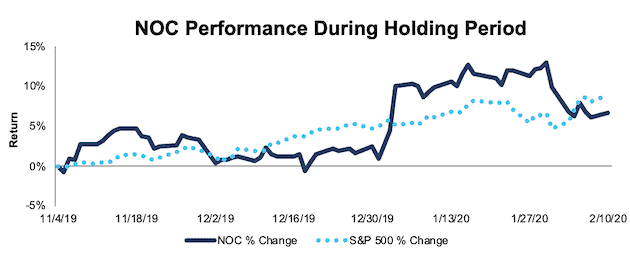

During the 98-day holding period, NOC outperformed as a short position, rising 8% compared to a 9% gain for the S&P 500.

This lower valuation means the risk in this stock has decreased. We believe it is time to close this short position.

Figure 1: NOC vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on February 12, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors at Harvard Business School (HBS) & MIT Sloan empirically show that our “novel dataset” is superior to “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).