We closed this position on February 12, 2020. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

New research from Harvard Business School and MIT Sloan shows earnings for the S&P 500 are distorted by an average of 22% in 2018. Since the HBS and MIT paper is based on our data, we created the Earnings Distortion Scorecard[1] to show how much unusual gains/losses distort earnings.

This report shows how to use the Earnings Distortion Scorecard to find a Danger Zone stock with significantly overstated earnings and an expensive valuation: Northrop Grumman (NOC: $346/share).

A Stock with Overstated Earnings

The Earnings Distortion Scorecard shows Northrop Grumman is a stock investors should avoid despite its earnings beat on October 24. We used the Scorecard for a very successful Long Idea (AbbVie - ABBV), which beat street estimates last week.

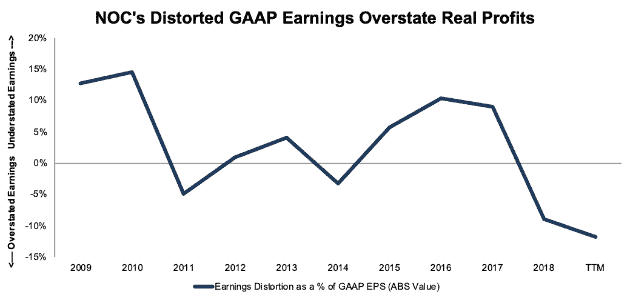

Over the past year, NOC’s reported earnings have significantly overstated the firm’s true profitability, in large part due to significant unusual gains/losses hidden in the footnotes. Figure 1 provides a historical look at the magnitude of earnings distortion in NOC’s GAAP earnings. As earnings distortion from hidden income increases, so does the level of earnings overstatement, both from GAAP net income and from street earnings, which the HBS & MIT Sloan paper shows do not capture most unusual items.

Figure 1: NOC Earnings Distortion – Increasingly Overstated

Sources: New Constructs, LLC and company filings

Since 2016, the number and size of unusual income disclosures for NOC has soared, and the company’s reported profits increasingly overstate its core earnings.

These unusual income items have helped NOC beat expectations in 10 out of the past 11 quarters, including when it reported third quarter earnings on October 24.

Our data shows that these earnings beats are the product of accounting distortions or what HBS & MIT call “transitory items”. The real fundamentals of the business are not as strong as reported earnings suggest.

Why is earnings data wrong?

In “Core Earnings: New Data and Evidence,” Ethan Rouen and Charles Wang from HBS and Eric So from MIT Sloan show that traditional data providers and analysts are missing or mis-categorizing a very material and growing amount of unusual gains/losses.

“…many of the …{unusual gains/losses} collected by New Constructs do not appear to be easily identifiable in Compustat…” – page 13

The authors show the market is inefficiently assessing earnings because too few people read financial footnotes. These footnotes contain important information that is required to measure reported and core earnings accurately.

Breaking Down NOC’s Earnings Distortion

Over the TTM period, NOC had $415 million in net unusual income adjustments that cause earnings to be overstated. Notable unusual gains include:

- $440 million ($2.61/share) in non-operating pension gains – Page 72 2018 10-K

- $82 million ($0.49/share) in company-defined other expenses – Page 1 3Q19 10-Q

- $84 million ($0.49/share) in non-recurring tax benefits – Page 62 2018 10-K

NOC’s non-operating pension gains are the result of its unusually high expected return on plan assets assumption for its pension plan. NOC assumes it will earn a long-term return of 8% annually on its pension plan assets, while the average company assumes long-term returns of 6-7%.

This optimistic assumption allows NOC to record income from its pension plan in the present, but it could force the company to take a significant charge if its actual returns lag going forward.

Overstated Earnings + Expensive Valuation = Unattractive Risk/Reward

With a price-to-earnings (P/E) ratio of 18, NOC appears undervalued by traditional metrics. The Industrials sector has an average P/E ratio of 21 and the S&P 500 average sits at 22. However, NOC’s P/E is distorted by its non-operating income.

Our reverse discounted cash flow (DCF) model more rigorously assesses the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price.

When we look at the expectations implied by its valuation, the stock looks much more expensive. In order to justify its valuation of $346/share, NOC must improve its NOPAT margin to 10% (up from 9% in 2018) and grow NOPAT by 7% compounded annually for the next 10 years. This seems ambitious for a company that has grown NOPAT by just 3% compounded annually over the past decade. See the math behind this dynamic DCF scenario.

If NOC maintains its 2018 NOPAT margin of 9% and grows NOPAT by 3% compounded annually over the next decade, the stock is worth $224/share today, a 35% downside to the current stock price. See the math behind this dynamic DCF scenario.

The combination of overstated earnings and an expensive valuation earns NOC our Unattractive rating.

How You Can Leverage the Earnings Distortion Scorecard

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Abstract, 4th sentence

Core Earnings: New Data and Evidence presents a long/short strategy that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings. Positions are opened in the month each 10-K is filed and held until the next 10-K is filed, or about a year.

This simple, low turnover strategy produced abnormal returns of 7-to-10% a year. These abnormal returns show that the market misses important data in the footnotes and that investors who adjust for unusual items can make more money.

Defining Earnings Distortion in This Analysis

In this report, Total Adjustments includes:

- + Acquisition and Merger Expenses, net

- + Foreign Currency Expenses, net

- + Legal Regulatory and Insurance Expenses, net

- + Company Defined Other Expenses, net

- + Other Non-Recurring Expenses, net

- + Other Real Estate Owned Expenses, net

- + Other Financing Expenses, net

- + Derivative Related Expenses, net

- + Pension Related Expenses, net

- + All Restructuring Expense, net

- + Minority Interest Expense, net

- + Preferred Dividends, net

See Figure I in the Appendix for the definition of core earnings and total adjustments used in the HBS & MIT Sloan paper.

We further breakdown each of the adjustment categories above in Figure II of the Appendix. This level of granularity allows investors to get a clear picture of all adjustments required to calculate a firm’s true earnings.

Appendix 2 provides details on the most complete data set we offer clients here.

This article originally published on November 4, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

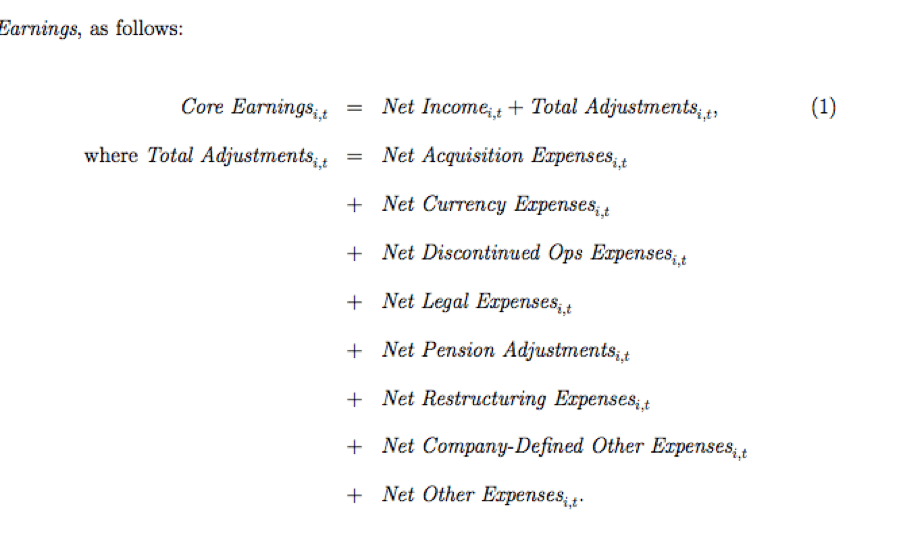

Appendix 1

Figure I contains the definition of core earnings used in the HBS & MIT Sloan paper. Certain adjustment categories we included in the analysis above were aggregated into the definition below. We believe breaking out these adjustments is necessary to ensure all necessary adjustments are captured and accounted for in calculating core earnings.

Figure I: Core Earnings Defined in the HBS & MIT Sloan Paper

Sources: Core Earnings: New Data and Evidence

Figure II details each specific adjustment type included in the total adjustments we detailed in this report.

Figure II: Breakdown of Adjustment Categories

The hidden and reported adjustment categories included in Total Adjustments defined earlier can be further broken down into the following adjustments:

- Acquisition and Merger Expenses, net

- Foreign Currency Expenses, net

- All Restructuring Expenses, net

- Write-downs

- Discontinued Operations

- Other Restructuring

- Legal, Regulatory, and Insurance Expenses, net

- Pension Related Expenses, net

- Recurring

- Non-Recurring

- Company Defined Other Expenses, net

- Other Non-Recurring Expenses, net

- Other Real Estate Owned Expenses, net

- Other Financing Expenses, net

- Derivative Related Expenses, net

- Minority Interest Expenses, net

- Redeemable Preferred Dividends, net

Sources: New Constructs, LLC

Appendix 2

The HBS paper focuses on core earnings for direct comparison with GAAP earnings, IBES and First Call earnings, and Compustat’s “income before extraordinary items” and “income minus special items”. Our preferred measure of profitability, net operating profit after tax (NOPAT), includes all the items in the HBS & MIT Sloan paper as well as several others. Our complete reconciliation of GAAP net income to NOPAT is below. To purchase this data for nearly all U.S. stocks from 1998 – 2018 click here.

Reported GAAP Net Income

Total Net Non-Operating Expenses Hidden in Operating Earnings

- + Hidden Total Restructuring Expenses, net

- + Hidden Foreign Currency Expenses, net

- + Hidden Other Real Estate Owned Expenses, net

- + Hidden Acquisition and Merger Expenses, net

- + Hidden Legal, Regulatory and Insurance Expenses, net

- + Hidden Derivative Related Expenses, net

- + Hidden Other Financing Expenses, net

- + Hidden Other Non-Recurring Expenses, net

- + Hidden Recurring, Non-Operating Pension Expenses, net

- + Hidden Non-Recurring Pension Expenses, net

- + Hidden Company Defined Other Expenses, net

Reported Net Non-Operating Expenses

- + Reported Derivative Related Expenses, net

- + Reported Other Financing Expenses, net

- + Reported Company Defined Other Non-Operating Expenses, net

- + Reported Acquisition and Merger Expenses, net

- + Reported Legal, Regulatory, and Insurance Related Expenses, net

- + Reported Interest Expense/(Income), net

- + Reported Expenses/(Income) from Discontinued Operations, net

- + Reported Losses/(Income) from Unconsolidated Subsidiaries, net

- + Reported Foreign Currency Loss/(Gain), net

- + Reported Non-Operating Other Real Estate Owned Expense/(Income), net

- + Reported Other Non-Operating Expense/(Income), net

- + Reported Write-Downs, net

- + Reported Restructuring Expense, net

- + Reported Other Non-Recurring Expense/(Income), net

Derived Datapoints

- + Change in Total Reserves

- + Goodwill Amortization Expenses, net

- - ESO Expense (Employee Stock Options), net

- + Interest for PV of Operating Leases

- + Quarterly/Annual Classification Disclosure Adjustments, net

- + Non-Operating Tax Adjustment

Net After-Tax Non-Operating Expense/(Income)

- +Reported Minority Interest Expenses, net

- + Reported Loss/(Gain) from Discontinued Operations, net

- + Reported Preferred Stock Dividends, net

- + Reported Redeemable Preferred Stock Dividends, net

- + Reported Other After-tax Charges, net

= NOPAT (Net Operating Profit After Tax)

[1] Earnings Distortion approximates the Total Adjustments featured in the HBS & MIT Sloan paper. See the final section of this report and the Appendix for more details on the adjustments used in this report and the HBS & MIT Sloan paper.