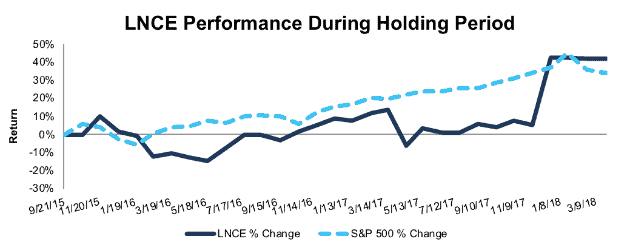

Snyder’s-Lance Inc. (LNCE: $50/share) – Closing Short Position – up 42% vs. S&P up 34%

Snyder’s-Lance was originally selected as a Danger Zone pick on 9/21/15. At the time of the report, the stock received a Very Unattractive rating. Our short thesis highlighted declining economic earnings (despite rising GAAP net income), competitive disadvantages, and overly optimistic expectations baked into the stock price.

The largest risk to any short thesis is what we call “stupid money risk.“ We noted in our original report that an acquisition could occur, despite LNCE being overvalued, as the snack food market has undergone consolidation in recent years. On 3/23/18, Campbell Soup (CPB) completed an acquisition of LNCE that will earn a paltry 3% ROIC ($138 million NOPAT from LNCE divided by the $4.9 billion acquisition price). The 3% ROIC on the deal will depress CPB’s 14% ROIC and economic earnings. This deal destroys value for CPB shareholders.

During the 927-day holding period, LNCE underperformed as a short position, rising 42% compared to a 34% gain for the S&P 500. Prior to the acquisition announcement, LNCE was outperforming as a short and was up just 12% while the S&P 500 was up 35%. Due to the acquisition, we have closed this position and removed it from our Focus List – Short Model Portfolio.

Figure 1: LNCE vs. S&P 500 – Price Return

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on April 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.