Texas Instruments (TXN) – Closing Long Position – up 21% vs. S&P up 10%

Texas Instruments (TXN: $118/share) was originally featured on 11/7/18, alongside four other stocks with a high return on invested capital (ROIC) and cheap valuation. This report, along with all of our research[1], utilizes our one of a kind database of footnotes disclosures to get the truth about earnings[2], as shown in the Harvard Business School and MIT Sloan paper, “Core Earnings: New Data and Evidence.”

The five stocks from the original report, AutoZone (AZO), Amgen (AMGN), Best Buy (BBY), Cognizant Technology Solutions (CTSH), and Texas Instruments are up an average of 15% while the S&P is up just 10% over the same time. AutoZone, the best performer of the group, is up over 47%.

At the time of the report, TXN received an Attractive rating. Our long thesis pointed out the firm’s accelerating profit growth, improving ROIC, and undervalued stock price.

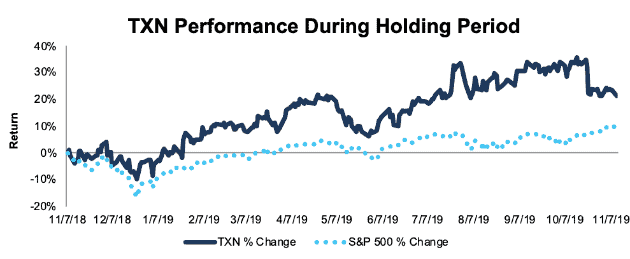

During the 370 day holding period, TXN outperformed as a long position, rising 21% compared to a 10% gain for the S&P 500.

While the firm still earns a top-quintile ROIC, its economic earnings declined over the trailing twelve month (TTM) period due to cyclical headwinds that drove profits down across the industry. When coupled with a more expensive valuation, TXN no longer presents the same risk/reward and was recently downgraded to an Unattractive rating. We believe it is time to take the gains and close this long position.

Figure 1: TXN vs. S&P 500 – Price Return – Successful Long Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 12, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.