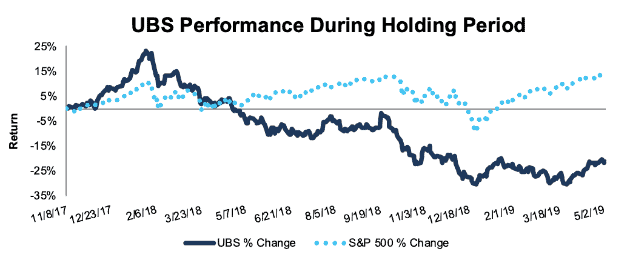

UBS Group AG (UBS: $13/share) – Closing Long Position – down 26% vs. S&P up 13%

UBS Group AG was originally selected as a Long Idea on 11/8/17. At the time of the initial report, the stock received a Very Attractive rating. Our long thesis highlighted the strength of UBS’ wealth management business, its investment in technology, and its undervalued stock price.

During the 544-day holding period, UBS underperformed as a long position, falling 26% compared to a 13% gain for the S&P 500.

UBS still earns a Very Attractive rating. The wealth management division has performed as expected and the company’s fundamentals remain strong.

However, the stock price has been driven by legal issues and possible lawsuits, such as the recent $5 billion fine for tax evasion in France. With a potential lawsuit on the horizon, regarding mortgage backed securities during the financial crisis, we believe it is time to cut our losses before further decline. We are closing this position.

Figure 1: UBS vs. S&P 500 – Price Return

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 8, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.