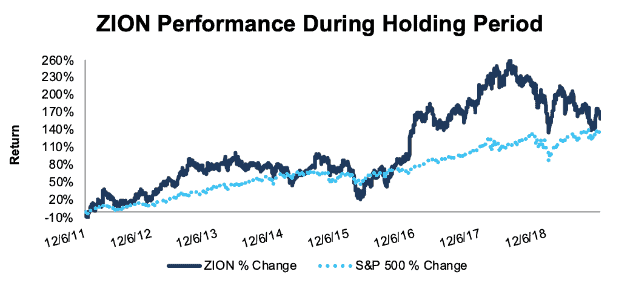

Zions Bancorp (ZION: $42/share) – Closing Short Position – up 159% vs. S&P up 130%

Zions Bancorp (ZION) was originally selected as a Danger Zone Idea on 12/6/11. At the time of the initial report, the stock received a Very Unattractive rating. Our short thesis noted the firm’s low return on invested capital (ROIC) and high growth expectations implied by its valuation.

During the nearly 8-year holding period, ZION underperformed as a short position, gaining 159% compared to a 130% gain for the S&P 500.

ZION has steadily improved its ROIC from -3% when we wrote our article, to 8% TTM. We also updated our weighted average cost of capital (WACC) calculation, which reduced ZION’s WACC and lowered the growth expectations implied by its valuation. These factors, combined with a 17% decline in the stock price over the past year, means ZION now trades a more reasonable level. Given the improved fundamentals and valuation, we are closing this short position.

Figure 1: ZION vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on October 3, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.