We closed this position on July 19, 2018. A copy of the associated Position Update report is here.

Carter’s Inc. (CRI: $93/share) – Maintaining Long Position – Up 4% vs. S&P +8%

Carter’s Inc. was selected as a Long Idea on 4/10/17. At the time of the report, the stock received a Very Attractive rating. CRI was downgraded to Neutral risk/reward by our rating system on 9/28/17 as the stock rose 7% in the two weeks prior.

Despite the downgrade risk/reward rating, we are maintaining our Long recommendation due to the firm’s strong underlying fundamentals, management’s expectations for continued growth, and the stock’s continued low valuation. The current 1.1 price-to-economic book value ratio (PEBV) means CRI is priced for only 10% growth in after-tax profits (NOPAT) over the remainder of its corporate life. Meanwhile, CRI has grown NOPAT by 16% compounded annually since 2003.

Our investment thesis highlighted 1) history of consistent profit growth; 2) industry leading profit margins; 3) the firm’s multi-channel sales model; and 4) the company’s undervalued stock price.

CRI reported 2Q17 earnings in July and exceeded expectations on both top and bottom lines, Guidance, while below expectations, implies continued revenue and profit growth through the end of the year.

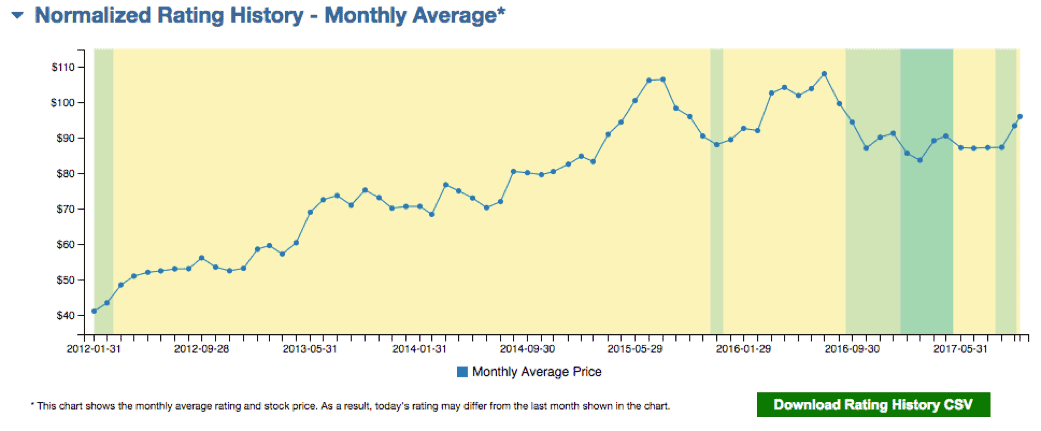

Figure 1: CRI Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

Despite broad weakness in retailers, CRI remains positioned to profit from its robust sales channels. Its products are sold in nearly 18,000 wholesale locations in the U.S. and the firm is not reliant upon building and occupying its own stores. Further, the low valuation combined with a favorable fundamental outlook continues to present an attractive risk/reward trade-off for investors. If CRI can maintain 2016 NOPAT margins (10%) and grow NOPAT by just 5% compounded annually over the next decade, the stock is worth $142/share today – a 53% upside.

This article originally published on October 12, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.