We hope you’re having a great week.

As expected, The Fed held interest rates steady. The current pessimism and uncertainty surrounding the global economy isn’t likely to change anytime soon.

The news isn’t all bad though! We know how to find the best stocks in this market.

Our data and models account for all the material and often-overlooked details found buried in company filings, which is precisely why our research generates alpha.

This week, we identified a Long Idea stock that could hold 40%+ upside potential even if the company’s profits were to decline. Think margin of safety meets strong risk/reward.

We originally made Meritage Homes (MTH: $67/share) a Long Idea in June 2020 and reiterated our bullish thesis on the stock many times since. See our reports on MTH here. The stock has slightly underperformed the S&P 500 since our original report, up 75% compared to the S&P 500 up 81%. However, with the stock down 10% year-to-date (YTD), we think shares have only gotten more attractive.

Meritage Homes, is steadily taking market share, building and delivering homes faster, all the while returning capital to shareholders through dividends and repurchases. Despite an uncertain housing outlook in the short-term, our thesis remains intact, and the stock remains undervalued.

MTH offers favorable Risk/Reward based on the company’s:

- long-term revenue and profit growth,

- growing market share,

- shrinking sales cycle,

- strong cash flow generation,

- high shareholder return, and

- cheap stock valuation.

What’s Working

We Still Need to Build More Houses

In the latest housing supply update, Freddie Mac estimated that the U.S. housing market was undersupplied by 3.7 million units as of 3Q24. The shortage of homes is a key driver of decreased housing affordability in the country. Put simply, when supply doesn’t increase enough to meet demand, prices (home and rent) rise.

As the 5th largest homebuilder in the U.S., Meritage Homes’ products remain in strong demand, throughout all economic cycles, because everyone needs a place to live.

Steadily Taking Market Share

Meritage Homes is in an advantageous position even as housing prices and interest rates remain high. The average sales price of new houses sold in the U.S. sits ~$404k in March 2025, up from ~$332k in February 2020, just before the COVID-19 pandemic sent home prices soaring. Entry-level homes, in which Meritage specializes, present a more viable and affordable option for any potential homebuyer.

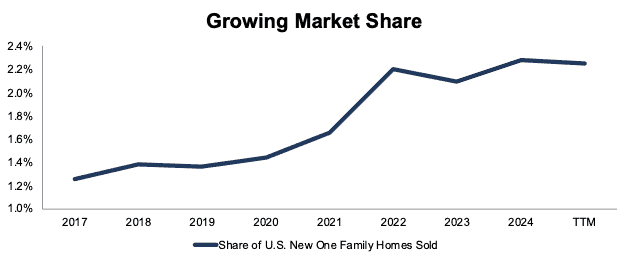

In fact, Meritage Homes’ homes closed (finished homes delivered to the customer) grew from 7,709 in 2017 to 15,520 in the TTM ending 1Q25. In turn, the company’s market share of U.S. new one family homes increased from 1.3% in 2017 to 2.3% in the TTM. See Figure 1.

Figure 1: Meritage Homes’ Share of U.S. New One Family Homes Sold: 2017 – TTM

Sources: New Constructs, LLC and company filings

Shortening the Sales Cycle

In 1Q25, Meritage Homes recorded its second highest first quarter orders and closings in company history.

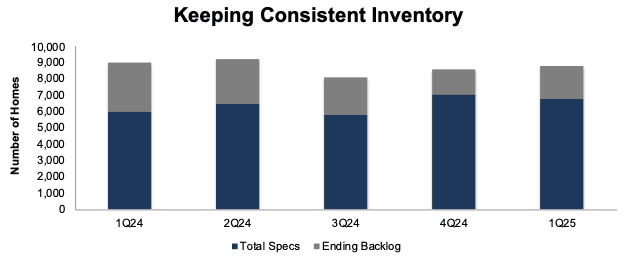

Meritage Homes’ spec home strategy, which offers move-in ready homes available to close within 60 days, speeds up the buying process. Essentially, this strategy shortens the time between home sale and home closing, and it can help target incentives and promotions to specific market conditions. Of the homes closed in 1Q25, approximately 61% were sold within the same quarter, up from 48% in the prior year period.

The company also achieved a record backlog (homes sold but not yet delivered) conversion rate of 221% in 1Q25, up from the 138% in 1Q24. Backlog refers to homes under contract that are not yet closed.

It’s important to note that the decrease in Meritage Homes’ backlog is not due to a decrease in demand, but rather due to a strategic pivot to shorten the sales cycle and sell homes later in the construction cycle.

When combining the number of homes in backlog and spec homes in inventory in 1Q25, Meritage has ~5 month supply, which is within the company’s preferred range of 4-6 month supply.

Figure 2: Meritage Homes’ Total Specs & Ending Backlog: 1Q24 – 1Q25

Sources: New Constructs, LLC and company filings

Profits Growing Over the Long-Term

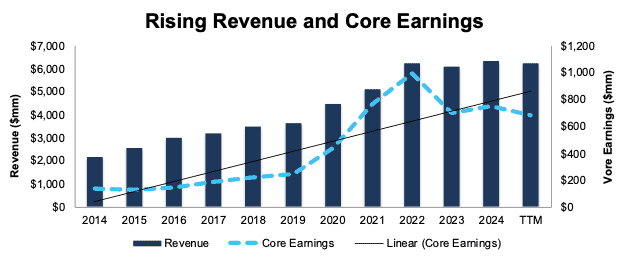

Meritage Homes’ fundamentals have been improving over the years. The company has grown revenue and net operating profit after-tax (NOPAT) by 11% and 17% respectively from 2014 through the TTM ended 1Q25. The company’s NOPAT margin improved from 7% in 2014 to 11% in the TTM, while invested capital turns fell from 1.5 to 1.2 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns and drive Meritage Homes’ return on invested capital (ROIC) from 10% in 2014 to 13% in the TTM.

Additionally, the company’s Core Earnings, a proven superior earnings measure that excludes unusual gains/losses, grew 17% compounded annually from 2014 through the TTM ended 1Q25. See Figure 3.

While below 2022 highs, Meritage Homes’ TTM ended 1Q25 Core Earnings are still higher than any annual period between 1998-2020.

Figure 3: Meritage Homes’ Revenue and Core Earnings: 2014 – TTM

Sources: New Constructs, LLC and company filings

Potential for 4.8%+ Yield

Meritage Homes started paying dividends at the beginning of 2023. Since then, Meritage Homes paid $179 million (4% of market cap) in cumulative dividends and increased its quarterly dividend from $0.14/share in 1Q23 to $0.43/share in 1Q25. The company’s current dividend, when annualized, provides a 2.5% dividend yield.

Though Meritage Homes started paying dividends relatively recently, it’s been returning capital to shareholders via share buybacks for much longer. From 2019 through 1Q25, the company repurchased shares worth $486 million (10% of market cap).

Since February 2019, Meritage Homes’ Board of Directors has authorized the repurchase shares worth up to $750 million, with no specified expiration date. At the end of 1Q25, the company remains authorized to repurchase shares worth up to $264 million. Should the company repurchase shares at its TTM (ending 1Q25) rate, it would repurchase $115 million of shares over the next twelve months, which equals 2.3% of the current market cap.

When combined, the dividend and share repurchase yield could reach 4.8%.

Strong Cash Flow Generation Supports Capital Return

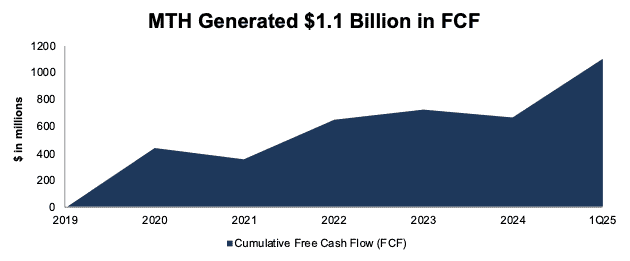

Meritage Homes generates strong free cash flow (FCF) that covers both its share repurchases and regular dividend payments.

From 2019 through 1Q25, Meritage Homes generated $1.1 billion (26% of enterprise value) in FCF while returning $665 million over the same time ($179 million in dividends and $486 million in repurchases).

We like companies that choose to return capital to shareholders instead of spending it on costly executive bonuses or acquisitions that rarely drive shareholder value creation. See Figure 4.

Figure 4: Meritage Homes’ Cumulative FCF Since 2019

Sources: New Constructs, LLC and company filings

What’s Not Working

High Mortgage Rates

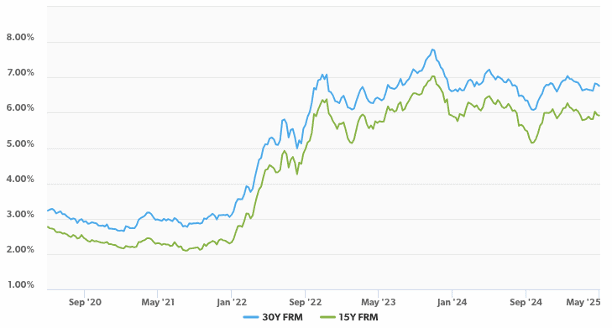

Mortgage rates have risen significantly from the record lows of 2021, when the 30-year fixed rate mortgage (FRM) was around 2.2% and the 15-year FRM was around 2.7%.

In May of 2025, Freddie Mac estimates that the average 30-year FRM sits at 6.8% and the average 15-year FRM sits at 5.9% in May 2025. See Figure 5.

High mortgage rates make purchasing a home more expensive and present a headwind to all builders.

Unfortunately, the easiest solution to aid consumers during times of high interest rates is to offer incentives and rate-buydowns, which create a drag on profitability.

Figure 5: 30- and 15-Year Fixed Rate Mortgage: May 2020 – May 2025

Sources: Freddie Mac

Tariff Uncertainty

In the 1Q25 earnings call, Meritage Homes’ management noted that they don’t yet know to what degree tariff-related cost increases will impact margins the remainder of the year.

However, management also noted that “the current status quo of no tariffs on lumber should get us most of our expected 2025 closings completed at current market lumber prices.”

The company also intends to “leverage its bargaining power with national vendors” given its large scale, limited floor plans, and high level of product visibility.

Margin Pressures Persist

Due to the high interest and mortgage rates, many homebuilders have increased incentives and rate buydowns, which negatively impact margins.

Meritage Homes’ average selling price (ASP) on home closings, home orders, and home backlogs fell 6%, 2%, and 1% YoY in 1Q25, respectively. Management noted that this decline was driven by “increased utilization of financial incentives”. We see the impact of these incentives in Meritage Homes’ NOPAT margin, which fell from 12% in 1Q24 to 8.6% in 1Q25. In the company’s 1Q25 earnings call, management noted: “we anticipate the using of pricing incentives to remain elevated for the near future.”

The good news is that the impact of lower margins, and any general housing downturn, are already more than priced into MTH at its current price. Details below.

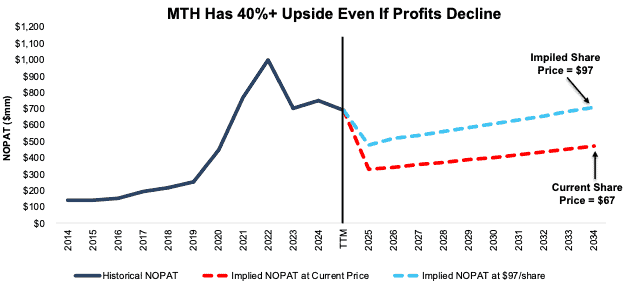

Current Price Implies Permanent 30% Profit Decline

At its current price of $67/share, MTH has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects the company’s profits to permanently fall 30% from current levels. For context, Meritage Homes has grown NOPAT by 21% compounded annually over the last five years and 17% compounded annually over the last ten years. Perhaps even more impressive, the company has grown NOPAT 9% compounded annually over the past two decades.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for MTH.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 5% (below five-year average of 13% and ten-year average of 9%, and TTM NOPAT margin of 11%) through 2034, and

- revenue grows 4% a year through 2034 (vs. consensus of 7% growth in 2025 and 9% growth in 2026) then

the stock is worth $68/share today – equal to the current stock price. In this scenario, Meritage Homes’ NOPAT falls 5% compounded annually from 2025 – 2034. In this scenario, Meritage Homes’ NOPAT would equal $471 million in 2034, or 32% below its TTM NOPAT. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 40%+ Higher at Consensus Growth Rates

If we instead assume:

- NOPAT margin immediately falls to 7% (still below five- and ten-year averages and its TTM NOPAT margin of 11%) through 2034,

- revenue grows at consensus rates in 2025 (7%), 2026 (9%), and

- revenue grows at 4% each year thereafter through fiscal 2034, then

the stock is worth $97/share today – a 45% upside to the current price. In this scenario, Meritage Homes’ NOPAT would fall <1% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario.

Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside. Furthermore, we think companies with long track records of profit growth deserve premium stock valuations, especially in a market filled with so many underperforming companies.

Figure 6 compares Meritage Homes’ historical NOPAT to the NOPAT implied in each of the above scenarios.

Figure 6: Meritage Homes’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on May 7, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.