We published an update on MTH on August 4, 2021. A copy of the associated Earnings Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

We recently highlighted a leading homebuilder positioned to excel during the widely expected economic recovery. However, the homebuilding market is not winner takes all and there is ample market share to go around. We’ve identified another undervalued homebuilder worth a look.

Investors overlooking Meritage Homes (MTH: $71/share) are in the Danger Zone. Despite rebounding from its March lows, there’s still value in this Long Idea.

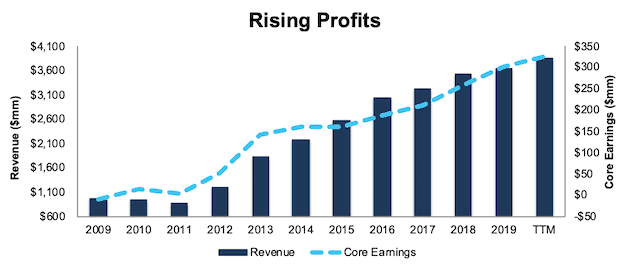

Meritage Homes’ History of Profit Growth

Meritage Homes has a strong history of profit growth. Over the past decade, Meritage homes has grown revenue by 14% compounded annually and core earnings[1] from -$10 million in 2009 to $301 million in 2019, per Figure 1. Core earnings provide a better measure of profitability and truer insights into valuation than similar measures of profits from legacy data providers.

Longer term, Meritage Homes has grown core earnings by 16% compounded annually over the past two decades. The firm increased its core earnings margin year-over-year (YoY) in each of the past three years and from 6% in 2016 to 8% in the trailing-twelve-month period (TTM).

Figure 1: Core Earnings & Revenue Growth Over the Past Decade

Sources: New Constructs, LLC and company filings.

Meritage Homes’ rising profitability helps the business generate positive free cash flow (FCF) in each of the past two years and a cumulative $263 million (9% of market cap) over the past five years. Meritage Homes’ $309 million in FCF over the TTM period equates to an 8% FCF yield, which is significantly higher than the Consumer Cyclicals sector average of 2%.

Balance Sheet Provides Ample Liquidity to Survive the Crisis

Companies with strong cash positions are better positioned to survive macro-economic uncertainty. Meritage Homes has the cash to survive the current disruption to operations. Prior to the end of 1Q20 (period ending March 31, 2020) Meritage Homes borrowed $500 million against its credit facility which gives the firm $797 million in cash on hand. Meritage still has $220 million remaining availability under its credit facility, which if tapped, would give the firm just over $1 billion in cash. The firm also has no debt maturities until 2022.

In a worst-case scenario, where Meritage Homes generates no revenue, the firm could operate for over 32 months with its available liquidity before needing additional capital. This scenario assumes Meritage Homes maintains selling, general, and administrative expenses ($95 million in 1Q20) at current levels. If we only include general and administrative expenses and exclude commissions and sales costs, which would presumably go away if the firm generated no revenue, Meritage Homes’ available cash would cover G&A expenses for over seven years.

However, it’s highly unlikely that Meritage Homes’ revenue would go to zero given the essential nature of the homebuilding industry and that Meritage continues to build homes. Furthermore, consensus estimates expect revenue to fall just 3.5% in 2020 before rebounding in 2021.

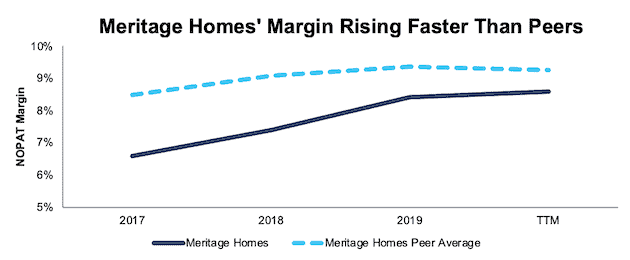

Profitability Is Closing the Gap with Peers

Before the current crisis, Meritage Homes’ profitability was trending higher and at a faster pace than its competitors. This improved profitability is a testament to the firm streamlining its product offering and design process and building more speculative (spec) homes to optimize the home sales process. With improving profitability and a strong balance sheet, Meritage Homes can not only survive the downturn, but is well-positioned to grow profits and market share when the economy recovers.

Per Figure 2, Meritage Homes’ net operating profit after-tax (NOPAT) margin has improved from 6.6% in 2017 to 8.6% TTM. Over the same time, the market-cap-weighted average of 16 other Homebuilding firms only improved from 8.6% to 9.2%. This peer group includes Lennar Corporation (LEN), PulteGroup (PHM), D.R. Horton (DHI), KB Home (KBH), and more.

Figure 2: NOPAT Margin Vs. Peers

Sources: New Constructs, LLC and company filings.

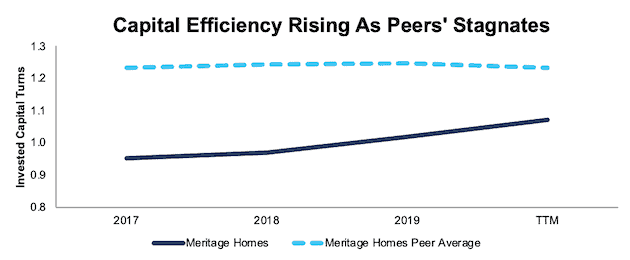

Meritage Homes’ invested capital turns, a measure of balance sheet efficiency, have increased from 0.95 in 2017 to 1.1 TTM. The peer group’s market-cap-weighted average invested capital turns have remained relatively flat, at 1.2, over the same time.

Figure 3: Invested Capital Turns Vs. Peers

Sources: New Constructs, LLC and company filings.

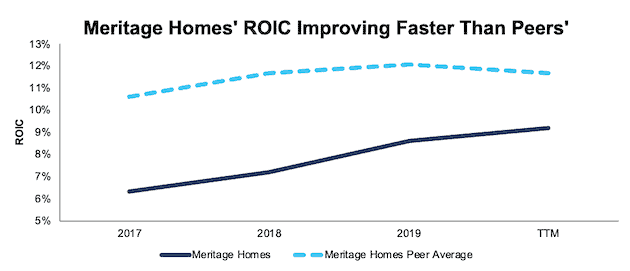

The combination of rising margins and invested capital turns drives Meritage Homes’ return on invested capital (ROIC) higher. Per Figure 4, Meritage Homes’ ROIC has improved from 6% in 2017 to 9% TTM while the market-cap-weighted average ROIC of peers has risen from 11% to 12% over the same time.

Figure 4: ROIC vs. Peers

Sources: New Constructs, LLC and company filings.

Market Share for the Taking – There Can Be More Than One Winning Homebuilder

Meritage Homes’ financial stability and profitability position the firm not just to survive the downturn, but also to expand its market share during a recovery, much as it has in the past. Meritage Homes increased its total houses sold as a percent of U.S. single-family new home sales from less than 0.1% in 1996 to 1.4% in 2019.

According to the Builder 100, which tracks the top homebuilders in the United States based on total closings, Meritage Homes ranked number 11 in 2009 and number 7 in 2019. While recent Long Idea D.R. Horton may be the largest homebuilder in the United States, it is not the only one positioned to grow its market share.

As Meritage Homes’ CEO, Steven Hilton, pointed out during the 1Q20 earnings call, “we're going to be very strategic, and we're going to use this opportunity, this is an opportunity to increase our market share …. it's not 2008 where we're just throwing the pots and pans off the ship to stay afloat. This is a different situation.”

Unless you believe that there will be no need for entry-level and first move-up homes in a post-COVID-19 world, it’s hard to argue against Meritage Homes’ ability to survive. And, if it survives, it’s hard to argue that the firm’s improving profitability (faster than peers) before the crisis will not aid in taking market share and growing profits after the crisis.

Meritage Homes’ Offerings Target Underserved Market

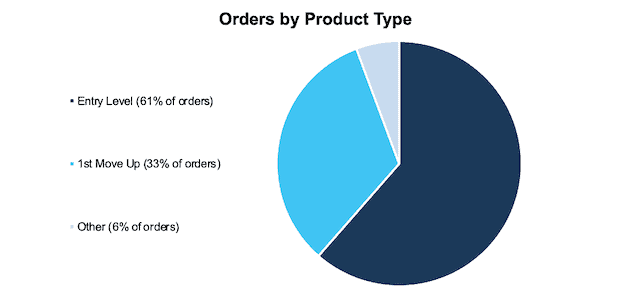

Over the past few years, Meritage Homes has shifted its strategy to target more entry-level buyers, instead of first and second move-up buyers. Per Figure 5, 61% of Meritage Homes’ house orders in 1Q20 were for entry- level homes and 33% were for first move-up homes. In 1Q18, entry level homes made up 38% of orders while first move-up made up 44% and second move-up made up 18% of orders.

Figure 5: Meritage Homes’ Homes Sales by Type – 1Q20

Sources: New Constructs, LLC and company filings.

Housing Is Less Affordable

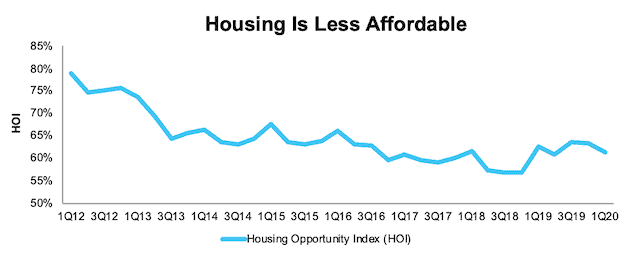

Meritage Homes’ strategic shift to entry-level homes better meets the market’s need for affordable homes. According to the National Association of Home Builders Housing Opportunity Index (HOI), which is defined as the share of homes sold that would have been affordable to a family earning a median income, housing has grown less affordable since 2012.

Per Figure 6, the HOI has fallen from 78.8% in 1Q12 to 61.3% in 1Q20. The median sales price over this time increased from $161k to $280k.

Figure 6: NAHB Housing Opportunity Index

Sources: New Constructs, LLC and National Association of Home Builders.

Lower Selling Prices Meet Market Demand

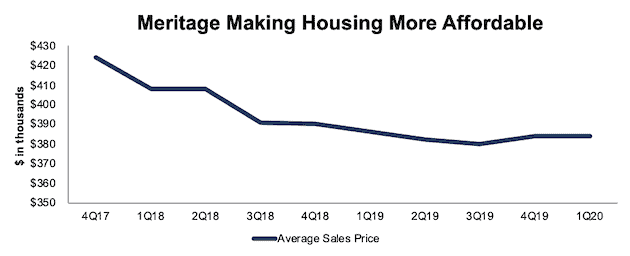

To meet the need for affordable housing, Meritage Homes streamlined its sales and design process to focus on spec homes, which are started prior to a sales contract and offer fewer customization options. In 1Q20, Meritage built 11.2 spec homes per community, up from 8.5 in 1Q19. Management aims to maintain a 4-5 month supply of spec homes based on community-level sales. These spec homes provide first-time buyers less wait time to move in than traditional homebuilding.

This strategic shift helps lower the average selling price of Meritage Homes’ houses, which fell from $424k in 4Q17 to 384k in 1Q20. Despite lower selling prices, Meritage Homes’ margins have improved over the same time, as noted earlier.

Figure 7: Average Sales Price Meritage Homes’ Houses

Sources: New Constructs, LLC and company filings.

Backlog Growth Shows Future Demand

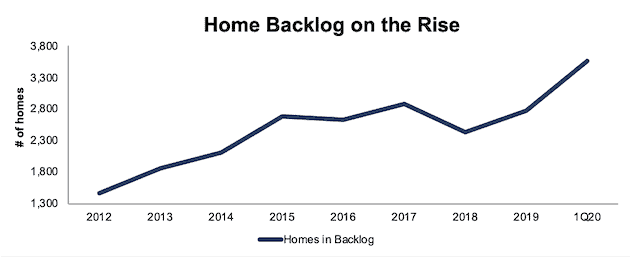

When you look beyond the current dip in economic activity, we think the demand for entry-level homes will remain strong over the long term. According to the U.S. Census, sales of newly built homes in May posted the strongest YoY growth since 2007. Increased demand for new homes is also represented in Meritage Homes’ backlog, which represents homes covered by contingent sales contracts but not yet closed.

Per Figure 8, Meritage Homes’ estimated backlog has grown from 1,472 homes in 2012 to 3,568 homes in 1Q20. The total value of the homes in backlog sits at $1.4 billion and provides a strong runway for future revenue.

Figure 8: Meritage Homes’ Backlog Since 2012

Sources: New Constructs, LLC and company filings.

It’s Not 2008 Again

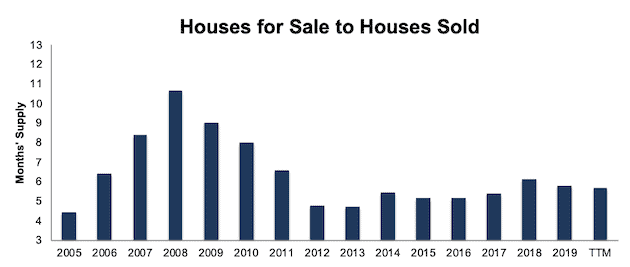

As we noted in our Long Idea on D.R. Horton, investors certainly remember the housing market collapse that led to the Great Recession in 2008-2009. While people love to discuss how risky financing practices drove the housing bubble, many seem to forget the second driver of the housing bubble – supply. The market was oversupplied in 2008 and is undersupplied today.

By looking at the ratio of houses for sale to houses sold, we can understand the level of supply in the housing market. Figure 9 shows the current supply in the market is much lower than 2007 and 2008. Over the TTM, the housing supply is nearly half what is was in 2008. Given that the financial practices that led to such an overbuild in the years prior to 2008 are largely obsolete (due to heavy regulation), it should be no surprise to see the market is much more evenly balanced today.

Figure 9: Ratio of Houses for Sale to Houses Sold in the U.S.

Sources: New Constructs, LLC and Federal Reserve Economic Data

It is also important to note that an economic recession does not necessarily produce a housing market downturn. In fact, home prices actually increased in three of the five recessions since 1980. Housing is an essential human need that can persist in the good times and the bad.

Furthermore, we believe a recovery is likely over the long term since the International Monetary Fund (IMF) and nearly every economist in the world believe the global economy will grow strongly in 2021. The IMF estimates the global economy will expand by 5.4%, and the U.S. economy by 4.5%, in 2021. Fitch Ratings projects global GDP growth of 5.1% in 2021, and for “pre-virus levels of GDP” to be reached in mid-2022 in the US and later in Europe. The overall growth in the economy should lead to a rebound in consumer activity, including home purchases.

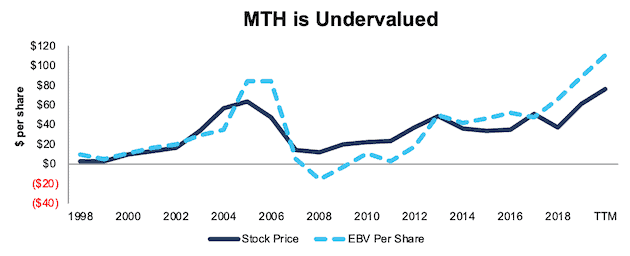

MTH Trades Well Below Its Economic Book Value

Despite rebounding from its March lows, at $71/share MTH still trades below its economic book value, or no-growth value and at a price-to-economic book value (PEBV) ratio of 0.6. This PEBV ratio means the market expects Meritage Homes’ NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long term.

Meritage Homes’ current economic book value is $112/share – a 58% upside to the current price.

Figure 10: Stock Price vs. Economic Book Value (EBV)

Sources: New Constructs, LLC and company filings.

Meritage Homes’ Current Price Implies Another Housing Crash

Below, we use our reverse DCF model to quantify the cash flow expectations baked into Meritage Homes’ current stock price. Then, we analyze the implied value of the stock based on different assumptions about COVID-19’s impact on the housing industry and Meritage Homes’ future growth in cash flows.

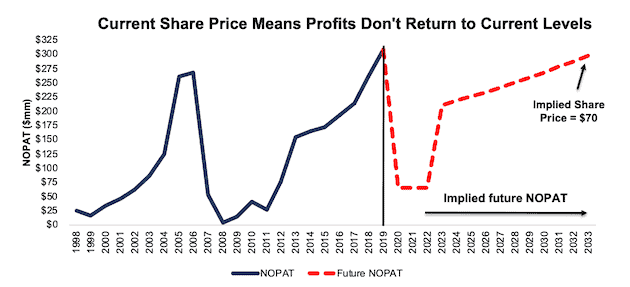

Scenario 1: Using projected revenue declines, historical margins, and average historical GDP growth rates, we can model the worst-case scenario already implied by Meritage Homes’ current stock price. In this scenario, we assume:

- NOPAT margins fall to 2.3% (average from 2007-2011, compared to 9% TTM) in 2020-2022, and increase to 7% (average since 2015) in 2023 and each year thereafter

- Revenue falls 22% (double the expected decline in single-family housing starts) in 2020 and does not grow until 2023

- Sales begin growing again in 2023, but only at 3.5% a year, which is equal to the average global GDP growth rate since 1961

In this scenario, where Meritage Homes’ NOPAT declines 1% compounded annually over the next 14 years (including a 79% YoY drop in 2020), the stock is worth $70/share today – nearly equal to the current stock price. See the math behind this reverse DCF scenario.

For reference, Meritage Homes’ NOPAT declined 92% YoY in 2008, before more than doubling just one year later in 2009.

Figure 11 compares the firm’s implied future NOPAT to its historical NOPAT in this scenario. This worst-case scenario implies Meritage Homes’ NOPAT 14 years from now will be 4% below its 2019 NOPAT. In other words, this scenario implies that 14 years after the COVID-19 pandemic, Meritage Homes’ profits won’t have recovered to their current level. In any scenario better than this one, MTH holds significant upside potential, as we’ll show.

Figure 11: Current Valuation Implies Severe, Long-Term Decline in Profits: Scenario 1

Sources: New Constructs, LLC and company filings.

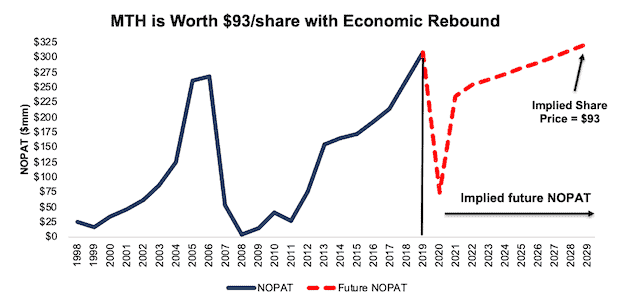

Scenario 2: Moderate Long-Term Recovery Could Be Very Profitable

If we assume, as does the IMF and nearly every economist in the world, that the global economy rebounds and returns to growth starting in 2021, MTH is undervalued.

In this scenario, we assume:

- NOPAT margins fall to 2.3% (average from 2007-2011, compared to 9% TTM) in 2020 and rise to 7% (average since 2015) in 2021 and each year thereafter

- Revenue falls 11% (equal to the expected decline in single family housing starts and worse than consensus estimate of a 3.5% drop in revenue) in 2020

- Revenue grows by 1% in 2021 and 8% in 2022 (consensus estimates), and 3.5% a year in 2023 and each year thereafter, which is equal to the average global GDP growth rate since 1961

In this scenario, Meritage Homes’ NOPAT only grows by less than 1% compounded annually over the next decade (including a 76% YoY drop in 2020) and the stock is worth $93/share today – a 31% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, Meritage Homes grew NOPAT by 48% compounded annually from the depths of the 2008 Financial Crisis through 2019 and 16% compounded annually over the past two decades. It’s not often investors get the opportunity to buy a strong firm in a growing industry at such a discounted price.

Figure 12 compares the firm’s implied future NOPAT to its historical NOPAT in scenario 2.

Figure 12: Implied Profits Assuming Moderate Recovery: Scenario 2

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Meritage Homes’ business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help Meritage Homes survive the downturn and return to growth as the economy grows again:

- Strong balance sheet and liquidity to survive the dip

- Leading homebuilder expanding into underserved (affordable housing) market

- Rising profitability prior to COVID-19 relative to its peer group

What Noise Traders Miss with Meritage Homes

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Strong core earnings growth over the past two decades

- Meritage Homes’ ability to grow market share over the past two decades

- The current economic downturn is different than 2008, which puts homebuilders at less risk

- Valuation implies the economy never recovers and profits permanently decline by 40%

Repurchases Could Provide Slight Yield

Meritage Homes does not currently pay dividends, but it returns capital to shareholders through share repurchases. Meritage Homes repurchased $116 million worth of shares from 2018-2019. In the three months ended March 31, 2020, the firm repurchased ~$61 million (2% of market cap) worth of shares.

Meritage Homes has suspended its share repurchase program “in light of the current economic conditions.” Prior to this suspension, Meritage Homes was authorized to repurchase an additional $23 million (0.8% of current market cap) worth of shares. When the firm restarts share repurchases once the crisis is over, investors benefit from an increased yield on their investment.

A Consensus Beat or Signs of Recovery Could Send Shares Higher

According to Zacks, consensus estimates at the end of January pegged Meritage Homes’ 2020 EPS at $6.79/share. Jump forward to June 25, and consensus estimates have fallen to $5.59/share. 2021 estimates follow a similar trend. At the end of January, 2021 EPS consensus was $7.60/share, which has since fallen to $5.89/share.

These lowered expectations provide a great opportunity for a strong business, such as Meritage Homes, to beat consensus, if not this quarter, then maybe the next, especially if new home orders return to any level of normalcy. Though our current Earnings Distortion Score, which is a short-term indicator of the likelihood to beat or miss expectations, for Meritage Homes is “In-line”, lowered expectations moving forward could make it much easier to beat earnings.

Lastly, any signs of a recovery in the global economy would send shares higher. We may already be seeing the beginnings of a recovery in the housing market as well. Meritage announced in mid-May that sales momentum increased during the last two weeks of April, and the firm expected May’s orders to be in-line with May 2019. As the CEO noted in the announcement, “qualified buyers are taking advantage of low interest rates and choosing to move into a safe, comfortable and healthy home of their own.” Continued upward sales momentum should send MTH even higher.

Executive Compensation Could Be Improved but Raises No Red Flags

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Meritage Homes’ executives receive both annual cash awards and long-term equity awards. The annual cash awards are tied to three performance measures: adjusted EBITDA, number of home closings, and customer satisfaction rating determined by a third-party rating agency.

Long-term equity awards, and specifically the performance share portion (50% of equity awards), are tied to return on assets (ROA) relative to a peer group and three-year total shareholder return relative to the peer group.

We would prefer the firm use ROIC improvement when determining executive compensation, as there is a strong correlation between improving ROIC and increasing shareholder value. Having accurate values for NOPAT and invested capital ensures investors have an apples-to-apples metric for measuring corporate performance and holds management accountable for every dollar invested into the company.

Despite not using ROIC when measuring performance, and instead using a flawed metric in adjusted EBITDA, Meritage Homes’ compensation plan has not compensated executives while destroying shareholder value. Meritage Homes has grown economic earnings from -$83 million in 2009 to $111 million TTM and by 13% compounded annually over the past two decades.

Insider Trading and Short Interest Trends

Over the past three months, insiders have bought no shares and sold 24 thousand shares for a net effect of 24 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 1.4 million shares sold short, which equates to 4% of shares outstanding and just under three days to cover. Short interest is up 8% from the prior month, but still minimal.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Meritage Homes’ 2019 10-K:

Income Statement: we made $151 million of adjustments, with a net effect of removing $59 million in non-operating expenses (2% of revenue). You can see all the adjustments made to Meritage Homes’ income statement here.

Balance Sheet: we made $870 million of adjustments to calculate invested capital with a net increase of $543 million. One of the largest adjustments was $689 million in asset write-downs. This adjustment represented 23% of reported net assets. You can see all the adjustments made to Meritage Homes’ balance sheet here.

Valuation: we made $2.2 billion of adjustments with a net effect of decreasing shareholder value by $1.0 billion. Apart from total debt, the most notable adjustment to shareholder value was $605 million in excess cash. This adjustment represents 21% of Meritage Homes’ market cap. See all adjustments to Meritage Homes’ valuation here.

Attractive Funds That Hold MTH

The following funds receives our Attractive-or-better rating and allocate significantly to Meritage Homes:

- Bullfinch Unrestricted Series (BUNRX) – 3.9% allocation and Attractive rating

- Invesco Dynamic Building & Construction ETF (PKB) – 3.0% allocation and Attractive rating

- Pacer U.S. Small Cap Cash Cows 100 ETF (CALF) – 2.6% allocation and Very Attractive rating

- Managed Portfolio Muhlenkamp Fund (MUHLX) – 2.5% allocation and Attractive rating

- iShares U.S. Home Construction ETF (ITB) – 2.3% allocation and Attractive rating

This article originally published on June 29, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).