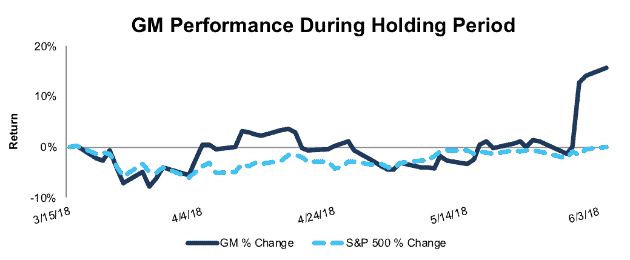

General Motors Co (GM: $43/share) – up 15%% vs. S&P +0%

We originally featured GM as a Long Idea on 3/15/18. At the time of the report, the stock received an Attractive rating. Two key elements of our thesis were:

- A valuation that implied an immediate 50% decline in after-tax profit (NOPAT)

- Self-driving and electric vehicles represent an opportunity for GM, not a threat

The market sees self-driving cars as a threat to incumbent automakers. We believe they represent an opportunity for GM to grow its business even further.

We’re not alone when it comes to optimism over GM’s self-driving opportunity. Last week, GM announced that Softbank plans to invest $2.25 billion in its autonomous vehicle unit. GM’s President Dan Ammann put it best when asked about SoftBank’s investment, “I also think it’s a big recognition of the opportunity that lays ahead.”

SoftBank’s investment comes as Tesla (TSLA) faces scrutiny due to a series of crashes in cars using its Autopilot technology, another sign that GM poses a larger threat to Tesla than many once thought.

Since our original Long Idea report, GM has significantly outperformed as a long position, rising 15% compared to a flat S&P 500. Despite its outperformance, GM remains undervalued, and this latest positive development leads us to add it to our Focus List – Long Model Portfolio.

Figure 1: GM vs. S&P 500 – Price Return: Successful Long

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on June 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.