On Monday, grid operators throughout the country will scramble to deal with the impact of diminished sunlight during the first total solar eclipse in the continental United States since 1979. There shouldn’t be any power outages, but engineers for utilities such as Duke Energy (DUK) have been running war games to prepare, which reflects the growing importance of solar to the U.S. energy system.

At the forefront of this growth in solar energy are the two largest solar companies in the U.S. by market cap: First Solar (FSLR: $49/share) and SunPower (SPWR: $10/share). In this article, we will judge FSLR and SPWR on five key categories:

- Profitability

- Corporate Governance

- Free Cash Flow Yield

- Growth Opportunities

- Valuation

With investors’ eyes turned towards the sun today, which of these solar stocks is the best bet to make your portfolio shine?

Profitability

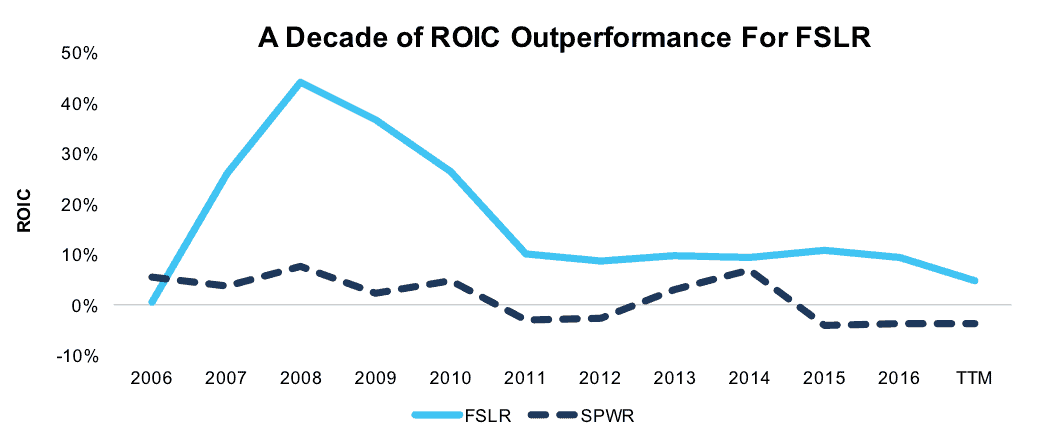

The most important metric we look at for any company is return on invested capital (ROIC). ROIC is the best measure of corporate performance and has the most direct link to valuation. As Figure 1 shows, First Solar has consistently earned a superior ROIC to SunPower over the past decade.

Figure 1: FSLR and SPWR ROIC Since 2006

Sources: New Constructs, LLC and company filings.

There’s no competition in this category. First Solar has the much better track record of profitability.

Corporate Governance

Superior profitability in the past means nothing if those profits cannot be maintained in the future. Many highly profitable companies have gone on to destroy shareholder value through overpriced acquisitions or wasteful spending. Compensation plans that reward executives for maximizing ROIC are the best way to ensure a focus on shareholder value.

First Solar ties a significant portion of executive’s long-term stock grants to ROIC. We have some concerns over the way the company calculates ROIC—especially with its decision to exclude certain stock-based compensation—but it’s still encouraging that the company rewards executives for superior capital allocation.

On the other hand, SunPower’s primary metric for calculating executive bonuses is “Adjusted EBITDA,” a metric also famously used by Valeant Pharmaceuticals (VRX). There’s no comparison; First Solar’s executive compensation plan is much more shareholder friendly.

Free Cash Flow Yield

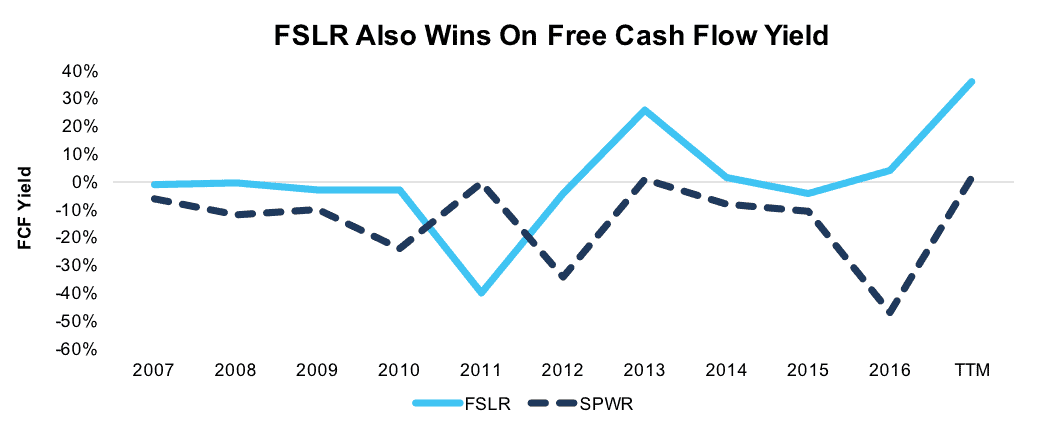

Cash is king. The value of any business ultimately comes down to its ability to generate free cash flow for investors. Figure 2 compares First Solar and SunPower on the basis of free cash flow yield over the past decade.

Figure 2: FSLR and SPWR Free Cash Flow Yield Since 2007

Sources: New Constructs, LLC and company filings.

It’s the same story as Figure 1. Over the past decade, First Solar has earned a superior free cash flow yield in every year but one. This competition is starting to look awfully one-sided.

Growth Opportunities

Even though they’re both in the solar industry, First Solar and SunPower have very different business models. SunPower focuses on high-efficiency panels that are ideal for rooftop solar installations, while First Solar’s thin-film panels hold up better in harsh environments and appeal to large-scale utilities.

Growth in the rooftop solar industry slowed significantly in 2016, putting a damper on SunPower’s outlook. First Solar, on the other hand, has some significant growth opportunities as developing countries such as India aim to supplement their power grids with solar energy.

Both companies face significant near-term pressure as a glut of new supply has caused solar panel prices to plummet, but First Solar has the better opportunity to offset that decline.

Valuation

These companies are difficult to compare on most valuation metrics due to the fact that First Solar earns a positive after-tax operating profit (NOPAT) while SunPower has lost money for the past two years. However, there are still a couple metrics we can use to compare the two.

First Solar has an enterprise value/invested capital (a cleaner version of price/book) of 0.61, while SunPower’s EV/IC is 0.80.

For enterprise value/revenue, it’s 1.31 for First Solar against 1.76 for SunPower.

It’s a clean sweep. First Solar beats SunPower in all five categories and is the better stock to buy for investors seeking exposure to the solar industry.

This article originally published on August 21, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

This article featured on MarketWatch on 8/18/17.

Photo Credit:Takeshi Kuboki (Flickr)