Valeant Pharmaceuticals (VRX: $31/share) finds itself back in the news this week, as Centerbridge Partners, a large holder of VRX bonds notified the company of its intentions to call a default as a result of VRX’s failure to file its annual report on time.

As recently as March 30, the company was getting traction in convincing debt holders to push the deadline back to May 31. But, with the new deadline come certain restrictions, which, as we highlighted in our February 29 Danger Zone report, would shut down the strategy that helped executives pump the stock to nosebleed heights.

What does Centerbridge know that no one else knows? Why are they pushing back on the concessions other debt holders seemed to be accepting?

Misaligned Compensation Incentives That Led To Disaster Remain Unchanged

We think Centerbridge understands that investing in VRX is not a good bet until Valeant’s leadership fully addresses the serious corporate governance flaws that are the source of the problems at the company.

Executive compensation plans that pay executives for non-GAAP metrics like Valeant’s misalign executive incentives with investors’ best interests. By paying executives for performance that does not generate real cash flows, Valeant’s board of directors created the misalignment that precipitated the executive behavior that got the company into so much trouble in the first place. This misalignment is the fact that Valeant executives get paid big bucks for meeting non-GAAP performance metrics while running the business into the ground and leaving investors holding the bag.

Until this misalignment is resolved and Valeant executives’ interests are aligned with investors, how can we be sure that their behavior will not revert to what got them in this situation in the first place?

Responsibility for Proper Corporate Governance Begins with the Compensation Committee

We recently pointed out the problems with compensation committees and how the structure of executive compensation can create inherent conflicts of interest between executives and shareholders. In many ways, Valeant is the poster child for how wrong things can go when executives’ interests are misaligned. We specifically identified problems at Valeant, problems that can’t be fixed with an annual filing. In a recent release by Valeant, the company noted:

“The tone at the top of the organization and the performance-based environment at the company, where challenging targets were set and achieving those targets was a key performance indication, may have been contributing factors resulting in the company’s improper revenue recognition.”

This tone at the top starts with the incentives management is given in regards to performance. In Valeant’s case, the following were goals management needed to achieve to receive cash and/or stock bonuses:.

- Total shareholder return

- Revenue growth

- “Do at least one significant deal that creates substantial shareholder value”

- “Cash EPS” – Valeant’s term for non-GAAP EPS

None of these goals lead to generating the cash flows Valeant needs to pay its debt holders, even if there is no default. In reality, they are straw men for corporate performance measurement with no real connection to the economics of the business.

Of all the goals, the worst for shareholders is, ironically, “Do at least one significant deal that creates substantial shareholder value” because there was no accountability for the amount management would pay for acquisitions. Lack of accountability directly led to the debt load ($30.4 billion in 2014, including off-balance sheet debt) Valeant is saddled with and increasing default risks.

A bad rule turns even worse when it is not enforced. Valeant executives got paid for the Allergan deal even though Valeant failed to actually acquire Allergan (a deal that would not have created shareholder value even if it had gone through).

Essentially, executives received the “significant deal” bonus with an “A for effort” note attached. In total $14.3 million was paid under the annual cash incentive program in 2014 and total compensation across five executives totaled $122.9 million. Compare this with 2013, when four executives were paid “only” $23.8 million.

Fund Holders Face Risks As Well

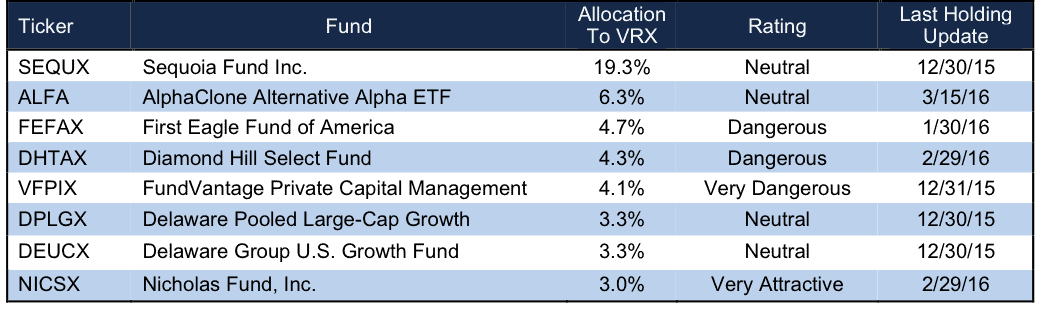

Shareholders aren’t the only investors watching investment in Valeant dwindle away as executives receive massive bonuses. Fund holders in ETFs or mutual funds that have large allocations to VRX pose similar risks, risks we covered in more detail in our report “ Avoid These 8 ETFs & Funds Most Exposed to Valeant.” Funds have cut holdings in VRX since the fallout, but many still allocate significantly to the stock. Unfortunately, most fund research does not analyze the holdings of a fund, even though the performance of holdings equals the performance of a fund. Our predictive ratings for ETFs give investors a different perspective as they are based on the quality of a fund’s holdings. Figure 1 shows the eight ETFs and mutual funds that allocate significantly to VRX and could pose a risk to investors’ portfolio.

Figure 1: Funds With Exposure To and Risk of Decline from Holding VRX

Sources: New Constructs, LLC and company filings

Since the 40% decline in VRX in mid March, investors in Sequoia Fund (SEQUX) have seen the importance of analyzing holdings prior to placing capital in a fund. On March 23, Robert Goldfarb resigned/retired from his position managing Sequoia, a position he held since 1980. Only a week later, Morningstar lowered its analyst rating to Bronze from Gold, a move which can be tracked to large fund outflows. Perhaps more alarming was Morningstar’s Gold rating on SEQUX, a sign that only reinforces why investors need independent fund research. In total, SEQUX is down 11% year-to-date while the S&P 500 is up 1%.

Stock Remains Overvalued, Even After Multiple Declines

All in all, VRX is down 51% since our Danger Zone report in late February. For investors hoping for a rebound, even after such a drastic decline, the stock is still overvalued.

In order to justify its current price of $31/share, the company would need to grow NOPAT by 15% compounded annually for the next 5 years. In this scenario, Valeant would be generating $18 billion in revenue, more than double its 2014 revenue, and greater than greater than Bristol Myers Squibb’s (BMY) 2015 revenue.

Even in an ideal scenario, in which Valeant focuses on internal growth and not destructive acquisitions, which as noted above, it may not even be allowed to undergo, VRX still has significant downside. If Valeant can grow NOPAT by 8% compounded annually for the next decade, the stock is worth $25/share today – a 19% downside.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: valuewalk (Flickr)

1 Response to "Misaligned Incentives That Led To Valeant Disaster Go Unaddressed"

Forbes article calling out the exec comp plan of VRX as the culprit: http://www.forbes.com/sites/nathanvardi/2016/04/13/valeant-pharmaceuticals-prescription-for-disaster/#10e22d966c65

We are not the only ones pointing out the corporate governance issues.