GAAP earnings ended 2021 highly overstated. Over the past two years, corporate profits did not decline as much, nor has the rebound been as robust, as GAAP earnings would lead investors to believe.

This report is an abridged version of S&P 500 & Sectors: Core Earnings Vs. GAAP Earnings Thru 2021, one of our quarterly series of reports on fundamental market and sector trends. The full version of the report analyzes Core Earnings[1],[2] and GAAP earnings for the S&P 500 and each of its sectors (last quarter’s analysis is here). These reports are available to those with a Pro or higher membership or can be purchased below.

Generally Accepted Accounting Distortions

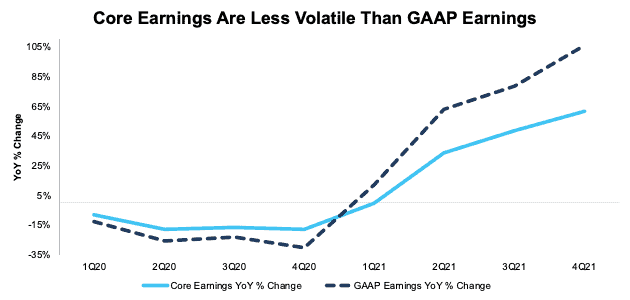

Figure 1 shows Core Earnings, which adjust for unusual gains/losses, are less volatile than GAAP earnings. For instance:

- In 2021, GAAP earnings rose 106% YoY compared to a 61% rise for Core Earnings.

- In 2020, GAAP earnings fell 30% YoY compared to an 18% fall for Core Earnings.

At the end of 2020, Core Earnings of $1.1 trillion were 21% higher than GAAP earnings of $877 billion. Now, at the end of 2021, Core Earnings of $1.7 trillion are 5% less than GAAP earnings of $1.8 trillion.

Figure 1: S&P 500 Core Earnings Vs. GAAP Earnings YoY Percent Change: 1Q20 – 4Q21

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 11, 2022 measurement period incorporates the financial data from calendar 2021 10-K, as this is the earliest date for which all the calendar 2021 10-Ks for the S&P 500 constituents were available.

Our research leverages more reliable fundamental data[3] that overcomes flaws with legacy fundamental datasets to provide a more informed view of the fundamentals of companies and a new source of alpha.

2021 GAAP Earnings Widely Overstated[4]

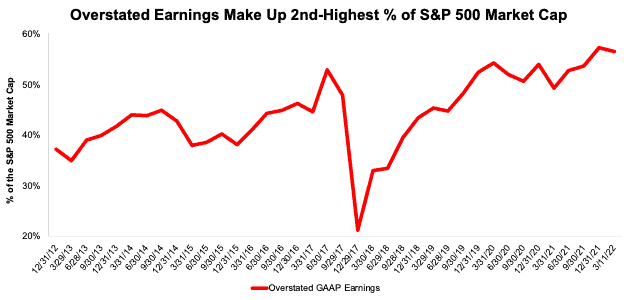

For 219 companies in the S&P 500, forty-four percent, GAAP Earnings overstate Core Earnings for calendar year 2021. When GAAP Earnings overstate Core Earnings, they do so by an average of 34%, per Figure 2. The overstatement was more than ten percent of GAAP Earnings for nineteen percent of companies.

The 219 companies with overstated GAAP earnings make up 56% of the market cap of the S&P 500, which is the second highest percent since 2012 (earliest data available). See Figure 3.

Figure 2: S&P 500 GAAP Earnings Overstated by 34% On Average

Sources: New Constructs, LLC and company filings.

We use Funds from Operations (FFO) for Real Estate companies rather than GAAP Earnings.

Figure 3: Overstated Earnings as % of Market Cap: 2012 through 3/11/22

Sources: New Constructs, LLC and company filings.

Key Details on Select S&P 500 Sectors

All eleven sectors of the S&P 500 benefited from a year-over-year (YoY) rise in Core Earnings in 2021, equal to the number of sectors with YoY improvement in the TTM ended 3Q21.

The Energy sector saw the largest YoY improvement in Core Earnings, which rose from -$1.1 billion in 2020 to $84.3 billion in 2021.

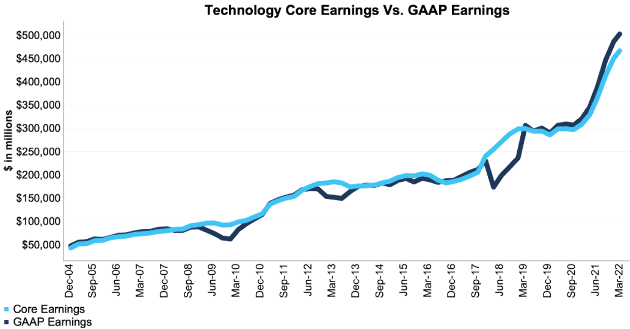

The Technology sector generates the most Core Earnings of any sector and grew Core Earnings by 42% YoY in 2021. On the flip side, the Real Estate sector has the lowest Core Earnings, and the Consumer Non-cyclicals sector had the weakest YoY growth in 2021.

Below we highlight the Technology sector and a stock with some of the most Earnings Distortion (i.e. overstated GAAP earnings) in the sector.

Sample Sector Analysis[5]: Technology Sector

Figure 4 shows Core Earnings for the Technology sector, at $466.9 billion, rose 42% YoY in 2021, while GAAP earnings, at $503.0 billion, rose 46% over the same time. Earnings power within the Technology sector is unevenly distributed. In 2021, five of the seventy-nine companies in the Technology sector – Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Facebook (FB), and Intel Corporation (INTC) - account for 62% of the sector’s total Core Earnings.

Figure 4: Technology Core Earnings Vs. GAAP: 2004 – 2021

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 11, 2022 measurement period incorporates the financial data from calendar 2021 10-K, as this is the earliest date for which all the calendar 2021 10-Ks for the S&P 500 constituents were available.

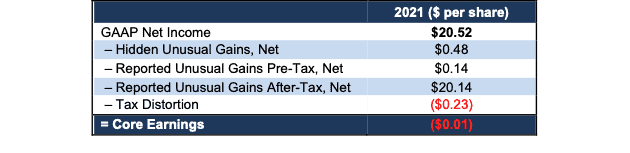

GAAP Earnings Overstatement Details: eBay Inc. (EBAY)

Below, we detail the hidden and reported unusual items that GAAP Earnings misses but that are captured in Core Earnings for eBay Inc. (EBAY). The firm has the ignominious distinction of being the stock with the most Earnings Distortion, and therefore overstated GAAP Earnings in the S&P 500’s Technology sector. After adjusting for unusual items, we find that eBay’s Core Earnings of -$7.8 million, or -$0.01/share are much worse than reported GAAP Earnings of $13.6 billion, or $20.52/share. eBay Inc.'s Earnings Distortion Score is Strong Miss. Our stock rating for EBAY is Unattractive.

Below, we detail the differences between Core Earnings and GAAP Earnings so readers can audit our research.

Figure 5: eBay’s GAAP Earnings to Core Earnings Reconciliation

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of $20.54/share, which equals $13.6 billion, is comprised of the following:

Hidden Unusual Gains, Net = $0.48/per share, which equals $319 million and is comprised of

- $486 million in gains on an equity investment in KakaoBank – Page 61

- -$7 million pre-tax restructuring charge – Page 113

- -$160 million loss on impairment of equity investment in Paytm Mall – Page 61

Reported Unusual Gains Pre-Tax, Net = $0.14/per share, which equals $90 million and is comprised of

- $90 million in foreign exchange and other gains

Reported Unusual Gains After-Tax, Net = $20.14/per share, which equals $13.4 billion and is comprised of

- $13.4 billion in income from discontinued operations

Tax Distortion = -$0.23/per share, which equals -$149 million

This article originally published on March 30, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Calculation Methodology

We derive the Core Earnings and GAAP Earnings metrics above by summing the Trailing Twelve Month individual S&P 500 constituent values for Core Earnings and GAAP Earnings in each sector for each measurement period. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Based on the latest audited financial data, which is the calendar 2021 10-K in most cases.

[3] Three independent studies prove the superiority of our data, models, and ratings. Learn more here.

[4] Overstated companies include all companies with Earnings Distortion >0.1% of GAAP earnings.

[5] The full version of this report provides analysis for all eleven sectors.