Too much of the rhetoric surrounding S&P’s downgrade of US debt misses the largest and most important point made by S&P’s bold move: the U.S. financial situation is very bad and getting worse with no reconciliation in sight.

It is difficult to deny the poor credit quality of an entity that grossly overspends its revenues, has a mountain of debt (most of which matures within the next few years) and has taken no meaningful steps toward remedying the situation?

By quibbling over S&P’s procedures and calculations, the Treasury and White House reveal that they have no solid rationale for disagreeing with the downgrade.

The recently announced investigation of S&P’s downgrade by the Securities and Exchange Commission (SEC) is just more smoke and mirrors as the status-quo merchants continue to try to delay the inevitable reconciliation with economic reality.

The only reasonable argument that I have heard against S&P’s downgrade is “why now”? It has been common knowledge that the US finances have been in bad shape for a long time.

The answer to that question is straightforward: (1) the US is adding, instead of subtracting, liabilities such as backing the too-big-to-fail banks and (2) in the face of accelerating growth in U.S. liabilities, political advantage continues to outweigh economic sense when it comes to our country’s leadership.

S&P did the world a favor when their downgrade forced most everyone to recognize the elephant-in-the-room – the U.S.’s inability to effectively manage its finances is leading the country toward financial disaster.

Let’s take a quick look at the numbers:

- $14.6 trillion in debt[1]

- 2010 budget deficit of about $1.3 trillion[2]

The math is simple. We spend much more than we make and we have lots of debt. In my view, that presents a serious problem especially when considering what we know about the future:

- Limited growth in tax revenues

- Growing social entitlement liabilities (Medicare, Medicaid, Social Security)

Few American would be surprised to learn that our social entitlements liabilities substantially increase the deficit between tax revenues and expense obligations.

We were in financial straits before our government decided to backstop the too-big-to-fail banking system

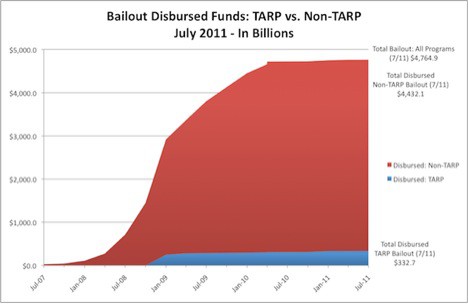

The Figure below reveals not only how big the bailout has been but also how small a part the Troubled Asset Relief Plan (TARP) played. You can click here to see a full list of each bailout program, the amount of money disbursed and the amount of money outstanding in each program.

Figure 1: TARP Was A Drop in the Bailout Bucket

We are moving in the wrong direction. We need to be reducing liabilities not adding to them, especially not by the trillions.

As my neighbor asked last night, “how can the debt ceiling debacle not trigger a downgrade in the credit quality of the US”?

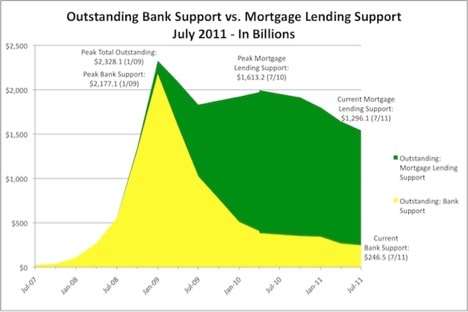

If you are wondering how much bailout money is still out there, the answer is in the figure below: $1.5 trillion.

“This massive effort is in stark contrast to the mere $2 billion the Treasury has spent to directly help homeowners stay in their homes via the widely criticized Home Affordable Mortgage Program (HAMP) program.[3]”

“The Federal Reserve and the Treasury have spent $1.6 trillion in a bank-shot to save the mortgage lending market by using the same financial companies that got us into this mess.[4]”.

Figure 2: Still On The Hook After Three Years

Taking stock of the growth in liabilities compared to the lack of growth in revenues would compel most rational people to do the same as S&P.

The sooner we, as a country, face the consequences of the capital misallocation and over-borrowing that fueled it, the better off we are.

The most troubling aspect of our predicament is the degree to which government over-spending went into wasteful endeavors. Good money chasing bad.

Let’s take a quick inventory of our capital allocation track-record as a country over the past decade or so. The tech bubble, Enron, Tyco, WorldCom, wars in Iraq and Afghanistan and the biggest of them all, the housing bubble…each represents egregious sums of capital allocated to very low to negative return activities. The US balance sheet has taken some serious hits in the last decade.

Making matters worse is the limited accountability for these misallocations of capital. As a result, the capital wastefulness looks to be continuing and making an already precarious financial situation worse.

Allow me to explain exactly how wasting capital hurts society.

Consider this hypothetical view of society as a whole. The total expenditures of the United States (private and public sector combined) is $1. If we expect a 50% annual return on investment, then that $1 of expenditure produces $0.50 of profit each year. That $0.50 of economic profit, a.k.a. net cash flow available after all costs, represents the amount of cash available to society to spend and/or reinvest. Accordingly, it directly affects the rate of growth of the US economy. The more cash available to spend and/or reinvest, the greater our consumptive capacity and the larger investments we can make to create more future cash flows.

If we expect only a 25% annual return, then that $1 of expenditure produces $0.25 each year. Compared to the scenario where we can expect a 50% return on investment, this 25%-return scenario produces half as much wealth for our society. There is much less cash available to be spent and/or reinvested in creating more future cash flows. By definition, economic growth will be much slower in the 25%-return scenario as there is less capital available for investing in wealth-producing ideas and businesses – that means slower job growth, lower spending and a slower rate of increase in our standard of living.

Misallocation of capital to lower-return investments carries a high cost for our entire society. The capital that one person or corporation wastes is lost forever from the use by more productive members of society. The less productively we allocate capital, the less capital we have. Such is the difficult side of free-market capitalism. That negative feedback loop has been the ruin of many countries. Take look at Europe.

The point is: when returns on investment decline, so do growth and prosperity. The most important driver of our future economic growth is the rate of return earned on our investments. More detail on this tautology is here.

Therefore, when capital from productive parts of a society is re-allocated to less productive parts of a society, the society will suffer as growth slows until it stagnates.

Given that returns on investment in the public sector tend to be much lower than those in the private sector, we can expect society to suffer when government grows too fast.

Public sector growth is not a problem if the private sector earns returns high enough to create enough value to cover the increasing costs of the public sector without hindering its ability to reinvest and grow. Indeed, this is exactly what has happened for most of the past twenty-five years. The public sector has grown, but the private sector’s impressive advancements in productivity created enough wealth that we, the private sector, could “afford” the public sector’s rising costs – at least for the time being

The “time-being” was a good time. Most of the 1990s and the first decade of this century were historically prosperous times. Wealth was abundant. The need for cost controls seemed low not just in the public sector but also in the private sector.

The future was bright. Too many members of our society (public and private) decided that they could borrow against future earnings to enable spending and investing beyond their current means.

As we have witnessed, there is a limit to how much we can borrow. This limit comes from the fact that our future earnings (and tax revenues) are not infinite. In other words, it is economically infeasible to borrow more than one will ever earn. Yet that is exactly what many consumers and local, state and federal governments have done around the world.

For Congress to make so little progress toward reconciling our over-leveraged and over-burdened financial situation with economic reality is troubling, to say the least.

The fact that S&P refused to allow that failure to fade out of our collective memory is a public service.

At a minimum, every American voter now has a clear and obvious reason to call his/her congressman and express a desire to get our finances in order.

[1] The US debt clock: http://www.usdebtclock.org/

[2] http://www.usgovernmentspending.com/federal_budget?fy=fy10

[3] http://www.prwatch.org/news/2011/08/10924/money-still-owed-federal-bailout-15-trillion-still-owed-treasury-federal-reserve

[4] Ibid

2 replies to "S&P’s Downgrade Did Us a Favor"

[…] $14.6 trillion in debt[1] […]

[…] saying “live by the sword, die by the sword” applies to SBUX and Mr. Schultz. As we enter a bear market, SBUX will be one of the many stocks with valuations driven to speculative heights by […]