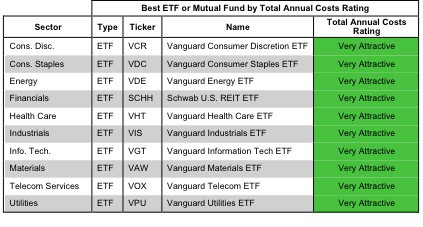

How To Find the Best Sector ETFs 2Q19

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Kyle Guske II, Senior Investment Analyst, MBA