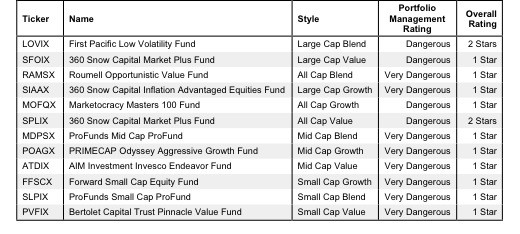

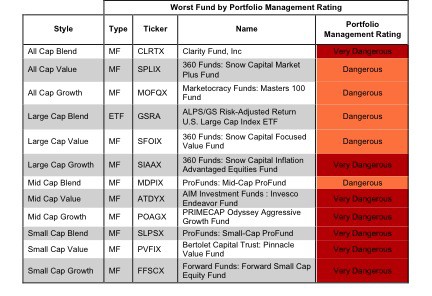

How to Avoid the Worst Style Mutual Funds

Why are there so many mutual funds? The answer is because mutual fund providers are making lots of money selling them. The number of mutual funds has little to do with serving investors’ best interests.

David Trainer, Founder & CEO