I don’t watch the news or read the papers. I don’t watch commercials either. I love live sports, and I almost always start watching a game 30-60 minutes after it starts so I can skip commercials. I don’t post stuff on social media any more either.

Why?

- Almost all of the news is crap. It’s focused more on entertainment than real news. Fake news is a thing, and I’m not playing along.

- Commercials/ads are unpleasant. I do not enjoy being bludgeoned by people trying to sell to me. Sitting in front of a TV while ads push all kinds of products, most of which I could not care less about, is not a good use of my time. Most of the pharmaceutical ads make me sick to my stomach when I hear about all the side effects the “medicine” they are pitching can cause.

- I do not like other people making money by selling my attention. So, I do not give it to them.

- I can find decent news/information in places where I am not assaulted by marketers.

Did I watch the debate? Ok, I admit I turned it on for a few minutes. I mean, the Trump v Biden thing is kind of a spectacle. If you’d asked me a year ago what I thought the chances of these two being the best the Democrats and Republicans could produce, I would’ve said zero. No way, surely there are some better options out there. And, here we are. I mean, honestly, I think it is kind of a clown show, and I was looking for a few laughs. Who knows, maybe one of their heads spins around 360 degrees – at this point anything is possible, no?

Figure 1: Big News Event

Image Source: BBC

To me, the worst of the worst is the political news. Both sides, all the networks. It is so clearly click bait, hate bate, anger bait. All kinds of bait – anything to draw you in and suck you down the many rabbit holes that push you farther and farther toward whatever extreme you are already leaning. However slightly you think of your lean or lack thereof, the media is trying to push or pull you toward an extreme so you can be triggered ever more easily by the constant barrage of bait.

Nevertheless, there are some investment implications that are very different depending on whether Biden or Trump wins.

I think Biden’s policies are probably more near-term friendly to stocks, while Trump’s policies are more long-term friendly. That said, these guys are known to flip-flop where they stand on certain issues whenever they see fit to get more votes.

Nevertheless, a Biden win is probably better for utility, materials and industrial sector stocks. Under Trump, I think energy, technology and financial sectors stocks will do better.

In the end, whoever wins, our focus at New Constructs will not change. We’ll continue to help clients find the best and avoid the worst stocks in any sector.

My readers know that I am not a big fan of “theme” investing. The truth is investing is not that easy. We cannot paint all stocks in any given sector or industry with the same brush.

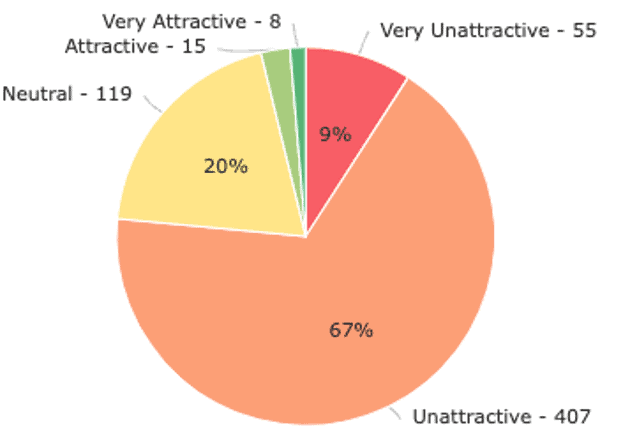

Take for example, AI stocks. Some are good and some are bad. In fact, precious few look good now. There were more good ones about 10 months ago when we highlighted a couple hidden gem AI stocks that were still cheap. Guess what!!! They are not cheap anymore. Per Figure 2, there are only 3 Attractive ones left. We’re going to talk about how we found hidden gem AI stocks 6 months ago and how we find them now in our next free training – you can register here.

Figure 2: AI Stocks – Precious Few Good Ones Left in the Semiconductor Industry

Sources: New Constructs, LLC and company filings

The technology sector does not look much better. And, who would be surprised given the huge run up we’ve seen in tech stocks, the magnificent 7 etc, and NVIDIA (NVDA). As a member of our online community recently posted in RIP S&P500, welcome the new S&P1:

“On Wednesday (06/05) 37% of the move on the S&P500 was due to one stock, NVDA.”

And, don’t think that passive investing is a safe place to hide. The major indices, in my opinion, have themselves become crowded trades “as investors blindly pour money into ETFs that hold many of the same stocks”. In fact, so many people have crowded into indices and a few popular stocks, that the opportunity for success for stock pickers has maybe never been better.

Figure 3: Only 23 Good Stocks Let in the Technology Sector

Sources: New Constructs, LLC and company filings

So, whoever wins the White House, the song remains the same at New Constructs: diligence matters. Hard work matters. We do things the right way because we don’t believe in short cuts or depending on luck. We take responsibility for our future by doing work we know we can be proud of no matter what happens. We’re not looking for gimmicks or to sell short cuts.

We’re doing the kind of research that can give you peace of mind in a world that makes war out of everything. And, so, you should not be surprised that our research has been proven superior by some of the most prestigious institutions in the world.

And, we’re happy to show you how and why we produce superior research. We regularly review our work and research on Long Ideas and Danger Zone Ideas with clients. We want you to know how much work we do! Here’s how we share our work:

- Free live Podcast every month. We just did one on June 12th. Get the free replay from our online community (use this form to sign up for free) and ask questions and make requests anytime! The next Podcast is on July 19th, register here.

- Monthly Let’s Talk Long Ideas webinars where we do deep dives into our research, analytics, reverse DCF models and ideas for our Professional and Institutional clients. Our next one is on June 20th at 3:00pmET. Replays are here for our Professional and Institutional clients.

- Fortune recently highlighted our unique perspective on Nvidia here.

If this message resonated with you and you want to start your investing future with us – schedule a meeting with us here.

Diligence (for the sake of diligence) matters,

David

This article was originally published on June 28, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.