This report focuses on providing investors the true costs incurred when investing in Style ETFs and mutual funds. A key component of our fund ratings, total annual costs (TAC), accounts for all the costs borne by investors, including transaction costs and many other fees. Expense ratios often drastically understate the total cost of a fund.

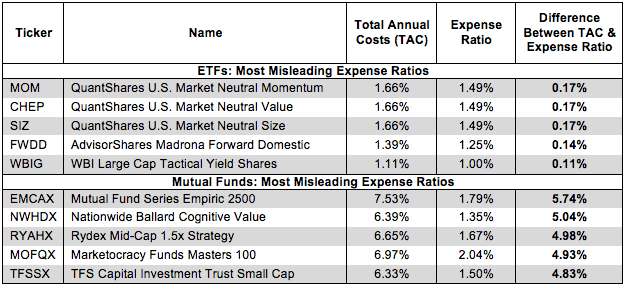

Figure 1 shows ETFs and mutual funds across all styles whose expense ratios understate their TACs by the most.

Figure 1: Funds With Most Misleading Expense Ratios

Source: New Constructs, LLC and company filings

QuantShares U.S. Market Neutral Momentum (MOM) is the style ETF with the greatest disparity between its TAC and expense ratio. Although the spread appears to be negligible right now, it will add up quickly over time. More importantly, investors deserve to know the true costs of being in any ETF. Mutual Fund Series Empiric 2500 (EMCAX) has the most misleading expense ratio amongst style mutual funds as its expense ratio is 5.74 percentage points lower than its actual total annual costs.

5.74 percentage points is a large difference. Over just ten years, 5.74% compounds to 74%. Most investors would like to know about such a large additional cost before they put their money into EMCAX.

The key takeaway for investors here is that they should focus on the total annual costs of ETFs and mutual funds rather than just the expense ratios, which can significantly understate the costs of being in a fund.

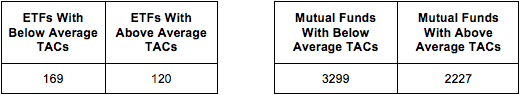

Style ETFs have an average TAC of 0.49%, while style mutual funds have an average of 1.95%. We recommend investors focus on funds with TACs that are below these averages,while avoiding funds that charge far above-average We have found that funds charging far above-average TACs face extreme difficulty consistently earning returns above a less-expensive benchmark.

Figure 2 shows the number of style ETFs and mutual funds with TACs above the average and below the average.

Figure 2: Number of Funds With Above and Below Average Total Annual Costs (TACs)

Source: New Constructs, LLC and company filings

Our Style Ratings for ETFs and Mutual Funds reveal our predictive ratings on the best and worst styles based upon the ratings of ETFs and funds within each style.

Disclosure: David Trainer and Max Lee receive no compensation to write about any specific stock, style or theme.

Photo Credit: GotCredit (Flickr)