Already, IPO investors have been getting burned. Prominent IPOs from recent years such as Twitter (TWTR), Lending Club (LC), and Box (BOX) are all down over 35% since they made their debut on the public market. The Renaissance IPO ETF (IPO) is down 7.5% so far this year, while the S&P 500 has been flat.

Most investors are unaware of how VCs use public markets to rake in huge pay days while also shifting risk out of their portfolios onto unsuspecting IPO investors.

Late-stage VCs increasingly build onerous provisions into funding deals that guarantee them big returns in an IPO. In the most recent funding round for mobile payments company Square, investors were guaranteed at least a 20% return in an IPO. If the price comes in below that, these VCs will get extra shares, diluting all the other investors.

These structured deals help fuel the bubble in private tech companies. Startups get cash so they can keep marketing like crazy, VCs get guaranteed payouts, and everyone gets the prestige and attention of being a “unicorn”. So who suffers? IPO investors that are tricked into believing these massive valuations have any basis in reality.

Bad IPO Pipeline Is Swelling

It’s getting harder and harder to find people that disagree with the notion that a startup bubble is forming. Even influential venture capitalists are warning of inflated valuations.

“Our late-stage, privately held technology market is clearly in a bubble,” wrote Upfront Ventures general partner Mark Suster on his blog last month.

The list of startup “unicorns”, privately held companies valued at $1 billion or more, has grown rapidly and now stands at 143.

“When we start throwing around the billion dollar valuation number in such a casual way, then it is a sign we are losing some perspective,” said Joe Horowitz, managing partner at Jafco Ventures. “Building a company that is truly worth a billion dollars or more takes a lot of work and lot of smart people.”

Instead, we have companies like Jet.com, the Amazon competitor that achieved a nine-figure valuation before it even launched and promised to undercut the ecommerce giant by 10-15%. Its plan was to not make any money on transactions and rely totally on member fees for its profits. Only now, the company has done away with membership fees as well.

So where are profits going to come from? Venture capitalists don’t seem to care. Jet.com just joined the unicorn ranks and raised $500 million at a valuation of $1 billion. With money being thrown around in such large quantities at ideas like Jet, we wonder if companies have any incentive to build profitable and sustainable business models.

As long as VCs can bet on selling these companies to unsuspecting IPO investors, why slow the gravy train?

Who Cares About Profits When You Have Unsuspecting IPO Investors

We’ve warned IPO investors about being extra careful because of special IPO accounting loopholes.

Now, we are warning you about VCs that are not only pushing valuations to unsupported levels, they’re doing so in a way that rewards companies with unsustainable business models. Companies chasing “unicorn” status are pushed towards spending excessively on customer acquisition rather than focusing on their core product, leading to companies with massive revenue growth and no profits. This helps them attract big funding rounds, which they then spend on more marketing.

“Companies are taking on huge burn rates to justify spending the capital they are raising in these enormous financings, putting their long-term viability in jeopardy,” writes Benchmark general partner Bill Gurley.

This short-term view helps the company achieve a higher IPO valuation while damaging its long-term prospects. Venture capitalists make a big profit, but the company itself earns a poor return on invested capital (ROIC). This short-term view helps the company achieve a higher IPO valuation while damaging its long-term prospects. It’s the same reason why companies hide their true stock compensation costs in the lead up to the IPO, leaving average investors with a nasty surprise once the VCs have gotten out.

This model has become so common that it is genuinely surprising when a tech IPO comes around that is actually profitable.

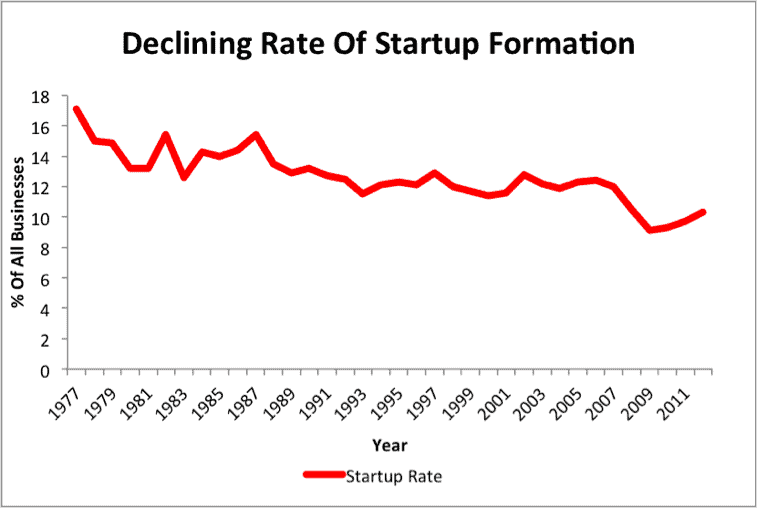

Not only has the VC funding model pushed companies away from sustainable growth models, it hasn’t done much to encourage new business formation. Figure 1 shows that while VCs have been chasing unicorns, the actual startup rate in the country has been in decline for decades.

Figure 1: Venture Capital Has Not Helped New Businesses

Sources: U.S. Census Bureau

Recent IPO Performances Suggest VCs Are Getting Too Cocky

Despite the bubble-like valuations occurring in many venture-backed startups, there are some signs of dampening enthusiasm. Fundraising for venture capital firms fell off sharply in the third quarter, and surveys of VC confidence are at their lowest point since the very beginning of 2013.

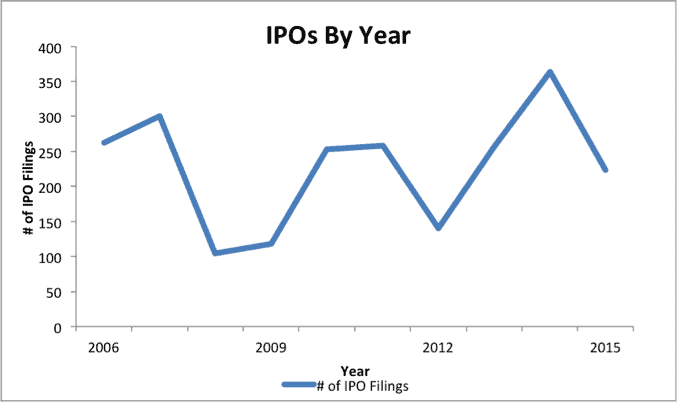

A big part of this concern seems to be the increasing difficulty for VCs to achieve profitable exits on the public markets. As Figure 2 shows, IPO activity is down significantly this year, and that makes it harder for investors to get big paydays and sell their shares for several times what they paid for them.

Figure 2: The IPO Slowdown

Sources: Renaissance Capital

Just as important as the volume of IPOs are the circumstances surrounding them. While TWTR and LC in 2013 and 2014 were highly anticipated by investors, BOX took a much different path to its IPO. The cloud storage company was forced to IPO at a depressed valuation simply because it couldn’t attract any more private funding, and it needed an influx of cash to keep the lights on.

Increasingly, venture backed tech companies are following the path of Box and getting a lackluster reception on the public markets. IPO “down rounds”, where the company IPOs at a valuation below its last round of private financing, used to be fairly uncommon, but recently they’ve jumped to nearly 50% of tech IPOs.

With a record number of billion dollar startups coming up against an unenthusiastic IPO market, companies are going to struggle to make the case for high IPO valuations. VCs don’t care as their returns are already locked in, but founders and executives will be scrambling to price shares high so they don’t end up having to dilute their own stakes.

This means investors should be especially wary of accounting for upcoming IPOs in the near future. These companies haven’t faced much public scrutiny, and they’ll be getting creative in the ways they try to inflate their profitability.

Eventually, the bubble is going to burst, VC money will dry up, and we’ll stop seeing as many risky and overhyped IPOs. Until that point, investors need to be on their guard.

Alternatives To Venture Capital

The good news is that startups shouldn’t be left without any access to capital after the VC bubble bursts. Increasingly, we’re seeing successful young companies find alternatives to the traditional venture-backed financing model. When they can afford it, some startups are bootstrapping, building their business without outside financing as much as possible.

In addition, business development corporations (BDC’s) have taken off in recent years, providing loans to small businesses that fall in between the high-growth favored by VCs and the more established companies that can get financing from big banks.

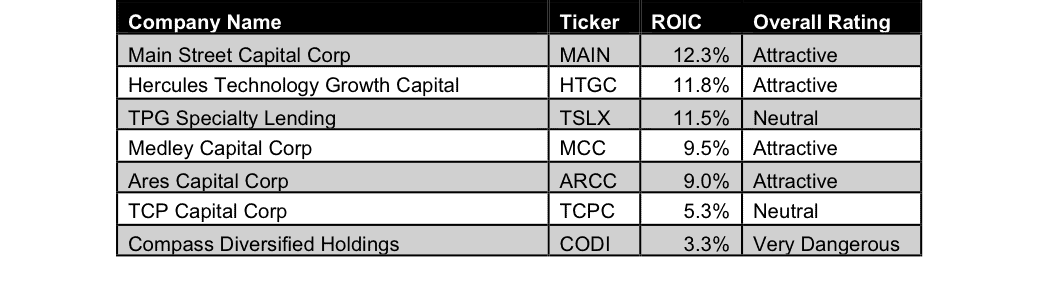

As Figure 3 shows, many BDC’s earn solid returns on capital by investing in stable, cash-flow generating businesses rather than chasing after unicorns.

Figure 3: ROICs For Business Development Corporations

Sources: New Constructs, LLC and company filings

For too many years, venture capitalists have held the mindset that the ultimate goal is a lucrative exit from an IPO. With that option starting to dry up, maybe we’ll start seeing a shift in attitudes and more young companies being pushed to create sustainable business models and cash flows rather than just focusing so heavily on customer acquisition. Not only would this be better for the overall economy, it would lead to companies being much more attractive investments when they hold their IPOs.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit Anthony Quintano (Flickr)