Wall Street analysts are too bullish on first quarter earnings expectations for most S&P 500 companies. Although down from record highs set in recent quarters, the percentage of S&P 500 companies whose Street EPS exceeds our Core EPS[1] remains high at 68%.

This report shows:

- the frequency and magnitude of overstated Street Earnings[2] in the S&P 500

- five S&P 500 companies likely to miss 1Q23 earnings

Get our report on the S&P 500 companies most likely to beat 1Q23 Street EPS estimates here.

Street Exceeds Core EPS for 339 S&P 500 Companies

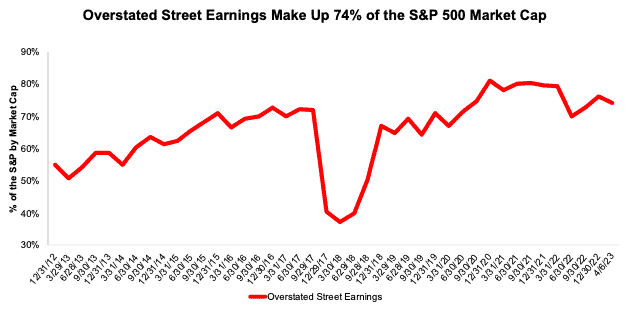

339 companies with overstated Street Earnings make up 74% of the market cap of the S&P 500 as of 4/6/23, which is down from 76% in 3Q22, measured with TTM data in each quarter.

Figure 1: Overstated Street Earnings as % of Market Cap: 2012 through 4/6/23

Sources: New Constructs, LLC and company filings.

When Street Earnings are higher than Core Earnings, they are overstated by an average of 19%, per Figure 2. For over a third of the S&P 500 (186 companies), Street Earnings are overstated by more than 10% vs. Core Earnings.

Figure 2: Street Earnings Overstated by 19% on Average in TTM Through 4Q22[3]

Sources: New Constructs, LLC and company filings.

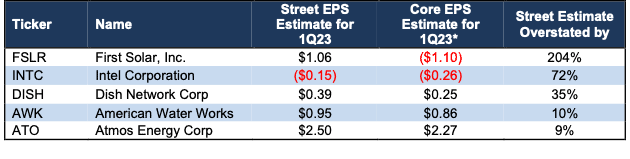

Five S&P 500 Companies Likely to Miss 1Q23 Earnings

Figure 3 shows five S&P 500 companies likely to miss calendar 1Q23 earnings because their Street EPS estimates are overstated. Below, we detail the hidden and reported unusual items that caused the overstated Street Earnings in the TTM ended 4Q22 for First Solar (FSLR). Because investors and analysts tend to anchor their earnings projections to historical results, errors in historical Street EPS lead to errors in Street EPS estimates.

Figure 3: Five S&P 500 Companies Likely to Miss 1Q23 EPS Estimates

Sources: New Constructs, LLC, company filings, and Zacks

*Assumes Street Distortion as a percent of Core EPS is the same for 1Q23 EPS as for TTM ended 4Q22.

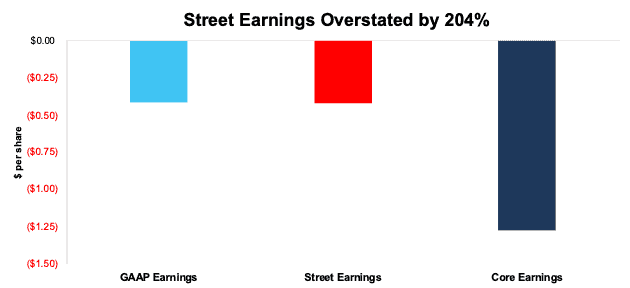

First Solar: The Street Overestimates Earnings for 1Q23 by 204%

The Street’s 1Q23 EPS estimate of $1.06/share for First Solar is $2.16/share higher than our estimate for 1Q23 Core EPS of -$1.10/share. Large gains due to the sale of a business and “other income” drive much of the difference between Street and Core EPS estimates. After removing these non-recurring gains, our analysis of the entire S&P 500 reveals First Solar as one of the companies most likely to miss Wall Street analysts’ expectations in its 1Q23 earnings report.

First Solar’s Earnings Distortion Score is Miss and its Stock Rating is Unattractive, in part due to its bottom-quintile return on invested capital (ROIC) of -2%, 0% free cash flow (FCF) yield, and price-to-economic book value (PEBV) ratio of 74.4.

Below we detail the unusual gains that materially boost and distort First Solar’s 2022 Street and GAAP earnings. After removing all unusual items, we find that First Solar’s 2022 Core EPS are -$1.28/share, which is lower than 2022 Street EPS of -$0.42/share and GAAP EPS of -$0.41/share.

Figure 4: Comparing First Solar’s GAAP, Street, and Core Earnings: TTM Through 4Q22

Sources: New Constructs, LLC and company filings.

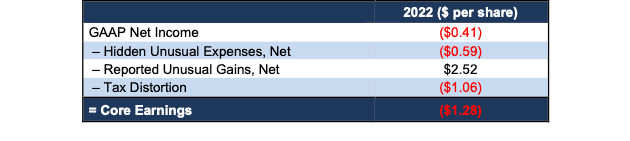

Figure 5 shows the differences between First Solar’s Core Earnings and GAAP Earnings so readers can audit our research. Given the small difference between GAAP and Street Earnings, the adjustments that drive the difference between Core and Street Earnings are likely mostly the same.

Figure 5: First Solar’s GAAP Earnings to Core Earnings Reconciliation: 2022

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of $0.86/share, which equals $91.8 million, is comprised of the following:

Hidden Unusual Expenses, Net = -$0.59/per share, which equals -$63.3 million and is comprised of

- $63.3 million impairments and net losses on disposal of long-lived assets

Reported Unusual Gains, Net = $2.52/per share, which equals $268.3 million and is comprised of

- $253.5 million gain on sales of businesses

- $31.2 million in “other income”

- First Solar disclosed in the notes that, in connection with its sale of the Luz del Norte plant, creditors agreed to forgive $30.2 million in loan balances, which was recorded as a gain in “Other Income”

- -$16.4 million foreign currency loss

Tax Distortion = -$1.06/per share, which equals -$113.2 million

Core Earnings are a more comprehensive measure of profits and capture all unusual items to ensure we calculate First Solar’s true profitability.

This article was originally published on April 12, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Street Earnings refer to Zacks Earnings, which are reported to remove non-recurring items using standardized assumptions from the sell-side.

[3] Average overstated % is calculated as Street Distortion, which is the difference between Street Earnings and Core Earnings.