While Street Earnings[1] overstate profits for the majority of S&P 500 companies, as shown in Street Earnings Overstated for 74% of S&P 500 in 4Q22, there are many S&P 500 companies whose Street Earnings are lower than their true Core Earnings[2].

This report shows:

- the frequency and magnitude of understated Street Earnings in the S&P 500

- five S&P 500 companies likely to beat 1Q23 earnings

Get our report on the S&P 500 companies most likely to miss 1Q23 Street EPS estimates here.

Street EPS Are Lower Than Core EPS for 154 S&P 500 Companies

For 154 companies in the S&P 500, or 31%, Street Earnings are lower than Core Earnings in the TTM ended 4Q22. In the TTM ended 3Q22, Street Earnings were understated for 143 companies.

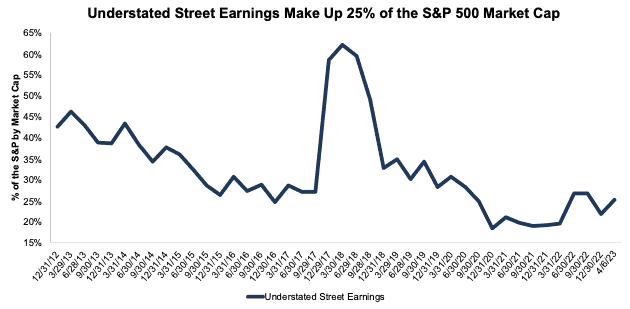

The 154 companies with understated Street Earnings represent 25% of the market cap of the S&P 500 as of 4/6/23, which is up from 22% in the TTM ended 3Q22.

Figure 1: Understated Street Earnings as % of Market Cap: 2012 through 4/6/23

Sources: New Constructs, LLC and company filings.

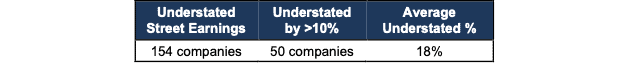

When Street Earnings are lower than Core Earnings, they are understated by an average of 18% per company, per Figure 2. For 10% of the S&P 500 (50 companies), Street Earnings are understated by more than 10% vs. Core Earnings.

Figure 2: Street Earnings Understated by 18% on Average in TTM Through 4Q22[3]

Sources: New Constructs, LLC and company filings.

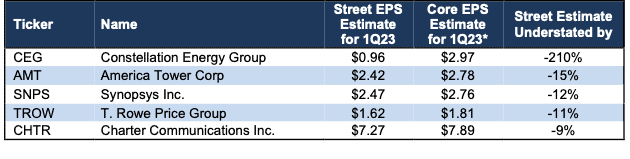

Five S&P 500 Companies Likely to Beat Calendar 1Q23 Earnings

Figure 3 shows five S&P 500 companies likely to beat calendar 1Q23 earnings because their Street EPS estimates are understated. Below we detail the hidden and reported unusual items that caused the understated Street Earnings in the TTM ended 4Q22 for T. Rowe Price Group (TROW).

Figure 3: Five S&P 500 Companies Likely to Beat 1Q23 EPS Estimates

Sources: New Constructs, LLC, company filings, and Zacks

*Assumes Street Distortion as a percentage of Core EPS is the same in 1Q23 as the TTM ended 4Q22

T. Rowe Price: The Street Underestimates Earnings Expectations for 1Q23 by $0.19/share

The Street’s 1Q23 EPS estimate of $1.62/share for T. Rowe Price is $0.19/share lower than our estimate for 1Q23 Core EPS of $1.81/share. Large acquisition costs included in historical EPS drive most of the difference between the Street and Core EPS estimates. After removing these unusual expenses, our analysis of the entire S&P 500 reveals T. Rowe Price as one of the companies most likely to beat Wall Street analysts’ expectations in its 1Q23 earnings report.

T. Rowe Price’s Earnings Distortion Score is Beat and its Stock Rating is Attractive, in part due to its top-quintile return on invested capital (ROIC) of 15% and high free cash flow (FCF) yield.

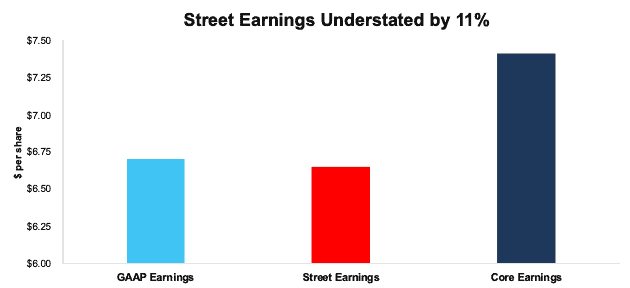

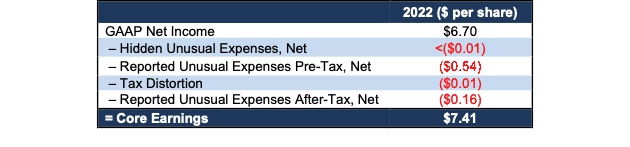

Below, we detail the unusual expenses that materially reduced T. Rowe Price’s TTM 4Q22 Street and GAAP Earnings. After removing all unusual items, we find that T. Rowe Price’s TTM Core EPS are $7.41/share, which is higher than the TTM Street EPS of $6.65/share and GAAP EPS of $6.70/share.

Figure 4: Comparing T. Rowe Price’s GAAP, Street, and Core Earnings: TTM Through 4Q22

Sources: New Constructs, LLC and company filings.

Figure 5 details the differences between T. Rowe Price’s Core and GAAP Earnings so readers can audit our research. Given the small difference between GAAP and Street Earnings, the adjustments that drive the difference between Core and Street Earnings are likely mostly the same.

Figure 5: T. Rowe Price’s GAAP Earnings to Core Earnings Reconciliation: 2022

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of -$0.71/share, which equals -$161 million, is comprised of the following:

Hidden Unusual Expenses, Net = <-$0.01/per share, which equals -$0.9 million and is comprised of:

- -$0.9 million in acquisition-related costs – Page 71

Reported Unusual Expenses Pre-Tax, Net = -$0.54/per share, which equals -$122 million and is comprised of:

- -$284 million acquisition-related amortization and impairment costs

- $161 million change in fair value of contingent consideration

Reported Unusual Expenses After-Tax, Net = -$0.16/per share, which equals -$36 million and is comprised of:

- -$36 million net income allocated to outstanding restricted stock and stock unit holders

Tax Distortion = -$0.01/per share, which equals $2.1 million

The $0.19/share Street Distortion highlights that Core Earnings include a more comprehensive set of unusual items when calculating T. Rowe Price’s true profitability.

This article was originally published on April 12, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Street Earnings refer to Zacks Earnings, which are adjusted to remove non-recurring items using standardized sell-side assumptions.

[2] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[3] Average understated % is calculated as Street Distortion, which is the difference between Street Earnings and Core Earnings.